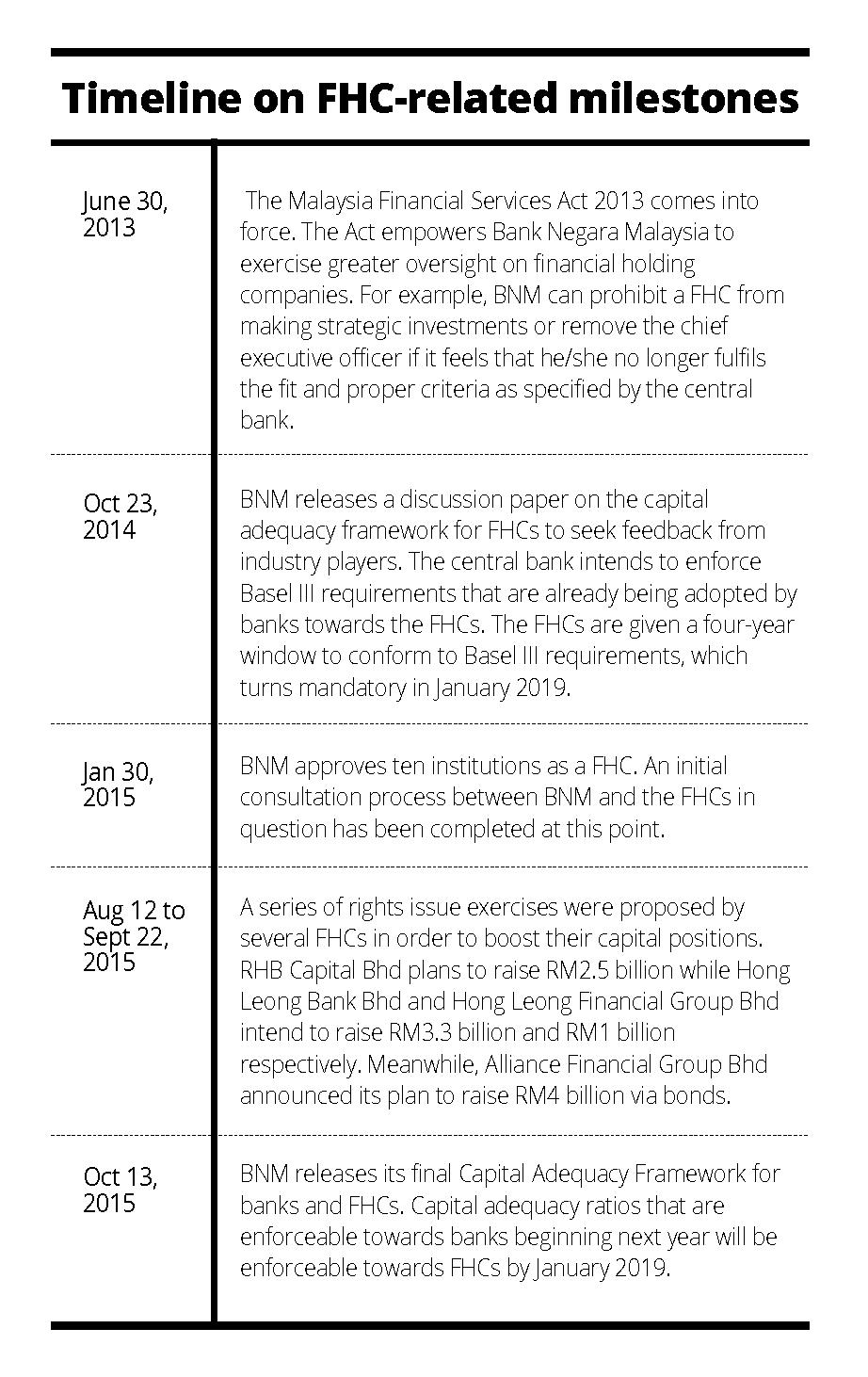

Bnm Capital Adequacy Framework 2020

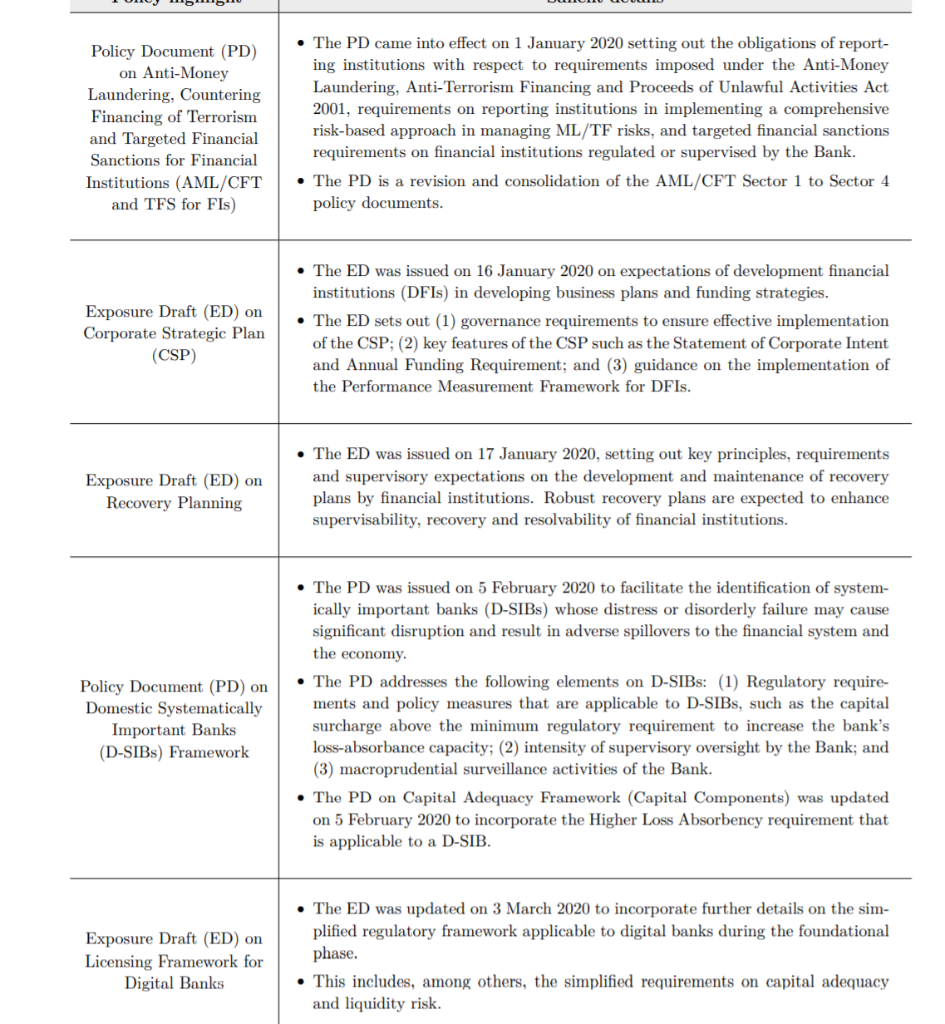

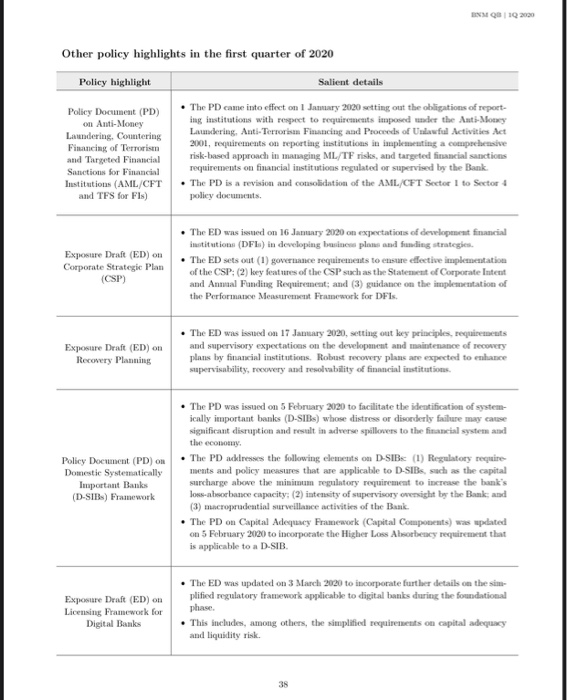

Bank negara malaysia is extending the consultation period for the exposure draft to april 30 2020.

Bnm capital adequacy framework 2020. Bank negara malaysia bnm. 1 for the group the amount excludes retained profits and other reserves from insurance and takaful business. Public islamic bank berhad. Highly confidential 6 maybank group pillar 3 disclosure h1 2020 table 3.

The minimum regulatory capital adequacy. This exercise provides insight into potential. Disclosure on capital adequacy under irb approach cont d notes. Effective from 25 march 2020 the bank is allowed to drawdown the ccb of 2 5 to manage the impact of the covid.

In line with the transitional arrangements under the bnm capital adequacy framework capital components the minimum capital adequacy requirement for common equity tier 1 capital ratio cet 1 and tier 1 capital ratio are 7 000 2019. Bnm said key features of the simplified regulatory framework include a capital adequacy. Group gross net weighted capital 2020 exposures exposures assets requirements exposure class rm 000 rm 000 rm 000 rm 000 i credit risk. 3 may 2019 part a overview a 1 executive summary 1 1 this document is part of the capital adequacy framework that specify the.

Capital adequacy framework capital components 5 of 44 issued on. Bnm rh pd 032 5 prudential financial policy department capital adequacy framework basel ii risk weighted assets page 1 506 issued on. The capital adequacy ratios of the bank below are disclosed pursuant to the requirements of bnm s capital adequacy framework for islamic banks cafib basel ii disclosure requirements pillar 3. Cet1 capital ratio tier 1 capital ratio total capital ratio 4 5 6 0 8 0.

30 june 2020 3 0 capital 3 1 capital adequacy 30 june 31 december 2020 2019 cet1 ratio 25 14 24 31 tier 1 capital ratio 25 14 24 31 total capital ratio 51 64 48 95 ccbm uses stress testing and scenario analysis to assess capital adequacy under wide range of extreme but plausible scenarios. The group has adopted the standardised approach for credit risk and market risk. 8 500 respectively for year 2020. Key features of the simplified regulatory framework include.

In a statement today bank islam said the sukuk shall qualify as tier 2 regulatory capital in compliance with bank negara malaysia s capital adequacy framework for islamic banks capital components hence will enhance the capital adequacy of bank islam in line with the basel iii requirements. 7 000 and 8 500 2019.