How To Calculate Tax Estimate For Cp204

This calculator will help you work out your tax refund or debt estimate.

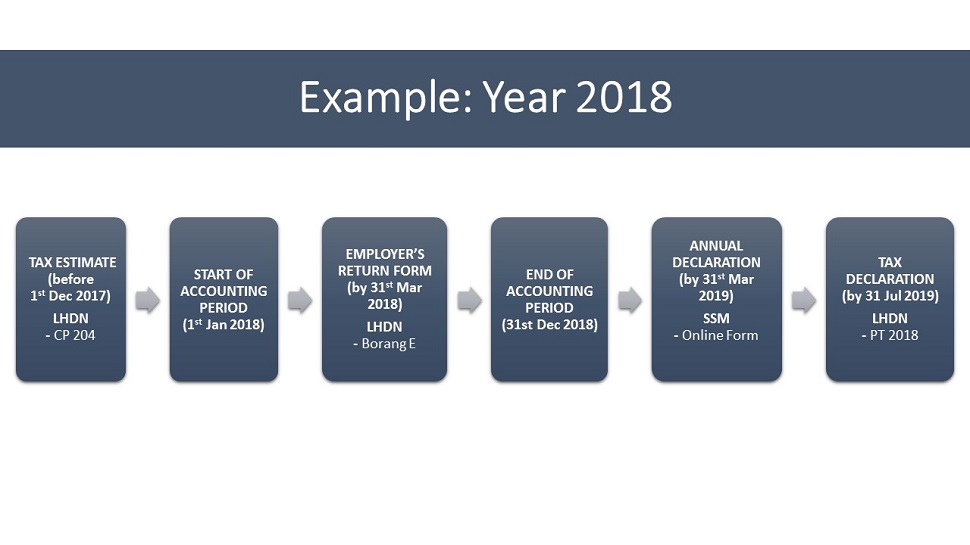

How to calculate tax estimate for cp204. The calculator will help you estimate your property tax payable based on the annual value of your property. Therefore for year. Please use the cp207 form payment slip which is provided together with the c form to make payment. The most commonly asked question by our clients in filling up the form cp204 is.

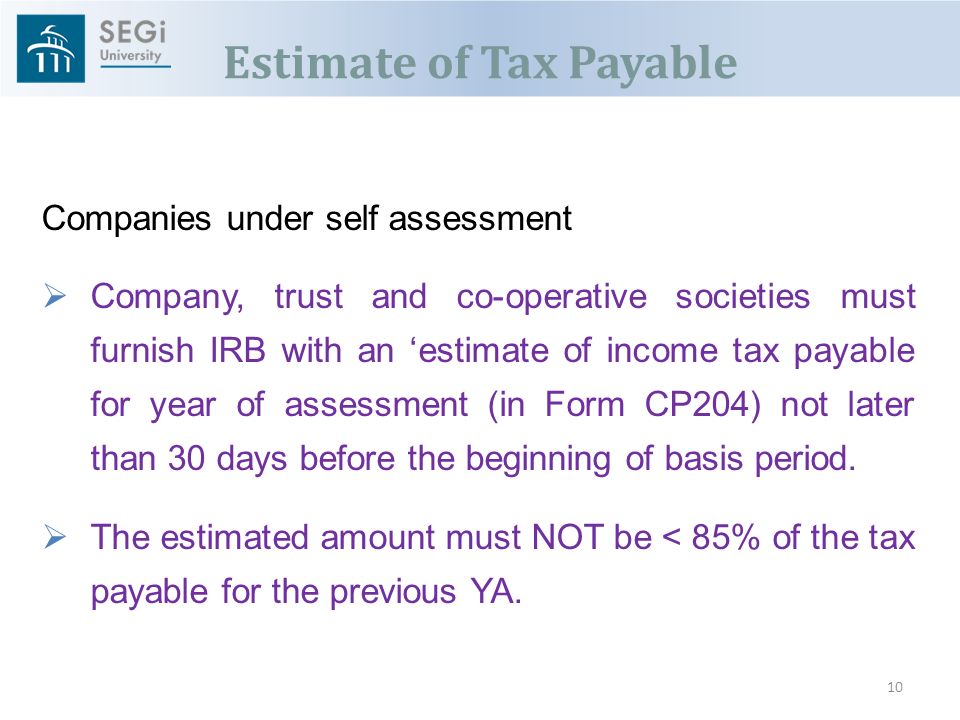

In the 6th 9th month the company revises the tax estimate to rm100 000. Failure to furnish estimate tax payable form cp204 liable to a fine ranging from rm200 to rm2 000 or face imprisonment or both. Submission of tax estimation cp204 form an existing company is required to. You can view the annual value of your property at mytax iras gov sg.

