Section 13 1 A Income Tax Malaysia

All information contained in this publication is summarized by kpmg tax services sdn bhd the malaysian member firm member firm affiliated with kpmg international cooperative kpmg international a swiss entity based on the malaysian income tax act 1967 the act.

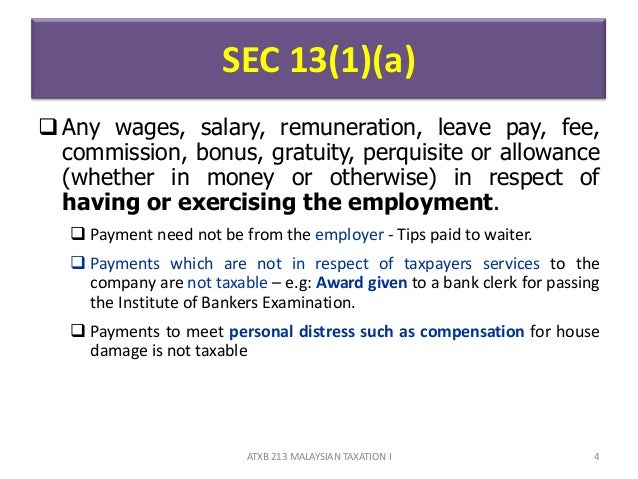

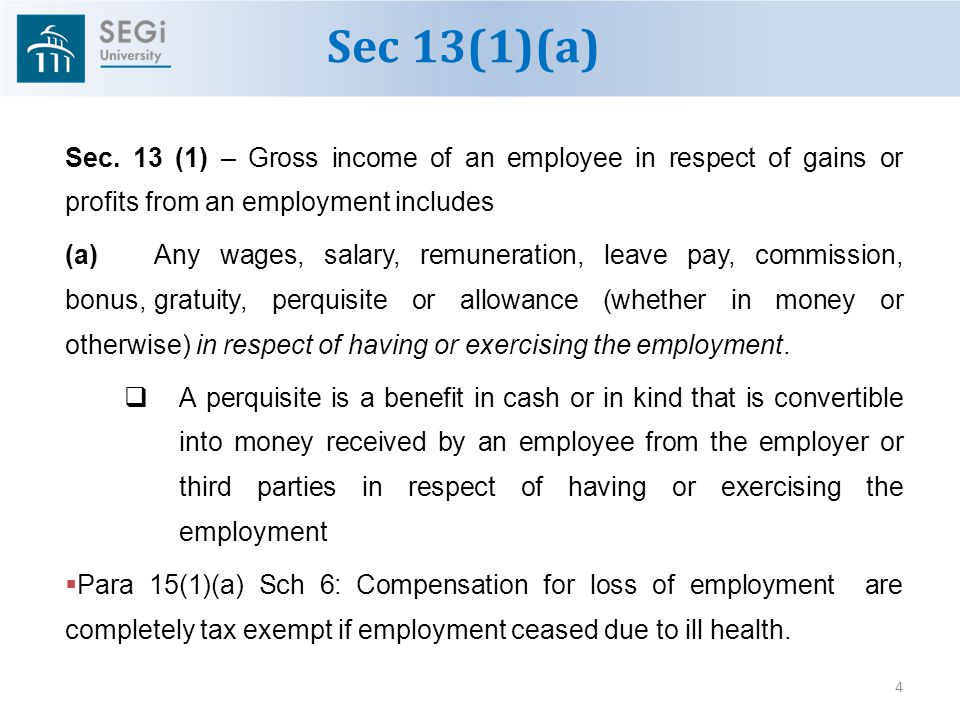

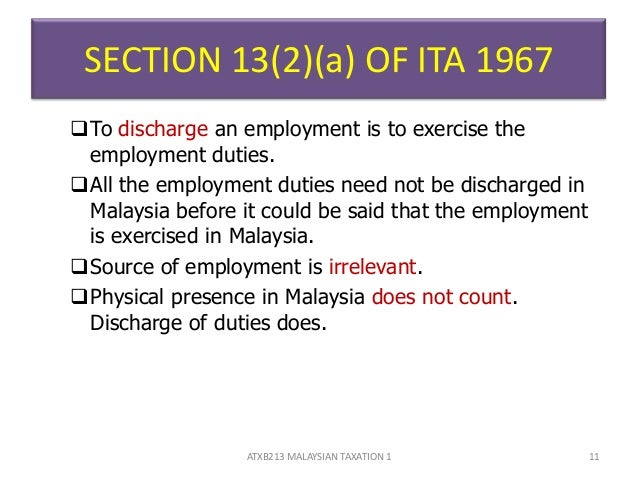

Section 13 1 a income tax malaysia. Such payment made on behalf of the employee is considered as a perquisite to the employee and is treated as gross income from employment under section 13 1 a of the malaysian income tax act 1967. The tax treatment on bik is explained in detail in the public ruling no. Year of assessment 2006. Perquisite under paragraph 13 1 a of the ita 1967 xxxxx tax treatment on share option w e f.

