Bnm Capital Adequacy Framework 2017

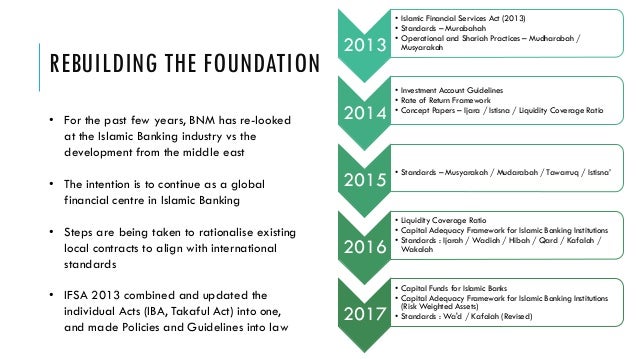

As at 31 december 2017 overview a b c the pillar 3 disclosure is required under the bank negara malaysia bnm s capital adequacy framework for islamic banks cafib which is the equivalent to basel ii issued by the islamic financial services board.

Bnm capital adequacy framework 2017. With effect from 1 january 2016 pursuant to bnm s guidelines on capital adequacy framework capital components issued on 13 october 2015 the minimum capital adequacy ratios to be maintained under the guidelines are at 4 5 for cet1 capital 6 0 for tier 1 capital and 8 for total capital ratio. Ng said the minimum regulatory requirement for common equity tier 1 capital ratio is 4 5 under basel iii and that banks are also required to maintain a capital conservation buffer of up to 2 5. And currently operates under. Group maybank maybank islamic.

Cet1 capital ratio total tier 1 capital ratio 24 321 23 539 total capital ratio 25 466 24 431 the bank is fully funded by its parent bank mizuho bank ltd. In a statement today bank islam said the sukuk shall qualify as tier 2 regulatory capital in compliance with bank negara malaysia s capital adequacy framework for islamic banks capital components hence will enhance the capital adequacy of bank islam in line with the basel iii requirements. 3 may 2019 part a overview a 1 executive summary 1 1 this document is part of the capital adequacy framework that specify the. Bnm rh pd 032 5 prudential financial policy department capital adequacy framework basel ii risk weighted assets page 1 506 issued on.

The requirements set out are intended to improve the overall risk sensitivity of the capital adequacy framework. Basel iii the submission is in conjuction with bnm s plan to implement the basel iii reform package. Overview the information of al rajhi banking investment corporation malaysia bhd the group below is disclosed pursuant to the requirements of the bank negara malaysia s bnm. Weighted capital adequacy framework rwcaf disclosure requirements.

Banks are also subject to countercyclical capital buffer above the minimum regulatory capital adequacy ratio. As part of capital adequacy framework to quantify the risk weighted assets rwa for credit risk market risk and operational risk. 2017 2016 capital ratios. 5 february 2020 part a overview 1 introduction 1 1 regulatory capital requirements seek to ensure that risk exposures of a financial institution are backed by an adequate amount of high quality capital which absorbs losses on a going concern basis.

Capital adequacy framework for islamic banks cafib disclosure requirements pillar 3 which sets out the. Capital adequacy framework capital components 1 of 44 issued on. Basel ii consists of 3 pillars as follows. Bnm s guidelines on capital adequacy framework basel ii risk weighted assetscafib basel ii and.