Bnm Capital Adequacy Framework

5 february 2020 5 interpretation 5 1 the terms and expression used in this policy document shall have the same meanings assigned to them in the fsa unless otherwise defined in this policy document.

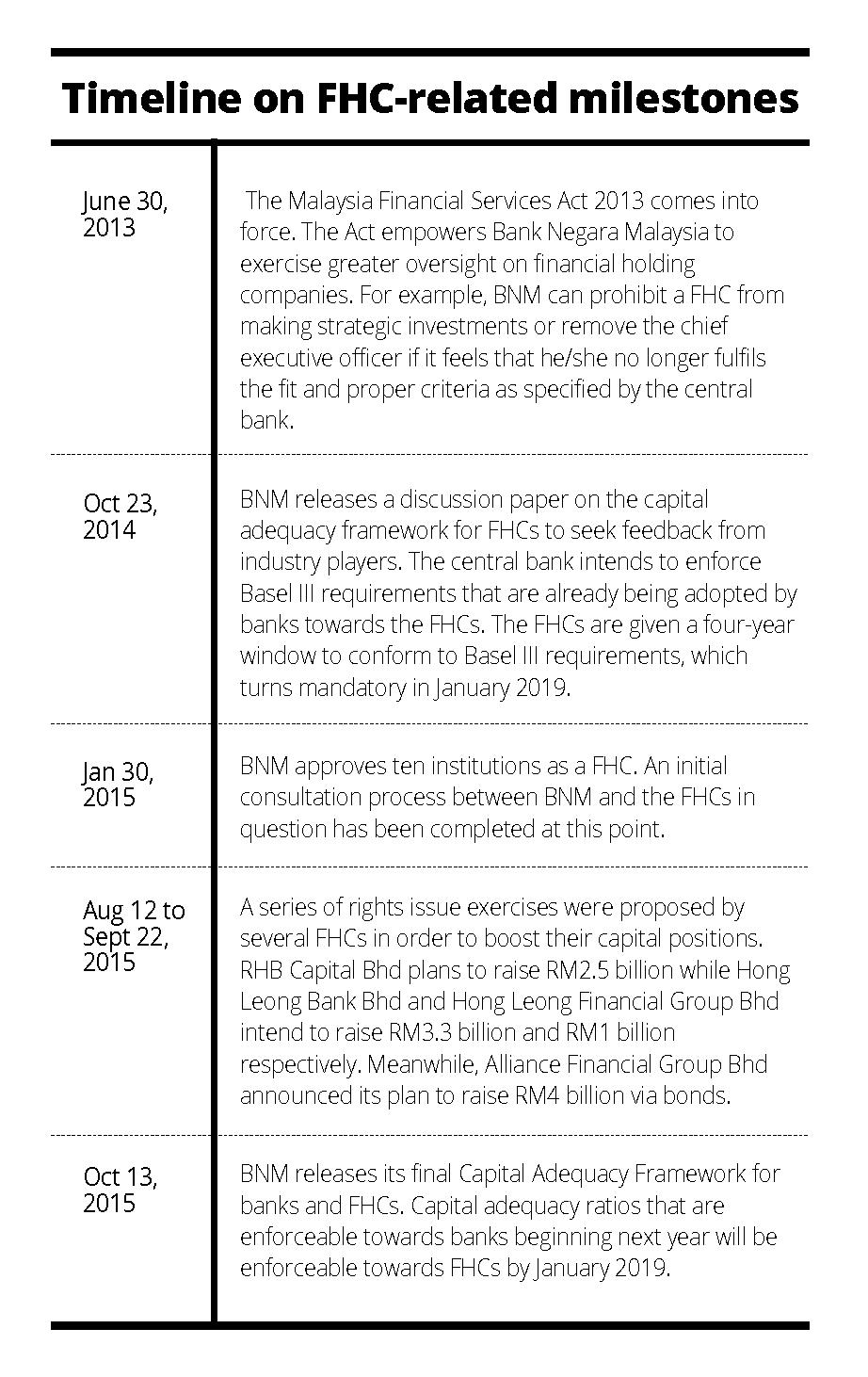

Bnm capital adequacy framework. Define bnm capital adequacy framework. Means bnm s capital adequacy framework capital components issued by bnm on 2 february 2018. In addition each banking financing institution within the banking group must comply with the minimum regulatory capital requirement imposed under guidelines known as the capital adequacy framework capital components and capital framework for islamic banks capital components issued by bnm which are generally based on the basel iii capital adequacy requirements. Bnm issued policy documents on the framework for domestic systemically important banks d sibs and on the capital adequacy frameworks for both conventional and islamic banks.

Minimum capital requirements. Bnm rh pd 032 5 prudential financial policy department capital adequacy framework basel ii risk weighted assets page 1 506 issued on. Licensed islamic banks 2. 5 2 for the purpose of this policy document.

Licensed banks carrying on islamic banking business 3. Subject to explicit approval by bank negara malaysia the bank. The policy on d sibs sets out the assessment methodology to identify d sibs in malaysia and contains the inaugural list of d sibs. Financial holding companies.

1 1 regulatory capital requirements seek to ensure that risk exposures of a financial institution are backed by an adequate amount of high quality capital which absorbs losses on a going concern basis. 2 february 2018 bnm rh pd 029 2 capital adequacy framework for islamic banks capital components applicable to. Means the capital adequacy framework capital components issued by bnm as amended replaced or supplemented from time to time. Capital adequacy framework capital components bnm.

Capital adequacy framework capital components 2 of 44 issued on. For irb approach only applicable for adoption from 1 january 2010. The basel committee on banking supervision the committee has decided to introduce a new capital adequacy framework to replace the 1988 accord international convergence of capital measurement and capital standards july 1988 the committee seeks views on its proposed approaches and on its plans for future work this new capital framework consists of three pillars.