Determinants Of Capital Structure Pdf

Find read and cite all the research.

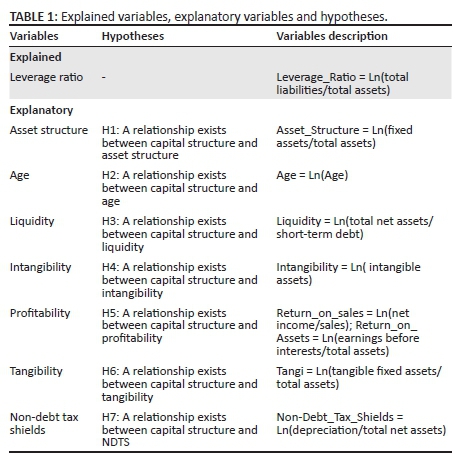

Determinants of capital structure pdf. Abstract this paper develops a study on identifying the most significant determinants of capital structure of 15 firms listed on the s p 500 index new york stock exchange using panel data over 5 years period from 2010 to 2014. Pdf the primary aim of this study is to identify the firm specific determinants of the capital structure of non financial firms in turkey and to test. The capital structure is all about the mixture of debt and equity. Determinants of capital structure.

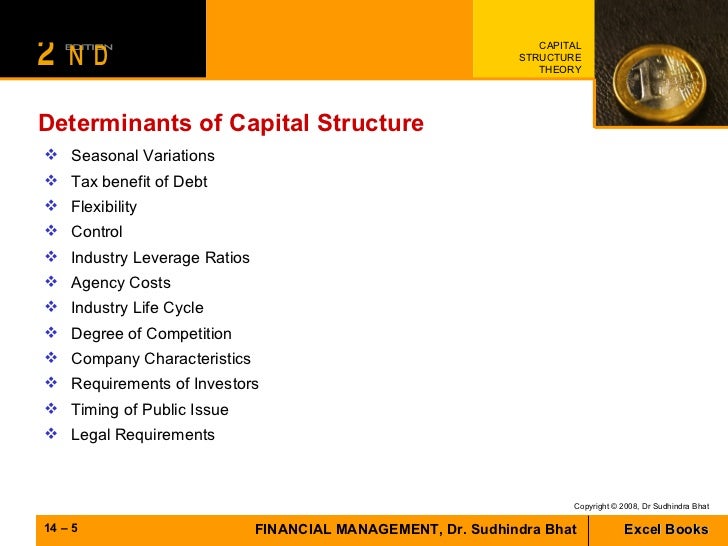

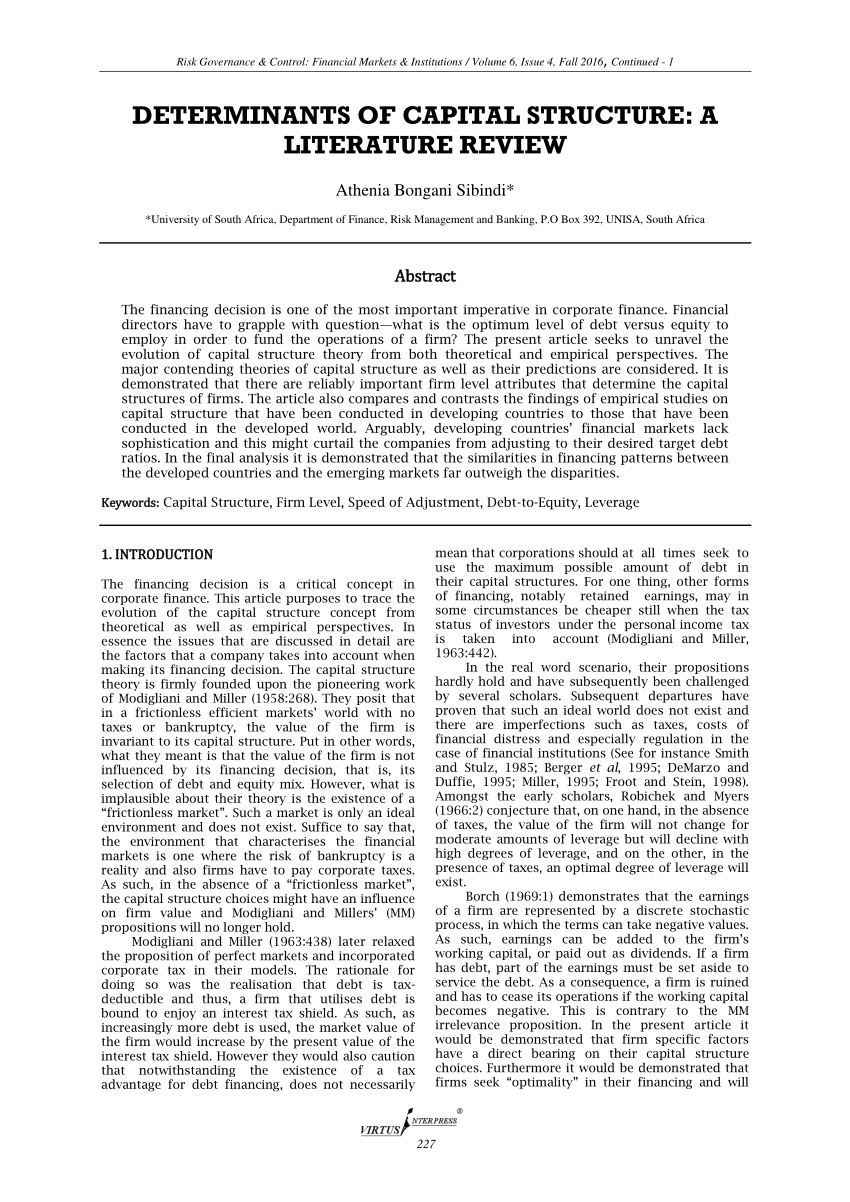

The need for insight into the capital determinants of capital structure. 3 3 seesmith and warner 35 for a comment on scott s model. The main aims of this study are to determine the factors which affect capital structure of corporations operating in energy sector and to detect capital structure theories with which capital structure of energy sector companies would comply. We may now briefly discuss the key factors governing a firm s capital structure decisions.

