Determinants Of Capital Structure In Hindi

The paper identifies the most important determinants of capital structure of 870 listed indian firms comprising both private sector companies and government companies for the period 2001 2010.

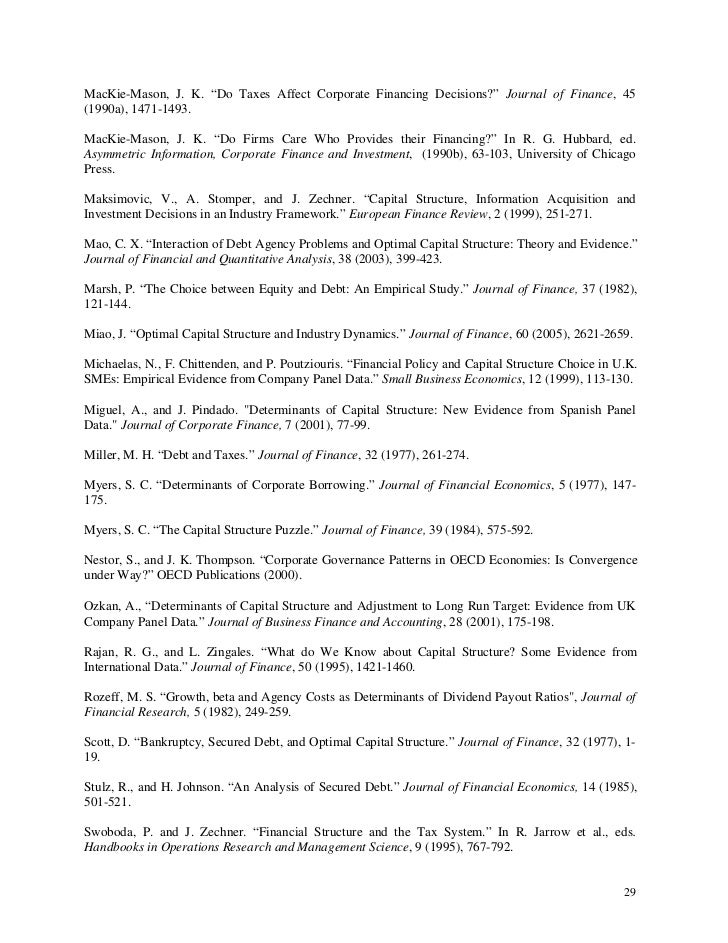

Determinants of capital structure in hindi. Determinants of capital structure an empirical evidence us by ra the university of lahore pakistan. Abstract this paper develops a study on identifying the most significant determinants of capital structure of 15 firms listed on the s p 500 index new york stock exchange using panel data over 5 years period from 2010 to 2014. Study determinants of capital structure in nepalese context are examined with r eference to capital structure theories. This theory is called neoclassical theory of investment behaviour because it is based on the neoclassical theory of optimal.

