Discuss The Determinants Of Capital Structure

While in period of boons and inflation the company s capital should consist of share capital generally equity shares.

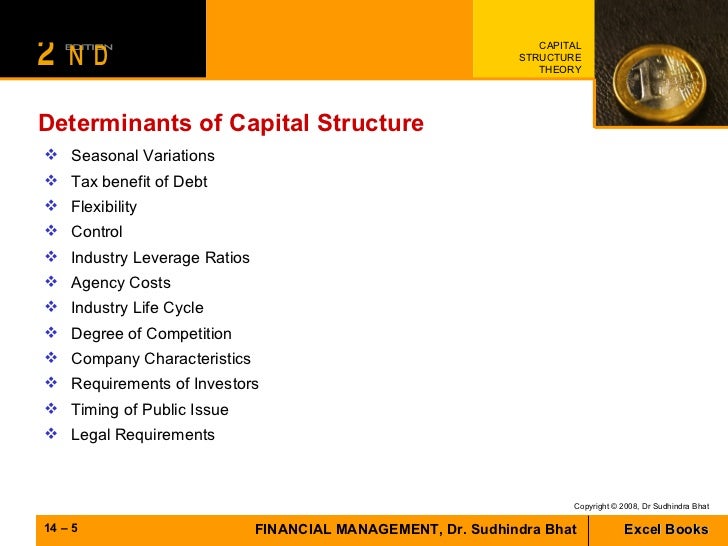

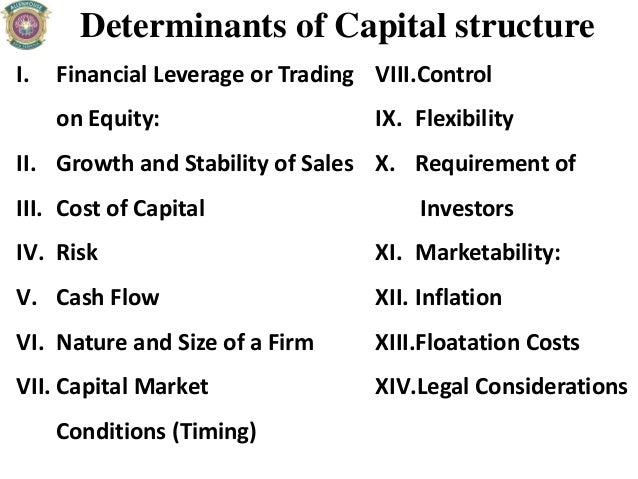

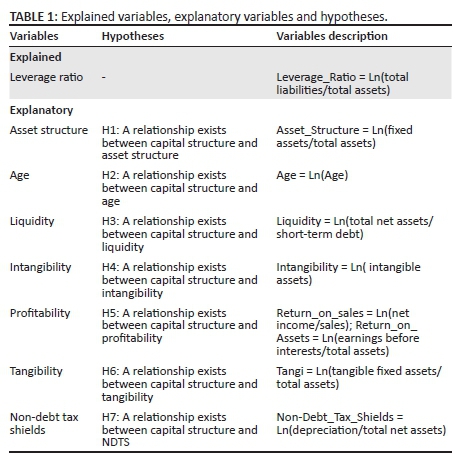

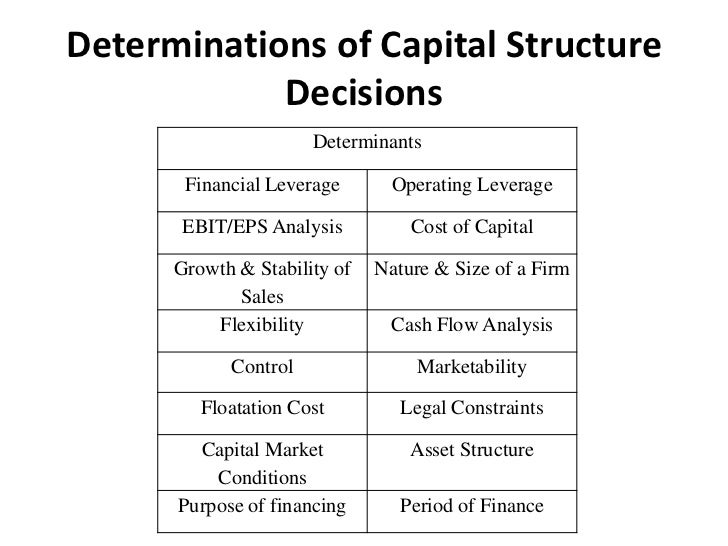

Discuss the determinants of capital structure. Determinants of capital structure an empirical evidence us by ra the university of lahore pakistan. Determinants of capital structure are dependent upon these ratios with the main factors being organizational size cost of fixed assets organizational purpose or focus legal requirements organizational control investment requirements reasons for obtaining finance terms of finance market conditions and flexibility required as well as requirements of investors or others who have a stake. Financial leverage 2 growth and stability of sales 3 cost of capital 4 risk 5 cash flow ability to service debt 6 nature and size of a firm 7 control 8 flexibility 9 requirements of investors 10 capital market conditions 11 assets structure 12. The factors influencing the capital structure or determinants of capital structure are discussed as follows.

