Bank Islam Credit Card Cash Withdrawal

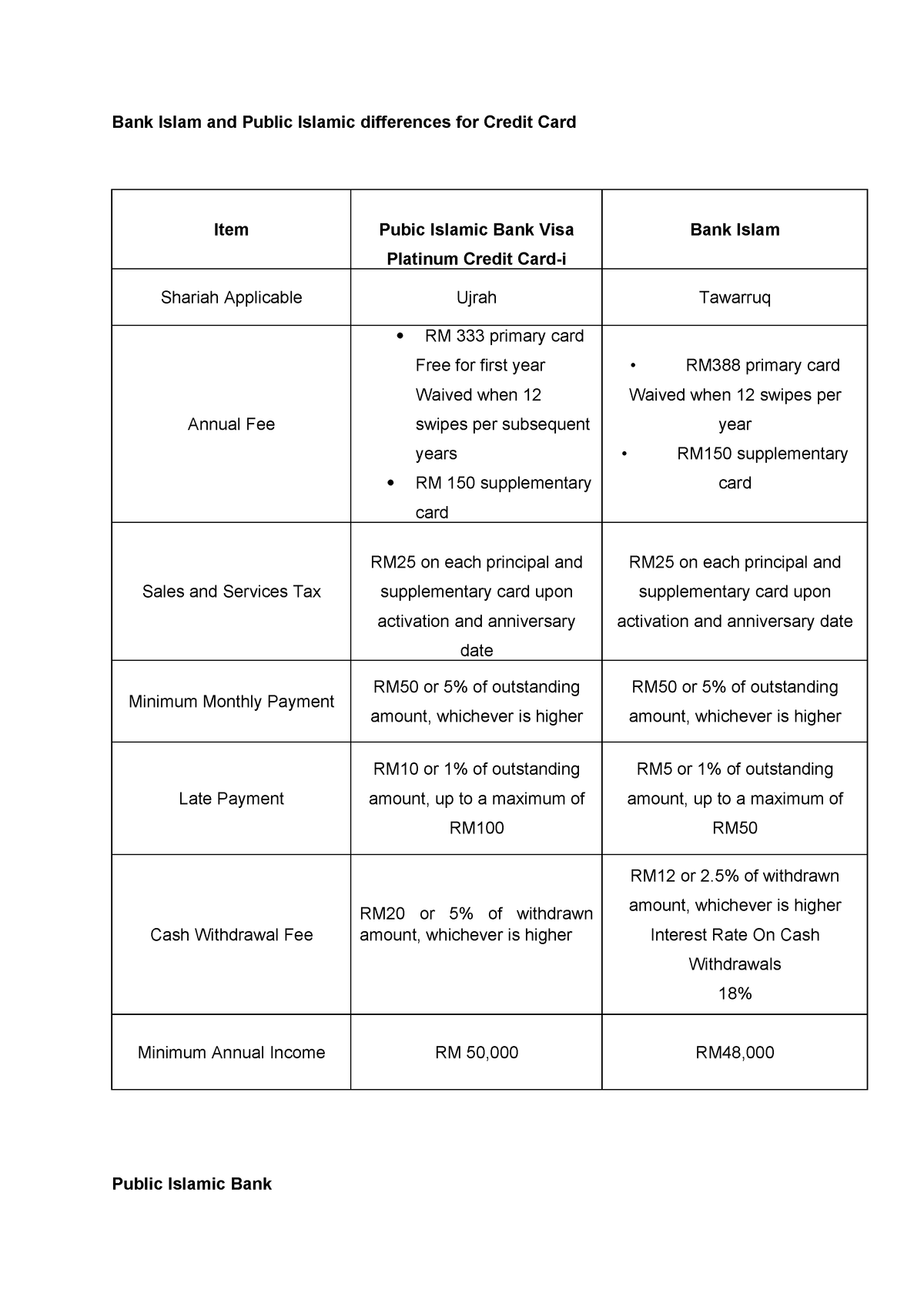

So instead of having a regular interest range of 15 to 18 per annum.

Bank islam credit card cash withdrawal. A withdrawal fee of 2 65 of the cash withdrawal or rm12 72 whichever is higher. Credit card cash withdrawal. While this seems like an attractive feature offering immediate cash it is important to know all the terms and conditions before making a credit card cash withdrawal. H ow to get cash advance use your credit card pin to get cash from any bank islam atm nationwide withdraw cash over the counter at any bank islam branch for more information on bank islam c ash advance please contact.

That is because making withdrawals with this card is taking a loan from the issuer and stipulating that something extra be paid back with the loan constitutes riba. Charges and how to withdraw. A cash advance fee is charged every time a credit card is used for withdrawal of cash. Terms and conditions bank islam credit card i cash withdrawal cash advance campaign credit cashback 25 february 2019 31 may 2019 the campaign period 1.

Charging a fee for issuing or renewing the card or making withdrawals with it that is greater than the actual costs incurred by the bank in this process. Cash withdrawal cash withdrawn from any bank atm or outlet which are. Click here to view terms conditions. Various charges applicable on credit card cash withdrawal are given below.

Bank islam malaysia berhad bank islam is organizing bank islam credit card i cash withdrawal cash advance. Competitive cash withdrawal fee. The bank also charges 3 50 riyals for every hundred riyals of cash withdrawn by the carrier of the card or a minimum of 45 riyals for every cash withdrawal. Campaign credit cashback campaign.

Cash advance fee. The cash advance fee varies from 2 5 to 3 of the withdrawal amount subject to a minimum amount. Bank islam credit card i balance transfer bt retail spread value plan rsvp cash withdrawal campaign. Credit card cash withdrawal charges fees interest.

Bank islam credit card i cash withdrawal cash advance campaign rm20 cashback to be won terms conditions terma syarat click here to download the terms conditions. Many banks offer a cash withdrawal facility on credit cards. The carrier of this card is also entitled to buy products in stores that the bank deals with without paying any cash and it becomes a loan from the bank. Bank islam cards come with a minimum interest rate of 13 5 and goes up to a maximum of 17 5 p a.