Pioneer Status And Investment Tax Allowance

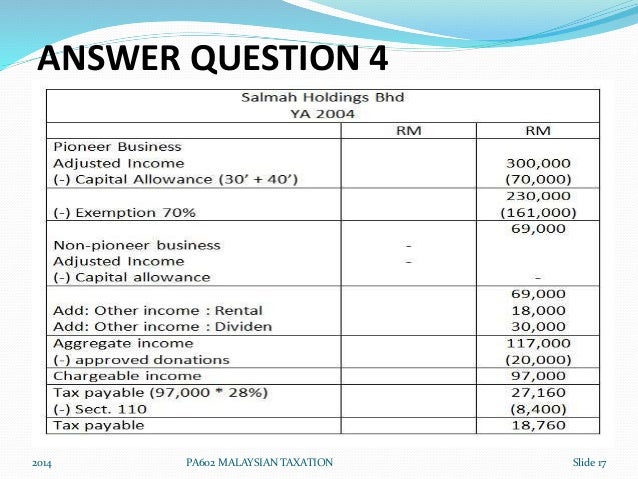

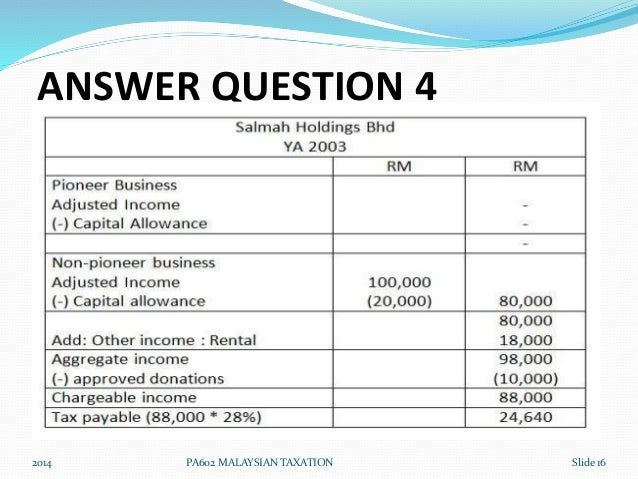

Capital expenditure incurred on assets acquired during tax relief period deemed incurred on the day following the end of tax relief period.

Pioneer status and investment tax allowance. While pioneer status is an income based tax incentive investment tax allowance is a capital expenditure based one that generally provides for a. For statutes relating to the tax incentives in the above please refer to the economic expansion incentives act and the income tax act. Tax exemption of statutory income for five years. Application for pioneer status received on or after 1 1 1991 but before 1 11 1991.

A company approved with a pioneer status certificate can enjoy income tax exemption between 70 100 of statutory income for 5 to 10 years whereas for investment tax allowance a company can get allowances between 60 100 on qualifying capital expenditure incurred within a period of 5 to 10 years. Pioneer status often provides a 70 exemption of statutory income for a period of 5 years. Pioneer status and investment tax allowance are two of the main tax incentives available in malaysia. A company approved with a pioneer status certificate can enjoy income tax exemption between 70 100 of statutory income for 5 to 10 years whereas for investment tax allowance a company can get allowances between 60 100 on qualifying capital expenditure incurred within a period of 5 to 10 years.

Candidates must first study closely the source authority for these incentives ie the relevant laws and the respective irb public rulings or guidelines where available to obtain a good general understanding. No as the exemption is based on income not on capital expenditure incurred. Pioneer status ps and investment tax allowance ita companies in the manufacturing agricultural hotel and tourism sectors or any other industrial or commercial sector that participate in a promoted activity or produce a promoted product may be eligible for either ps or ita. The alternative to pioneer status incentive is usually the investment tax allowance ita.

Say hello reach out to us for information on how we can facilitate your investment journey or other enquiries. Ii differences between pioneer status and investment tax allowance. Pioneer status and investment tax allowance july 28 2019 this tax is specifically suitable for companies with large capital investment but cannot generate returns over a short time. Pioneer status ps is an incentive in the form of tax exemption which is granted to companies participating in promoted activities or producing promoted products for a period of 5 or 10 years.