Letter Of Credit Malaysia

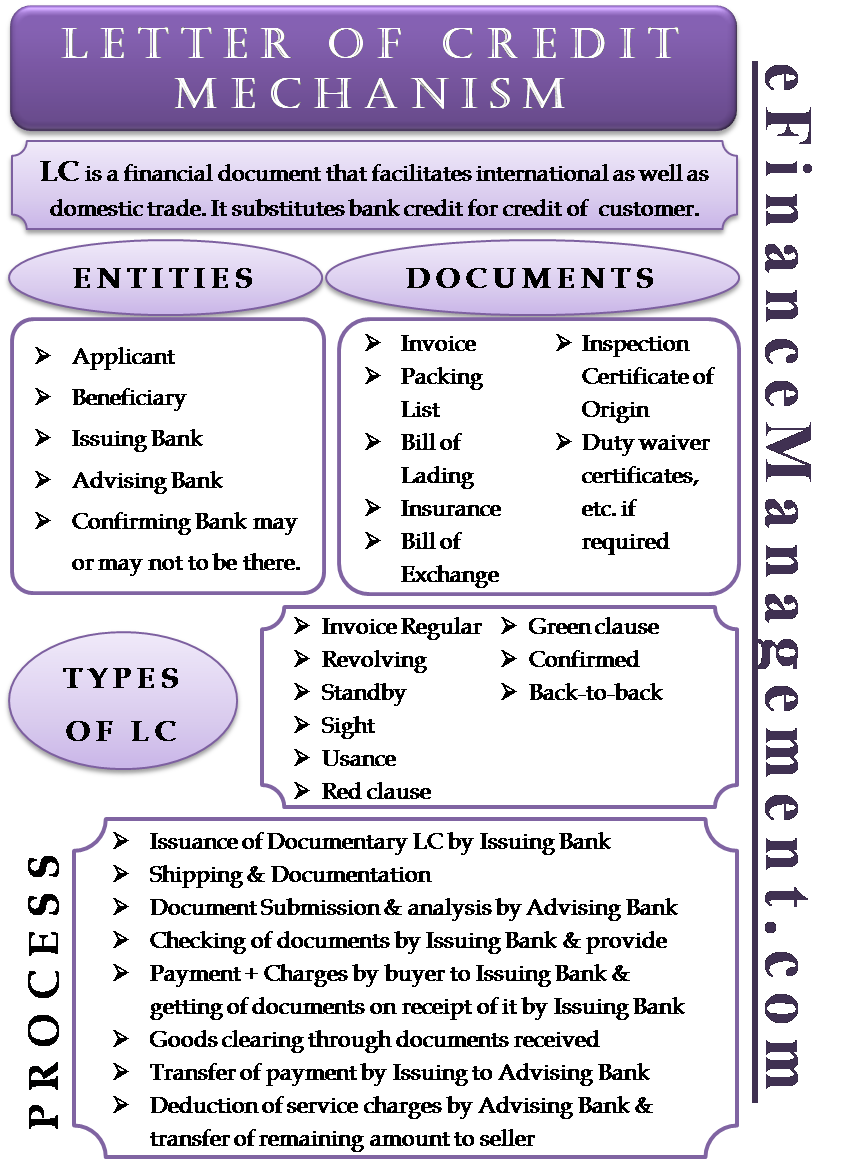

The bank will only make payment upon presentation of the stipulated documents which complies with the terms and conditions of the lc i.

Letter of credit malaysia. Ocbc business banking you re in malaysia. Whether it s getting you acquainted with your credit score or ratings assisting you with your credit information or getting you to know your rights we are all about ensuring that positive culture is a culture within every malaysian s reach. Fcy denominated documentary credit usd50 flat or equivalent for general charges please refer to general charges trade note. Uob sme product disclosure sheet version 2 november 2016 standby letter of credit united overseas bank malaysia bhd 271809k 1 product disclosure sheet read this product disclosure sheet before you decide to take out the standby letter of credit.