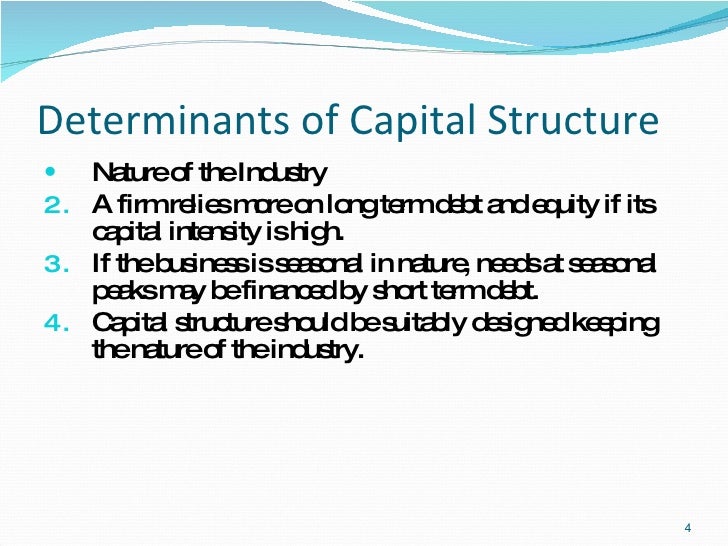

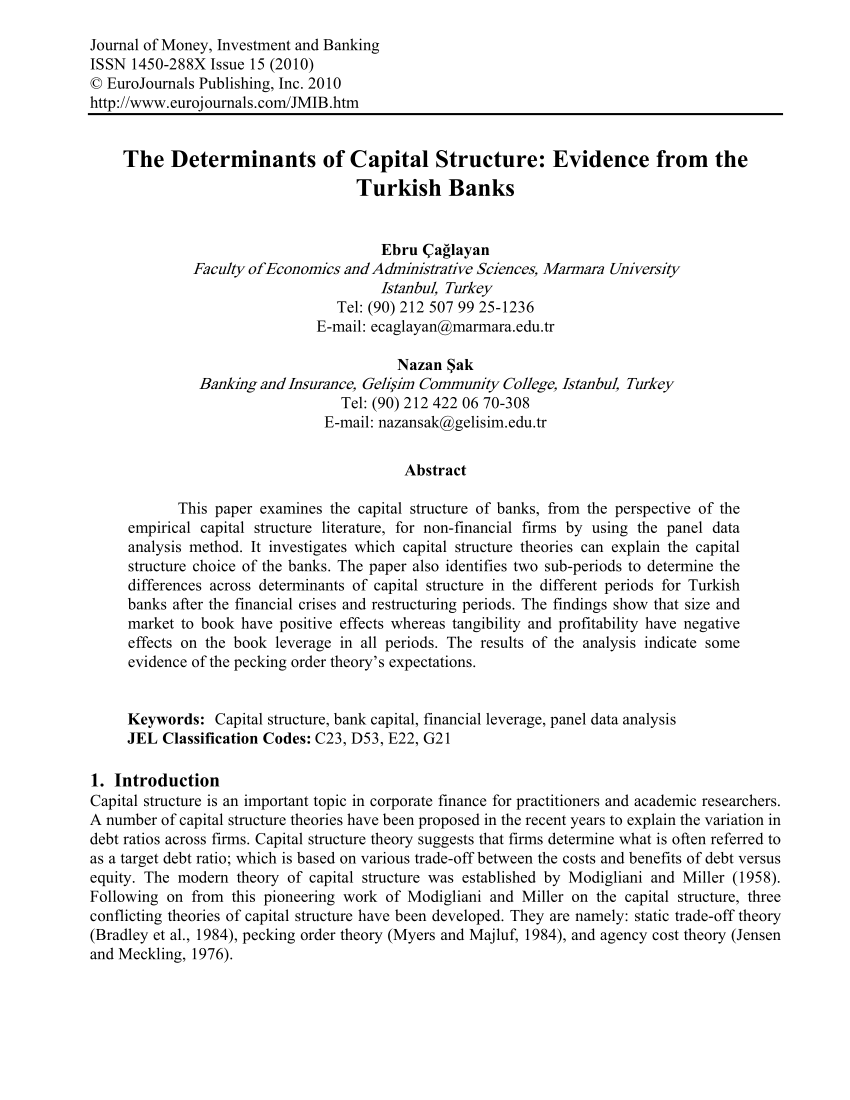

The use of long term fixed interest bearing debt and preference share capital along with equity share capital is called financial leverage or trading on equity. There are numerous factors both qualitative and quantitative including the subjec tive judgment of financial managers which conjointly determine a firm s capital structure. Capital structure should be designed very carefully. Determinants of capital structure in ethiopian commercial banks case.

Financial leverage or trading on equity. In addition to this the two variables profitability and growth established negative relationship and the remaining four variables tangibility size age and tax shield showed positive. Determinants of capital structure. Most capital structure theories argue that the type of assets owned by a firm in some way affects its capital structure choice.

Scott 33 suggests that by selling secured debt firms increase the value of their equity by expropriating wealth from their existing unsecured creditors. 3 3 seesmith and warner 35 for a comment on scott s model. We may now briefly discuss the key factors governing a firm s capital structure decisions. This article throws light upon the top seventeen factors determining the capital structure.

Capital market condition in the lifetime of the company the market price of the shares has got an important influence. During the depression period the company s capital structure generally consists of debentures and loans.