Sales Of Goods Act 1957 Section 21

The statutory of implied terms main function is to protect the rights to every buyer or consumer.

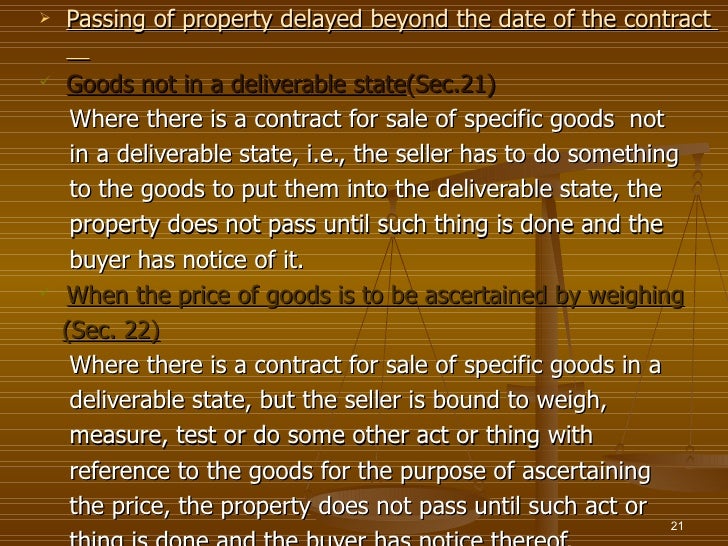

Sales of goods act 1957 section 21. Soga applies to contracts for the sale of all types of goods including second hand goods and makes no distinction between commercial sales and private sales or between wholesale and. 2 in relation to contracts made on certain dates this act applies subject to the modification of certain of its sections as mentioned in the schedule. 1 this act applies to contracts of sale of goods made on or after but not to those made before 1st january 1894. Federal territory johore kedah kelantan negeri sembilan pahang perak perlis selangor and terengganu 23 april 1957 malacca and penang 23 february 1990 chapter i preliminary short title and application 1.

Implied terms of the sale of goods act 1957. Section 14 of the soga is divided into three parts. Laws of malaysia reprint act 382 sale of goods act 1957 incorporating all amendments up to 1 january 2006 published by the commissioner of law revision malaysia under the authority of the revision of laws act 1968 in collaboration with percetakan nasional malaysia bhd 2006. Couturier v hastie 1852 8 exch 40 1852 exam 2015 questions exam 2016 questions exam 2017 questions exam 2016 questions the five sources of malaysian law and their customs.

These statutory implied terms are in section 14 17 of the sales of goods act 1957 and are the implied terms in every contract of sale of goods. The sale of goods act 1957 soga is the law applicable to sale of goods in malaysia. Section 1 states that the act shall have effect within peninsular malaysia only. In general there is no implied warranty or condition as to the quality or fitness for any particular purpose of goods supplied under a contract of sale.

Goods must be reasonably fit for purposes for which the buyer wants them section 16 1 section 16 1 states that. Sale of goods 7 laws of malaysia act 382 sale of goods act 1957 an act relating to the sale of goods. 1 this act may be cited. List of international services an excerpt of the gst act with effect from 1 jan 2020 in accordance with section 21 3 of the goods and services tax gst act a supply of services shall be treated as a supply of international services where the services or the supply are for the time being of any of the following described below.

The act does not apply to sabah and sarawak. 21 sale by person not the owner.