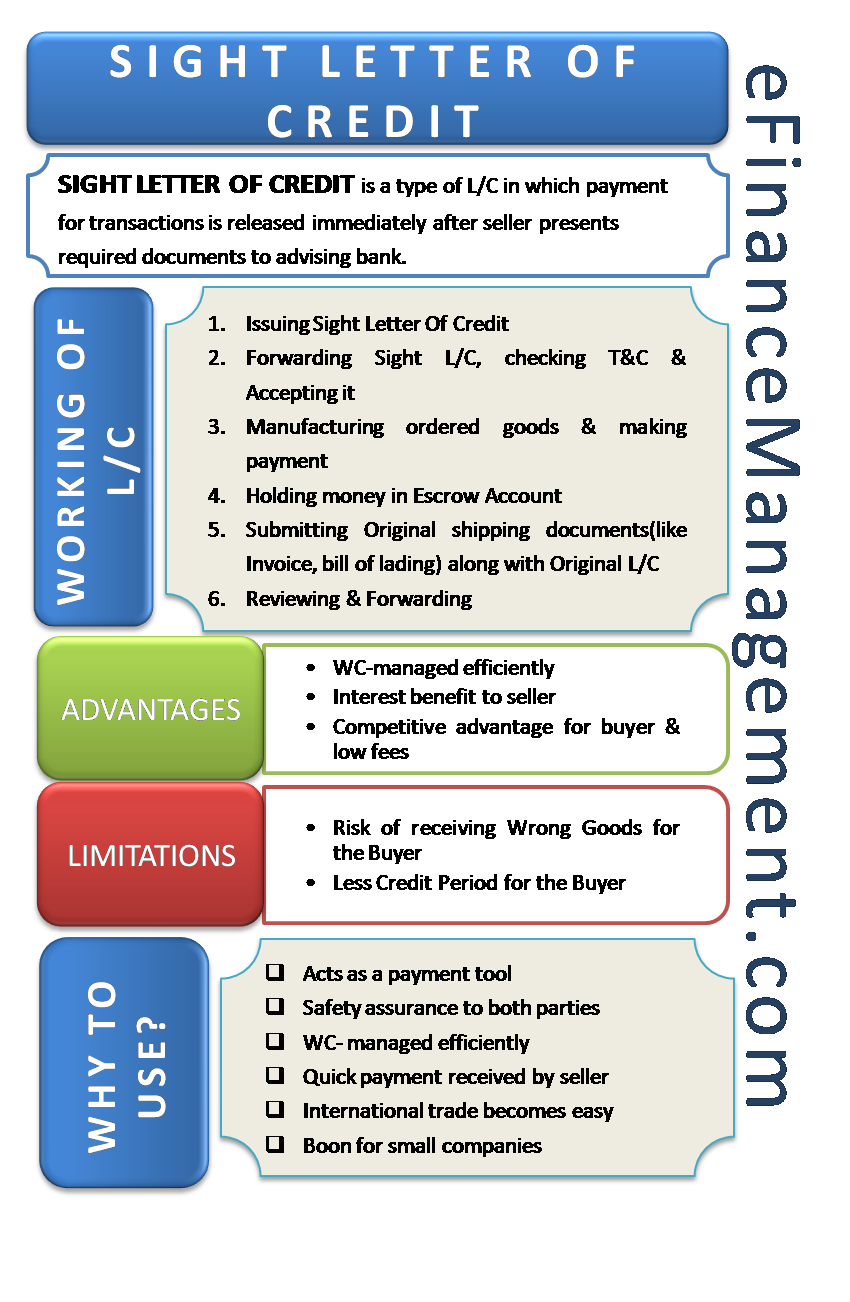

Letters of credit are used extensively in the financing of international trade where the reliability of contracting parties cannot be. Standby letter of credit i is a written undertaking issued to a beneficiary at the request of an applicant to pay a specified sum of money to the beneficiary against their written demand and presentation of complying document upon default of obligation by the applicant under the shariah concept of kafalah. Be sure to also read the terms in the letter of offer. The security that payment will be effected.

Under wakalah concept upon received all the shipping documents customer in order to collect the documents instruct kfh malaysia to debit their current account for settlement hence payment to its supplier. It is possible to be credit positive no matter the circumstance. The letter of credit can be issued under wakalah contract agency relationship or murabahah contract cost plus. A letter of credit i lc i is a written undertaking given by a bank on behalf of a buyer to make a specified payment to a seller named in the lc i.

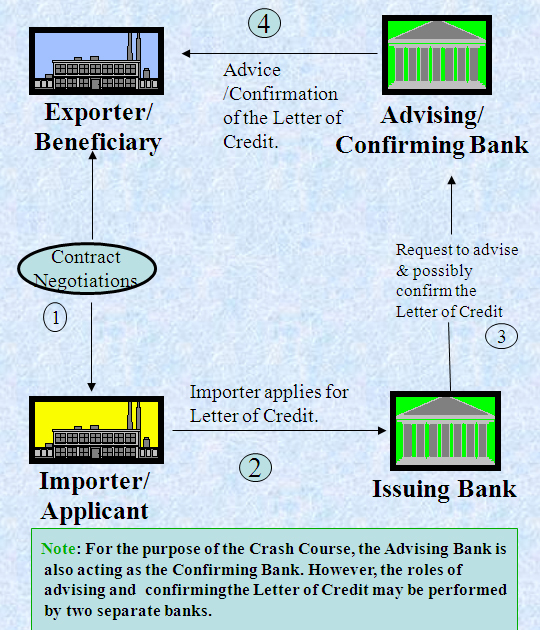

Import letter of credit assures payment to your seller if their documents meet the terms and conditions of your lc. Advantage for the buyer. The security that the supply of goods will be paid. A letter of credit is a promise by a bank on behalf of the buyer customer importer to pay the seller beneficiary exporter a specified sum in the agreed currency provided that the seller submits the required documents by a predetermined deadline advantage for the seller.

Hong leong bank letter of credit constitutes an irrevocable undertaking to honour a complying presentation of documents under letter of credit. A letter of credit lc also known as a documentary credit or bankers commercial credit or letter of undertaking lou is a payment mechanism used in international trade to provide an economic guarantee from a creditworthy bank to an exporter of goods.