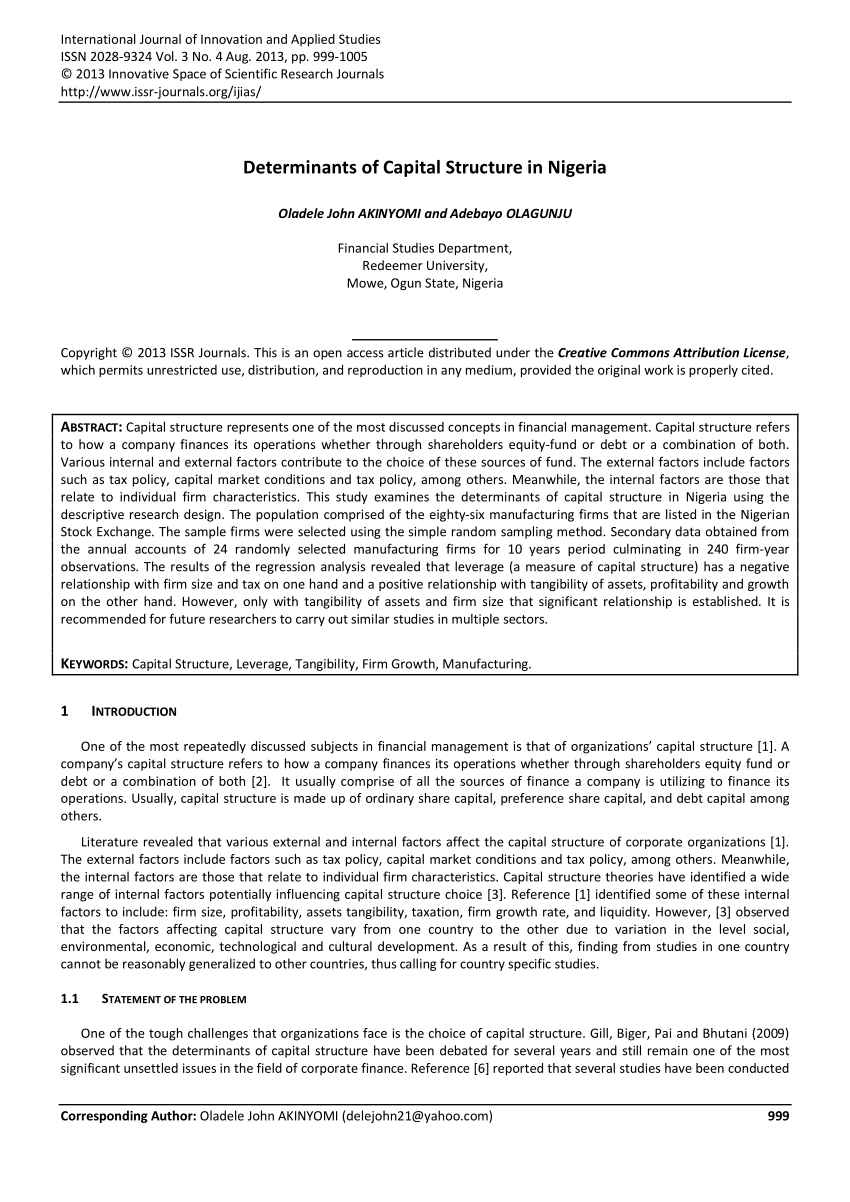

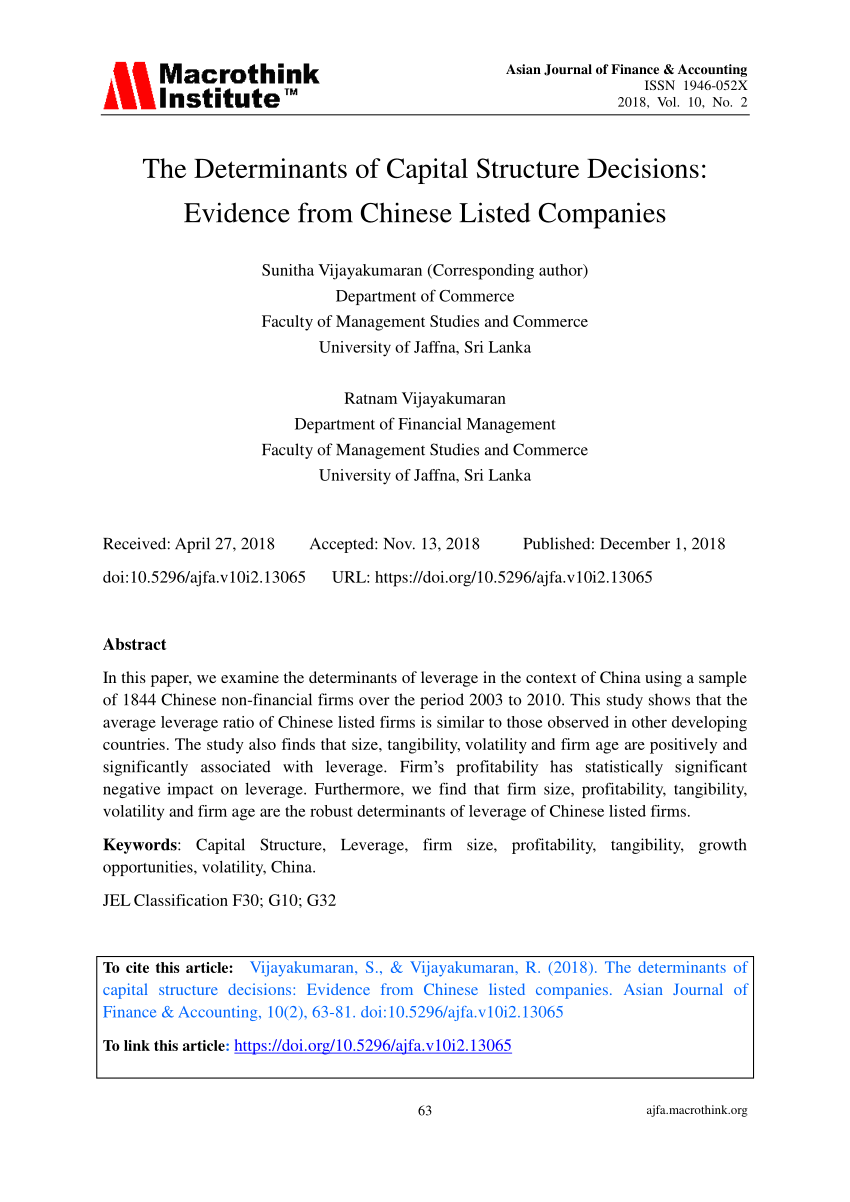

Most capital structure theories argue that the type of assets owned by a firm in some way affects its capital structure choice. Download full text pdf read full text. This paper investigates the determinants of capital structure in the context of three gcc countries and the impact of their stock markets development on the financing choices of firms operating in these markets. The decision on the capital structure poses many challenges for companies.

Determinants of capital structure an empirical evidence us by ra the university of lahore pakistan. This study has adopted the approach of combining the dynamism of capital structure and the impact of stock market development on firms financing choices. Capital structure s determinants assessment of empirical studies and a comprehensive over view of such type of research in pakistan. Determinants of capital structure in ethiopian commercial banks case.

The present article seeks to unravel the evolution of capital structure theory from both theoretical and empirical. In addition to this the two variables profitability and growth established negative relationship and the remaining four variables tangibility size age and tax shield showed positive. Scott 33 suggests that by selling secured debt firms increase the value of their equity by expropriating wealth from their existing unsecured creditors. Determinants of capital structure of a firm.