Partnership Business In Malaysia

.png)

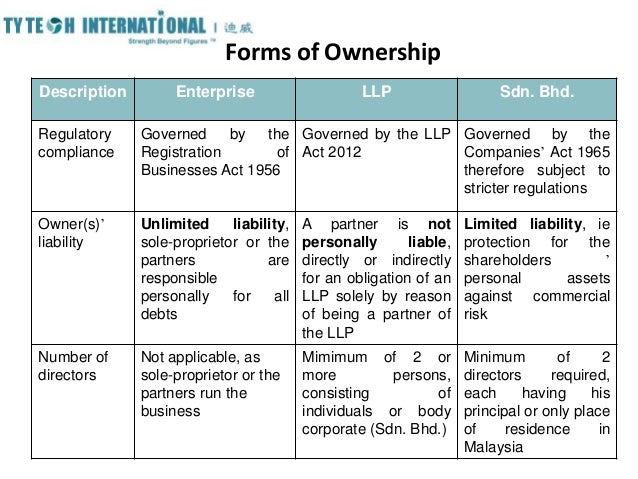

A partnership is a form of entity where 2 or more individuals come together to carry out a business.

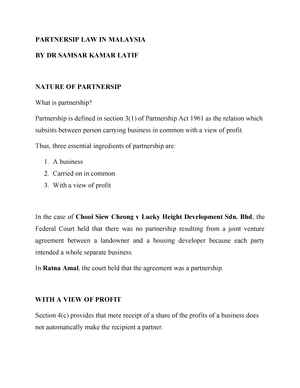

Partnership business in malaysia. Business travel packages packaging products agents packaging product processing processing services business travel services. There are 2 types of partnership in malaysia i e. Fitstar is registered as a partnership entity in malaysia. This means in essence the business has two or more owners.

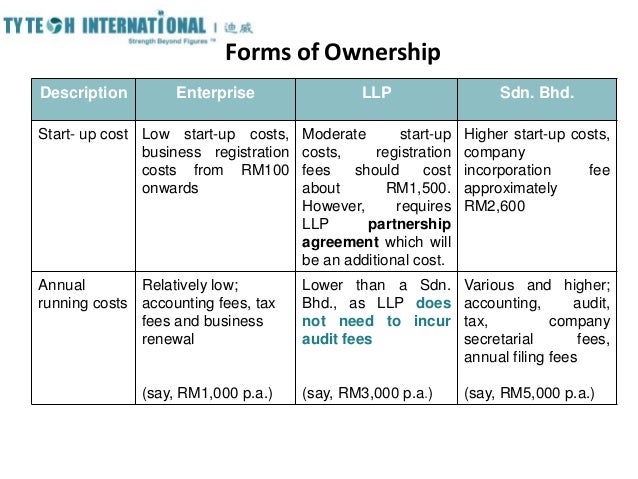

The conventional partnership governed by the partnership act 1961 and the limited liability partnership llp governed by the limited liability partnership act 2012. Our initial capital is rm 200 000 where my contribution is 60 and the remainder of 40 is contributed by jerry. In malaysia the business profits of partnerships are taxed at the individual personal tax rate of each partner involved. My name is ben.

Partners are not eligible for salary. Registration of sole proprietorship enterprise or partnership in malaysia. Here are the details. How to register a business in malaysia suruhanjaya syarikat malaysia ssm is the goverment agency which handling the registration of various forms of business entity in malaysia e g.

For this reason tax planning opportunities for those who own a partnership are somewhat limited. The malaysian partnerships can operate with a maximum of twenty members and their liabilities are unlimited there are certain rules and regulations that stipulate how a. Most decisions require majority of the partners. A partnership in malaysia is a type of business which requires at least two partners and up to 20 which should be registered with the ssm by following the above mentioned rules the registration of a local business can be completed at any of the ssm offices but investors also have the option of registering it using an online portal the ezbiz online services.

All partners are entitled to take part in managing the business. Looking partnership companies in malaysia including melaka raub kuala lumpur george town and more. Partners are not eligible for interest on their capital injected into the partnership. Sole proprietorship partnership perkongsian and private limited company.

I am running a partnership business in malaysia with my partner jerry. Loans or advances by partners to the business will carry an interest at the rate of 8 per year. It is a fitness studio known as fitstar. Therefore a partnership does not pay taxes on its business income but instead moves the tax burden to the individual partners.

A partnership company is defined as a business whose profits and management options are shared between two or more individuals.