Bank Rakyat Fixed Deposit Pidm

7 month 8 month 9 month.

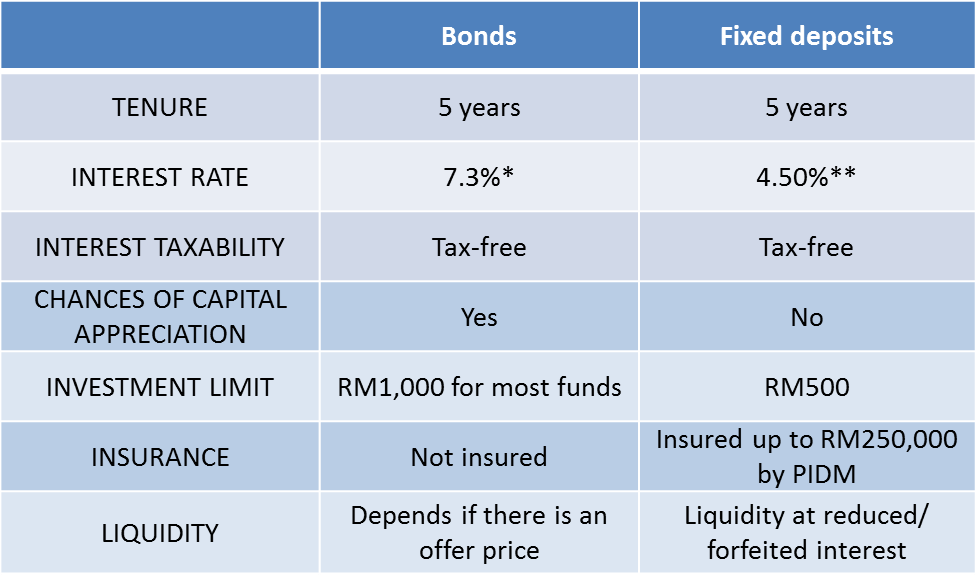

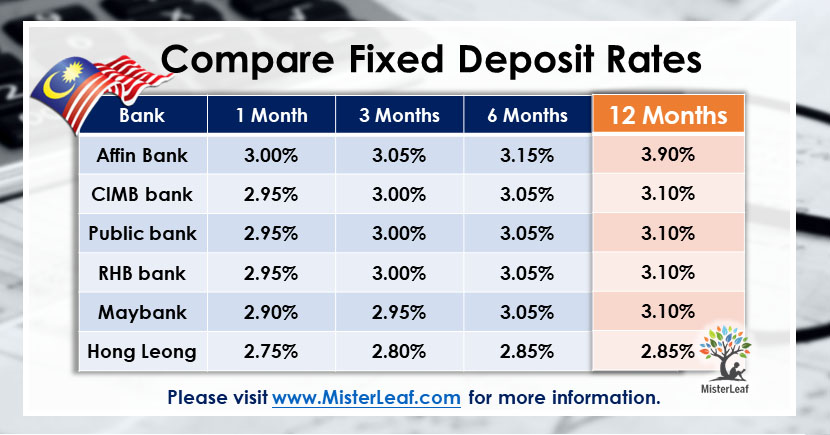

Bank rakyat fixed deposit pidm. Rates per annum 1 month. Pidm provides a list of member banks here so to answer the question in the screenshot above. Bank muamalat is a pidm member while bank rakyat is not because fun fact bank rakyat is a development financial institution regulated under a different. Interest for 9 months fixed deposit.

Interest for 24 months fixed deposit. Are fixed deposits in bank rakyat protected under pidm otherwise what equivalent protection does a depositor has. Bank rakyat fixed deposit rates. 4 month 5 month 6 month.

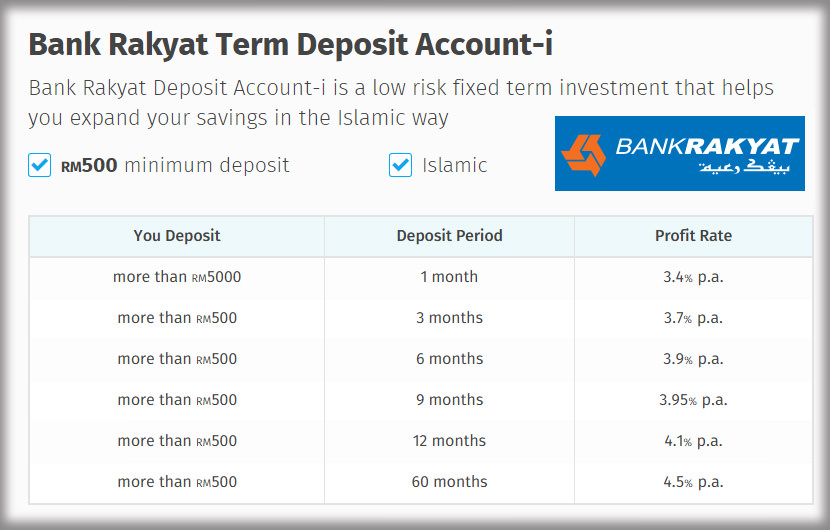

And are automatically required to be members of pidm regardless of whether it s a local bank or a foreign bank operating in malaysia. Bank rakyat deposit terms range from 1 month up to 5 years. Deposit of more than rm5 000 profit can be paid monthly minimum 6 months automatic renewal upon request deposit certificates may be used as collateral for other syariah compliant financing. No however as bank rakyat is a cooperative bank all depositors will be.

Account details apy updated. Does pidm covers this fixed deposit account. Deposit insurance system takaful and insurance benefits protection. Pidm protects your deposits in the bank as well as your takaful and insurance benefits in the unlikely event of a failure of a member bank or a takaful operator insurance company.

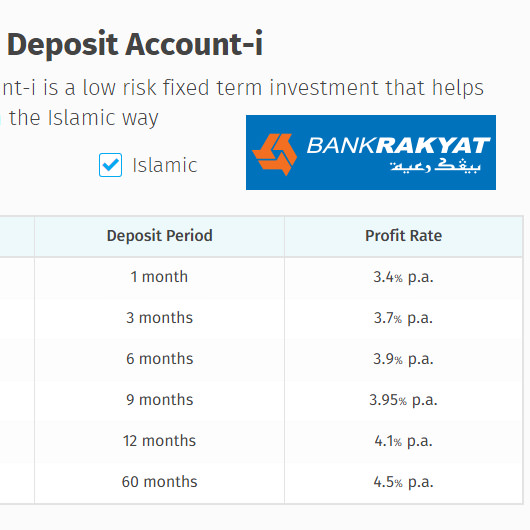

Shariah concept tawarruq minimum deposit rm 500 2 to 60 months minimum deposit rm 5 000 1 month members of the bank rakyat offered 0 1 higher than the benefits offered to the public. Rates show are per annum. Bank rakyat 5 year term deposit. Depositor may choose manner of profit payment either on a monthly basis or upon maturity.

Applicable to minimum placement of rm500 and above. 10 month 11 month 12 month. Bank rakyat fixed deposit interest rates. Contact details level 12 axiata tower.

Check out the fixed deposit rate offered by bank rakyat for various months of placement. Interest for 12 months fixed deposit. This coverage offers a one off compensation worth rm10 000 in the event of death and permanent disability for customer aged between 18 to 65 years only. A rupiah savings account that can be opened in all bri units with only rp50 000 initial deposit britama a savings account with many facilities including e banking support so that transactions can be done anytime anywhere.