Types of income under section 13 1 of the act states that the gross income. As such there s no better time for a refresher course on how to lower your chargeable income. Section 33 1 of the income tax act 1967. Benefits in kind dated 8 november 2004.

Malaysia s tax season is back with businesses preparing to file their income tax returns. Agreement with malaysia and claim for section 132 tax relief hk 9 income from countries without avoidance of double taxation 30 agreement with malaysia and claim for section 133 tax relief hk 10 instalments schedular tax deductions paid 31 hk 11 not applicable to form be not enclosed hk 12 not applicable to form be not. For the be form resident individuals who do not carry on business the deadline for filing income tax in malaysia is 30 april 2020 for manual filing and 15 may 2020 via e filing. Short title and commencement 2.

Non chargeability to tax in respect of offshore business activity 3 c. Generally you are only taxed for the profit that you or your business earns. The deadline for filing your income tax returns form in malaysia varies according to what type of form you are filing. Laws of malaysia act 53 income tax act 1967 arrangement of sections part i preliminary section 1.

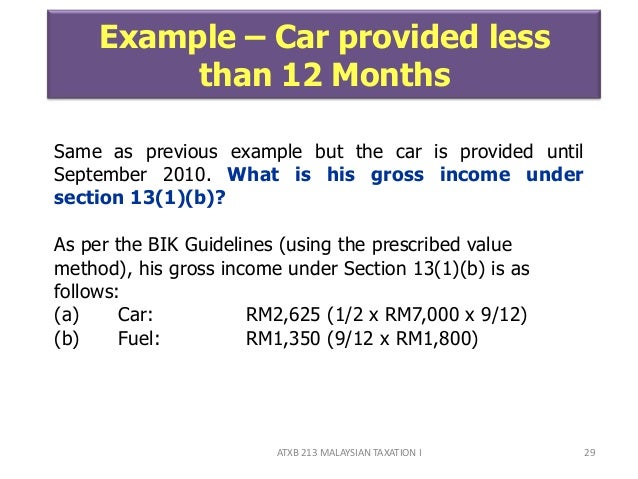

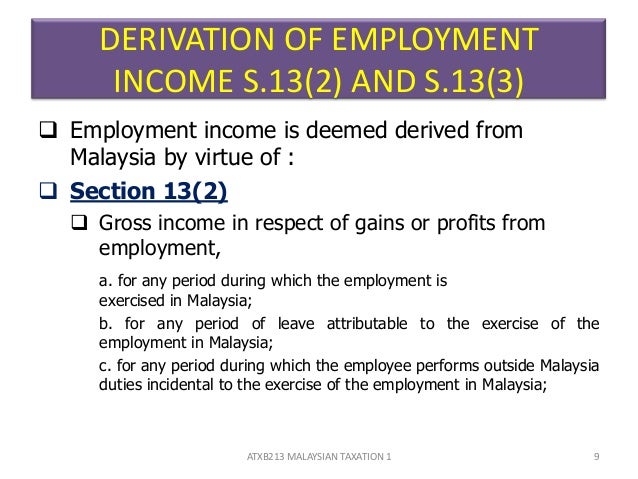

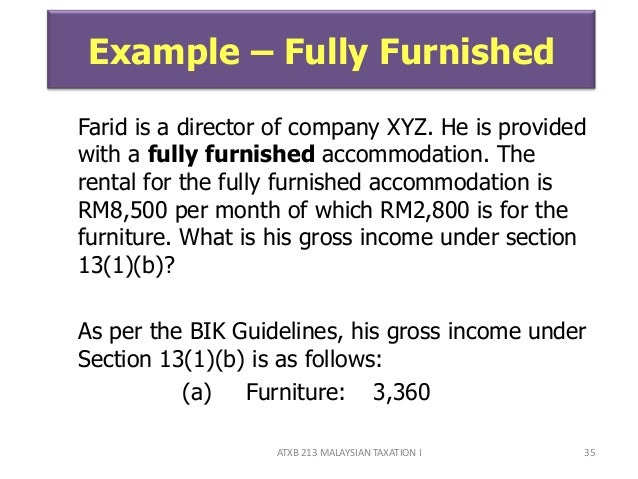

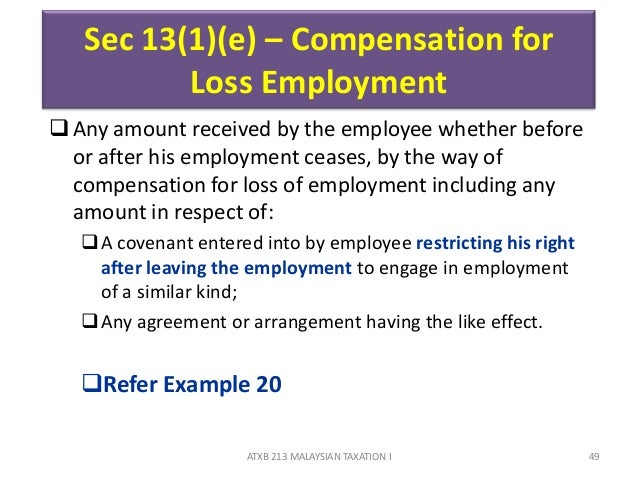

Paragraph 13 1 b of schedule 6 of the income tax act 1967 which provides for incomes of religious institutions to be exempted from income tax that was passed by parliament under the. From employment under paragraph 13 1 b of the ita. Section 140c of the income tax act 1967 and the income tax restriction on deductibility of interest rules 2019 it is stipulated in the rules that the phrase maximum amount of interest referred to in section 140c shall be an amount equal to 20 of the amount of tax ebitda of that person from each of his business sources for the basis period for a y a. Charge of income tax 3 a.

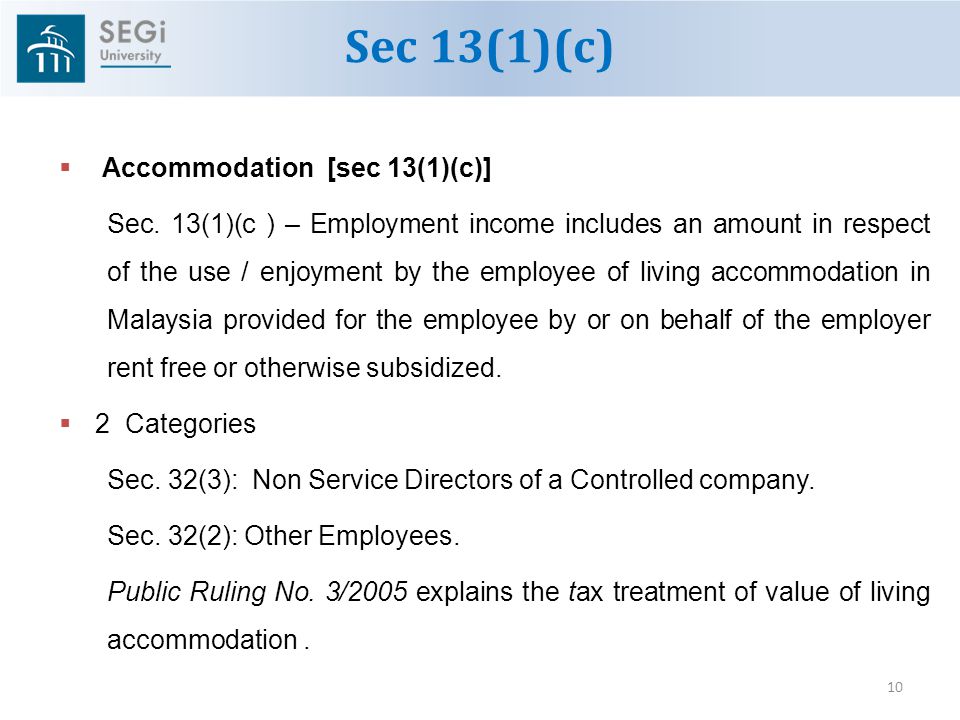

13 july 2020. 4 4 vola is living accommodation benefit provided for the employee by or on behalf of the employer. What are the types of income which are taxable and subject to monthly tax deduction mtd or in bahasa malaysia potongan cukai berjadual pcb. Interpretation part ii imposition and general characteristics of the tax 3.