Bank Islam Hire Purchase Interest Rate

Hire purchase interest rates shopping around for the right hire purchase financing car loan is important before making a decision as to which you should take on.

Bank islam hire purchase interest rate. Hire purchase vs car loans. Dont act upon spoof e mail. In an announcement by bank negara malaysia bnm hire purchase loans and fixed rate islamic financing will come with additional interest charges after the six month moratorium that is effective. It noted that its fixed rate hire purchase loans already do not have compounding interest while eligible products under the moratorium include personal mortgage asb education and sme loans.

Bank islam will never request for internet banking account updating via e mail or disclosure of customers personal identification number login id password and i access code to third parties under any circumstance. Therefore the purpose of these comparative tables is to help you narrow down your options determine what suits you and compare products from different banking institutions before making that big decision. Shadowy argument for using a shadow interest rate. Faqs on hire purchase and fixed rate islamic financing products see latest update to response in question 6.

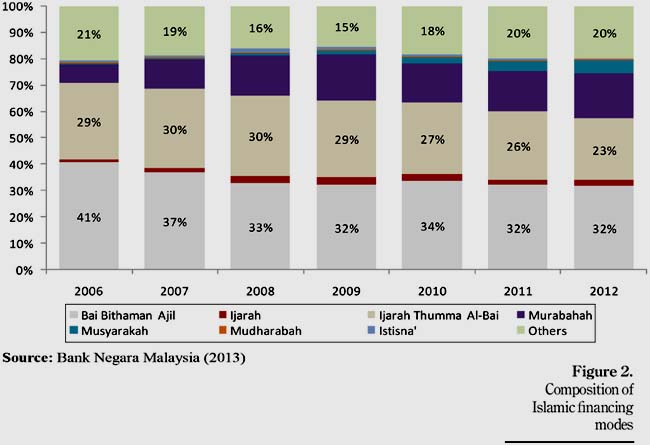

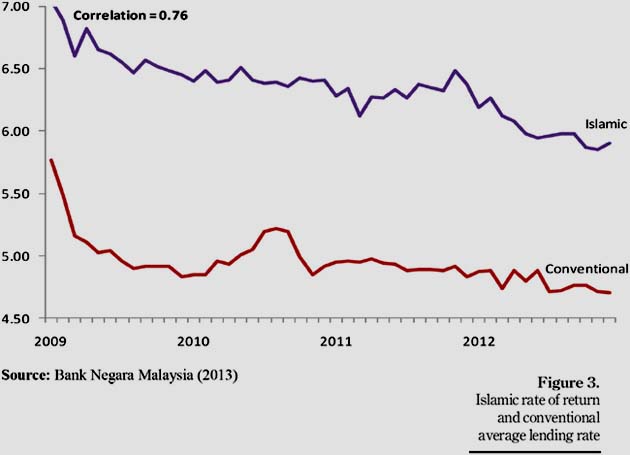

All islamic financing facilities profit rates are already not compounded in line with shariah principles. Size of interest receipts and payments. A hire purchase agreement provides the hirer with the option to become the owner of the item at the end of the tenure of the hire provided that the hirer h. Non bank islamic financial intermediaries.

Further to bank negara malaysia s bnm announcement on 25 march 2020 banking institutions are in the process of formalising agreements which reflect the revised payment terms with borrowers customers with hire purchase hp loans and fixed rate islamic financing to give effect to the 6 month moratorium on loan financing payments. Indicative effective lending rate refers to the indicative annual effective lending rate for a standard 30 year housing loan home financing product with financing amount of rm350k and has no lock in period. Over rm15 000 000 worth of prizes to be won. Preclude interest profit rates to accrue over the deferment period.

Bank islam car loan. Report any suspicious activity at 03 26 900 900.