Determinants Of Capital Structure Ppt

A structural equation modeling approach powerpoint presentation free to download id.

Determinants of capital structure ppt. The adobe flash plugin is needed to view this content. In addition to this the two variables profitability and growth established negative relationship and the remaining four variables tangibility size age and tax shield showed positive. To identify the determinants of capital structure in food personal care industry no. Capital structure refers to the mix of debt and equity used by a firm in financing its assets.

Issuing shares borrowing from the market and use of retained earnings. Abstract this paper develops a study on identifying the most significant determinants of capital structure of 15 firms listed on the s p 500 index new york stock exchange using panel data over 5 years period from 2010 to 2014. Presentation on determinants of capital structure. Get the plugin now.

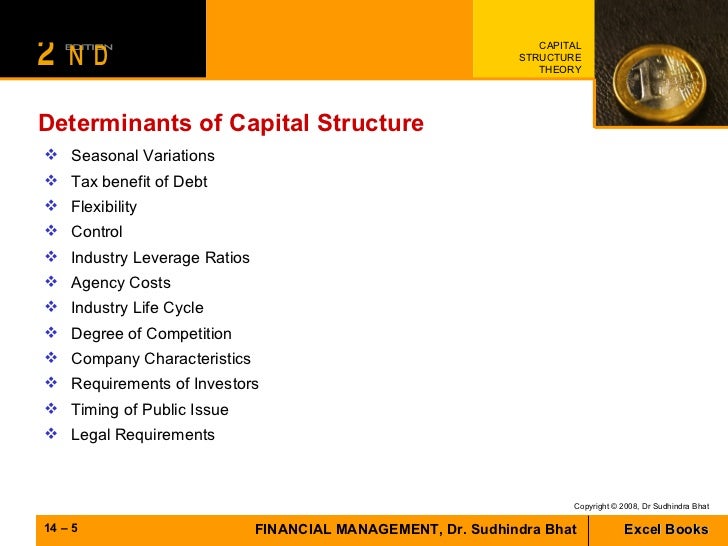

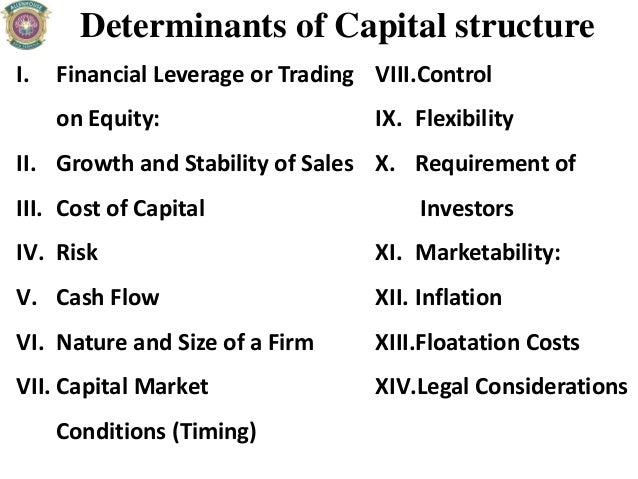

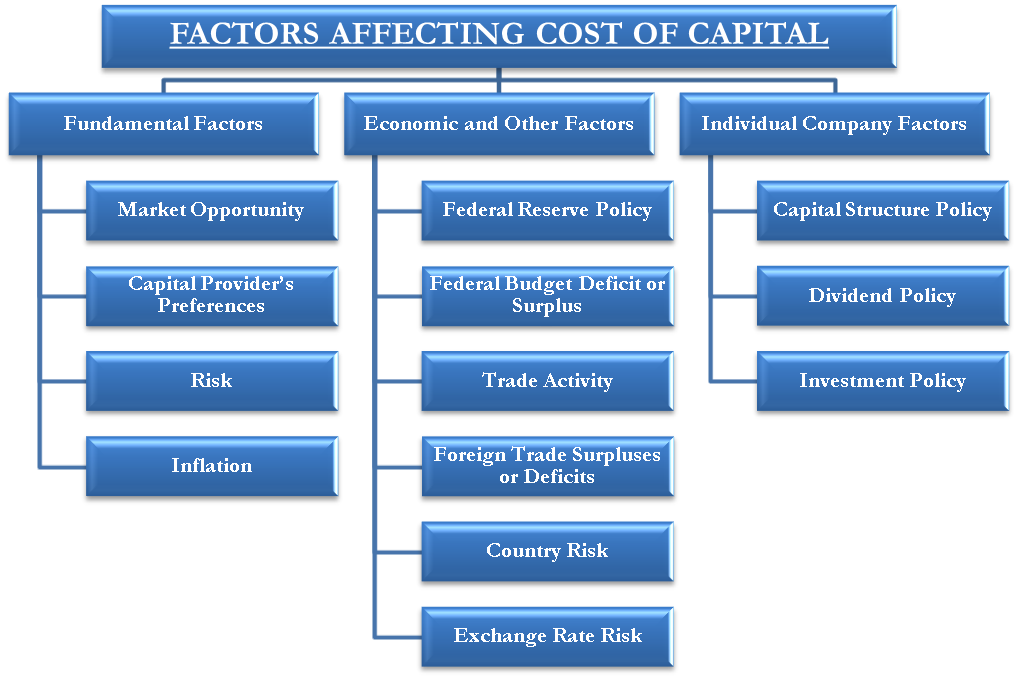

3 3 seesmith and warner 35 for a comment on scott s model. Factor expected sign main theory weak support proxy 1 profitibility negative pecking order net income total assets 2 size positive bankruptcy cost theory tradeoff theory log of sales 3 tangibility positive myers version of tradeoff theory fixed assets total assets 4 growth opportunities positive. There are numerous factors both qualitative and quantitative including the subjec tive judgment of financial managers which conjointly determine a firm s capital