Bank Rakyat Fixed Deposit Campaign 2020

Public bank fixed deposit term deposit i 2 08 3 months 2 28 8 months rm10 000.

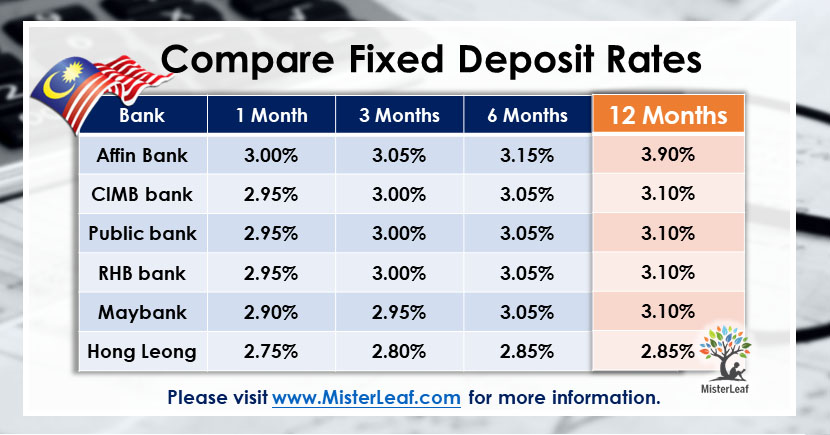

Bank rakyat fixed deposit campaign 2020. Bank rakyat fixed deposit rates. Don t forget to check this article from time to time for the latest fixed deposit promotions. The first one valid until 31st of december 2020 offers preferential rates of up to 16 88 p a. If you are interested in any of the fixed deposit promotions above please contact the respective bank to get started.

Agent bank rakyat care bank agent rakyat care rakyat care bank rakyat faq. Interbank giro ibg meps regional. Subject to online banking withdrawal limit by customer s bank. Britama valas save in foreign currency and enjoy transaction flexibility and competitive exchange rates.

Ocbc bank online fd promo 1 95. Bank rakyat launches term deposit i account campaign for loyal customers tuesday 23 jun 2020 07 27 pm myt chief executive officer datuk rosman mohamed said the campaign which runs from june 15 to november 15 2020 was held to show its appreciation to customers who are loyal to the bank amidst the challenging global economy caused by the covid 19 pandemic. With fixed monthly deposits this investment savings comes with a life insurance coverage. At the specified maturity date you then return the certificate of deposit to the bank to withdraw your.

Bank agent rakyat care list. Public bank efd via fpx. Also share it with your friends so they can start making some extra money too. 1 apr to 31 dec 2020.

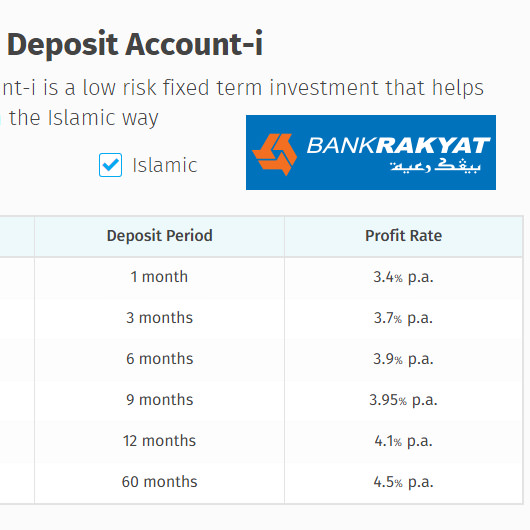

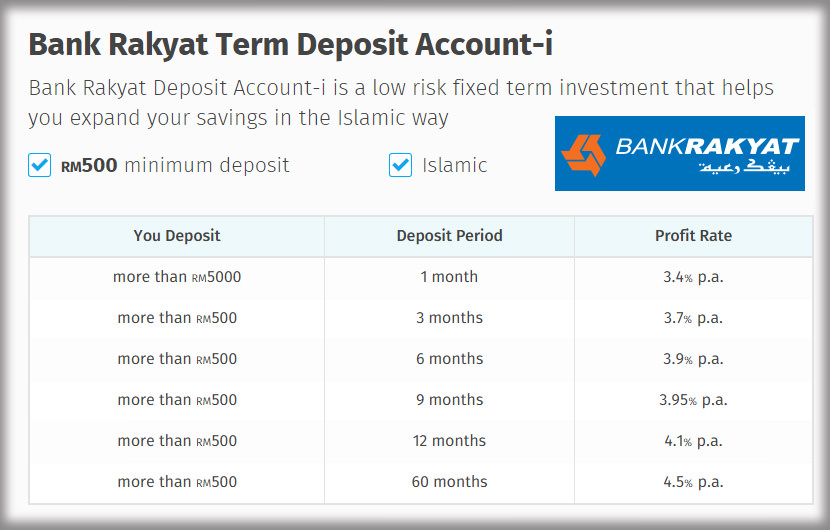

Hsbc singapore dollar time deposit is the most accessible variant comes with impressive rates and currently offers two promotions. Shariah concept tawarruq minimum deposit rm 500 2 to 60 months minimum deposit rm 5 000 1 month members of the bank rakyat offered 0 1 higher than the benefits offered to the public. How does a fixed deposit account work. One stop bill payment.

Rm10 million 3 months 8 months. On a 3 month time deposit when you purchase an insurance plan. 15 sept to 3 nov 2020. Meps instant transfer ibft credit card i.

In a typical fd arrangement you place a sum of money into a bank by cash or cheque and receive in return a certificate of deposit indicating the deposited amount the interest and the maturity date.