Income tax estimator this link opens in a new window it will take between 15 and 25 minutes to use this calculator. How to calculate tax estimate for cp204. In the 6th 9th month the company revises the tax estimate to rm100 000. Estimate of tax payable in malaysia.

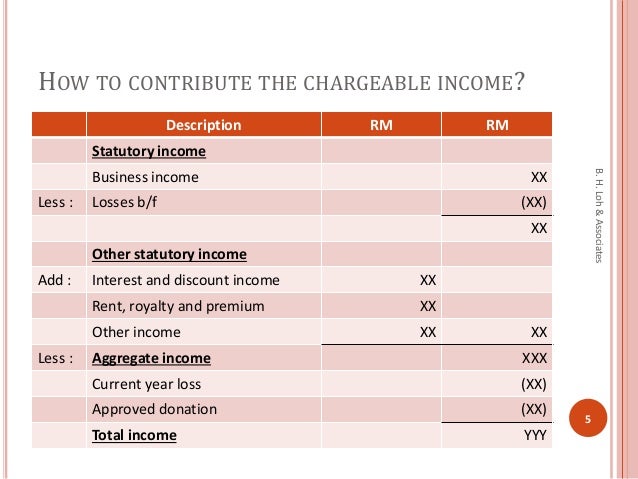

Therefore for year assessment 2008 abc sdn bhd has to furnish a tax estimate of at least rm85 000 85 from the revised estimate of the year assessment 2007. When a company has determined its actual tax payable balance of tax which is the actual tax payable after deducting total instalments on the tax estimate has to be paid within 7 months from the close of the accounting period. The most commonly asked question by our clients in filling up the form cp204 is. With effect from y a 2008 where a sme first commences operations in a year of assessment the sme is not required to furnish an estimate of tax payable or make instalment payments for a period of two years beginning from the year of assessment in which the sme commences operations.

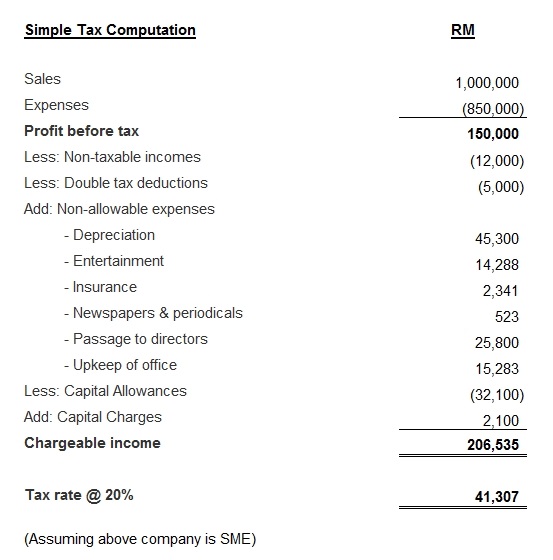

Use the simple tax calculator if you don t want or need a detailed calculation. Abc sdn bhd has furnished estimate for the year of assessment 2007 amounting to rm50 000. In order to calculate the possible tax payable for the coming year the company must made several assumptions and projections based on the current year s management results. The revision is agreed by irbm.

Therefore for year assessment 2010 abc sdn bhd has to furnish a tax estimate of at least rm85 000 85 from the revised estimate of the year assessment 2009. Penalties with regards to estimate tax payable. The estimated tax payable for the first year will be the basis for the tax estimate for the next year of assessment. The revision is agreed by irbm.

How to calculate tax estimate for cp204. Fails to pay the monthly tax estimate instalment by 15th of the month a late payment penalty of 10 will be imposed on the balance of tax instalment not paid for the.