structure. Capital structure theories 1 net income approach ni suggested by durand it says a change in the capital structure will lead to a corresponding change in the overall cost of capital as well as the total value of the firm if the ratio of debt to equity is increased the weighted average cost of capital will decline while the value of the firm will increase and vice versa assumptions.

Most capital structure theories argue that the type of assets owned by a firm in some way affects its capital structure choice. We may now briefly discuss the key factors governing a firm s capital structure decisions. Scott 33 suggests that by selling secured debt firms increase the value of their equity by expropriating wealth from their existing unsecured creditors. A firm can choose a mix of three modes of financing i e.

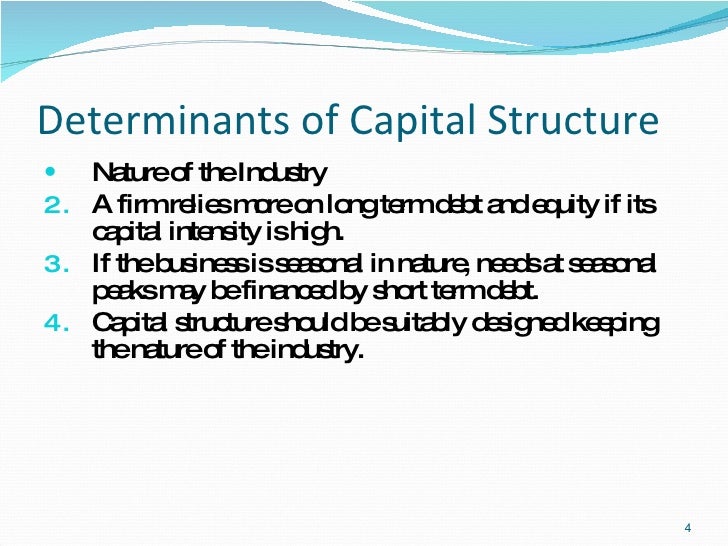

A case of listed energy sector companies in pakistan. The capital structure of a concern depends upon a large number of factors such as leverage or trading on equity growth of the company nature and size of business the idea of retaining control flexibility of capital structure requirements of investors cost of floatation of new securities timing of issue corporate tax rate and the legal requirements. Determinants of capital structure in ethiopian commercial banks case. Determinants of capital structure presentation free download as powerpoint presentation ppt pdf file pdf text file txt or view presentation slides online.

The ratio of this mix of funds purely depends on the firm and known as optimal capital structure of the firm.