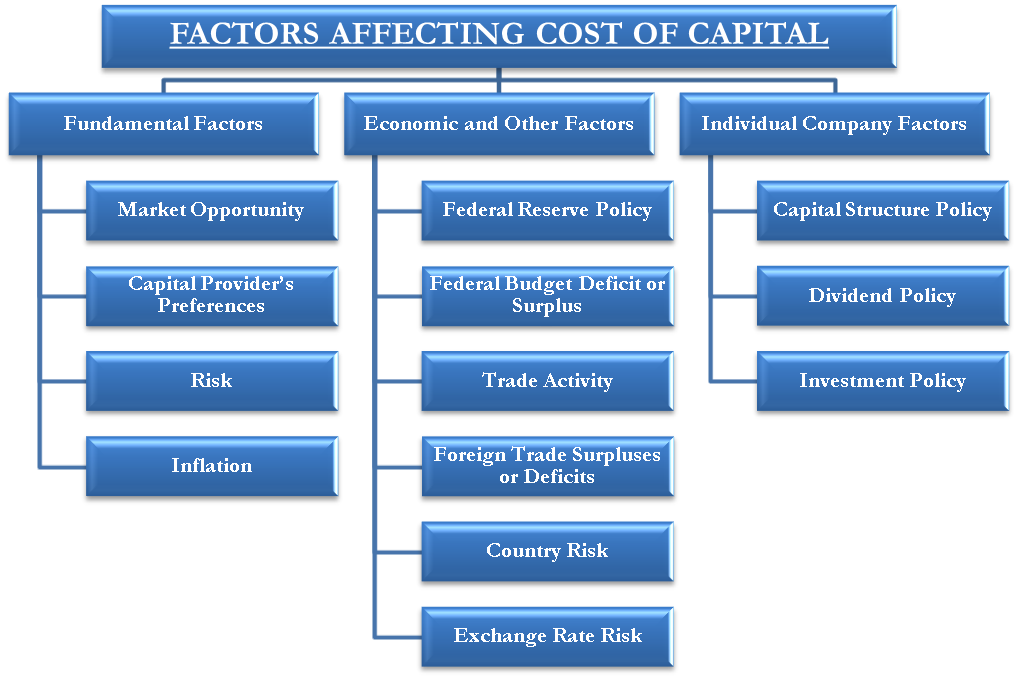

Ten independent variables and three dependent variables have been tested using regression analysis. Determinants of capital structure in ethiopian commercial banks case. Let us make in depth study of the neoclassical theory of investment in an economy. We may now briefly discuss the key factors governing a firm s capital structure decisions.

In addition to this the two variables profitability and growth established negative relationship and the remaining four variables tangibility size age and tax shield showed positive. The objective of this paper is to examine the capital structure of the indian firms. Design methodology approach different conditional theories of capital structure are reviewed the trade off theory pecking order theory agency theory and theory of free cash flow in order to formulate testable propositions concerning the determinants of capital structure of the manufacturing firms.

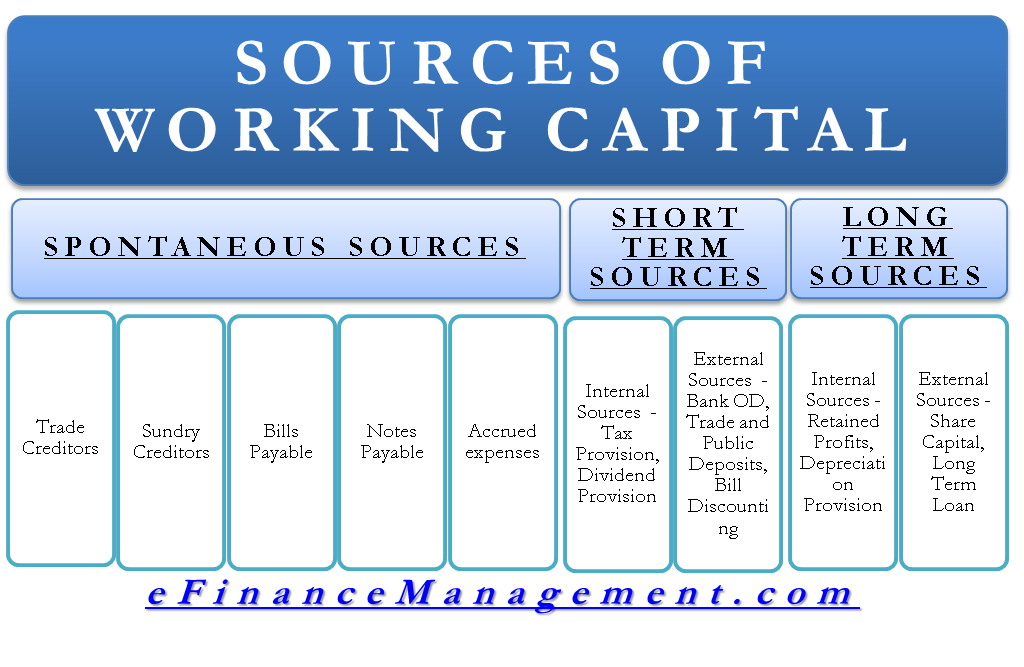

There are numerous factors both qualitative and quantitative including the subjec tive judgment of financial managers which conjointly determine a firm s capital structure. The investigation has been performed using panel data procedure for a sample of 504 indian companies listed on any stock exchange of india during 1994 95 2003 04. The capital structure of a concern depends upon a large number of factors such as leverage or trading on equity growth of the company nature and size of business the idea of retaining control flexibility of capital structure requirements of investors cost of floatation of new securities timing of issue corporate tax rate and the legal requirements. Determinants of capital structure of a firm.