Bank Islam Hire Purchase

Further to bank negara malaysia s bnm announcement on 25 march 2020 banking institutions are in the process of formalising agreements which reflect the revised payment terms with borrowers customers with hire purchase hp loans and fixed rate islamic financing to give effect to the 6 month moratorium on loan financing payments.

Bank islam hire purchase. Mortgages personal loans business. Save more with our non compounding charges credit cards. In addition a suite of other financing options already offered by toyota such as the toyota ez beli plan jom drive aitab toyota drive and of course the conventional hire purchase and vehicle lease schemes these two new financing plans offered by bank islam aims to make owning a toyota a much more financially accessible option to all malaysians. Public islamic bank gives no warranty as to the entirety accuracy or security of the linked web site or any of its content.

Report any suspicious activity at 03 26 900 900. Dont act upon spoof e mail. Requirements under the hire purchase act 1967 hp act and shariah. Bank islam hire purchase car loan vehicle financing i from bank islam is based on bai bithaman ajil bba contract method of sale with deferred payment to ease your burden while owning your dream car.

Address on monetary fiscal economics of islam. Why are other loans financing e g. This additional step is required to incorporate the changes to the payment schedule and or amounts as a result of the six month payment deferment in the loan financing agreements. Bank islam will never request for internet banking account updating via e mail or disclosure of customers personal identification number login id password and i access code to third parties under any circumstance.

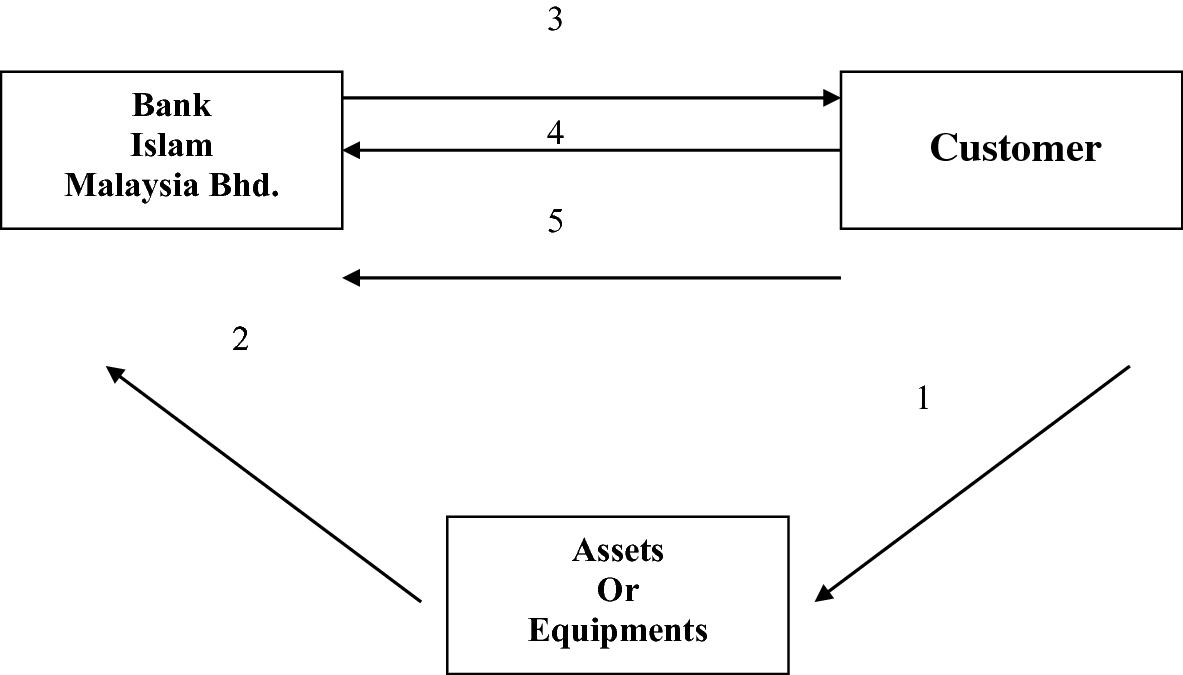

Vehicle financing under the shariah principle of al ijarah thumma al bai we offer an attractive margin of financing and competitive financing rates. We provide trade financing working capital and term financing facilities to meet client s funding requirements. The bank reserves the right to withdraw and or cancel the auto financing at any time if there is any misrepresentation in any form by you and or if the bank discovers any information which may affect the bank s decision to grant the auto financing and or if the bank has reasons to believe that any information supplied or declaration made by you to the bank in relation to your application for. Financing you and your business.

Under its terms a business entity or individual may request the bank to purchase capital goods such as equipment.