What Is Deferred Tax Asset How A Deferred Tax Asset Is Most Commonly Created

If taxes are overpaid or paid in advance then the amount of overpayment can be considered an asset and illustrates that the business should receive some tax break in the next filing.

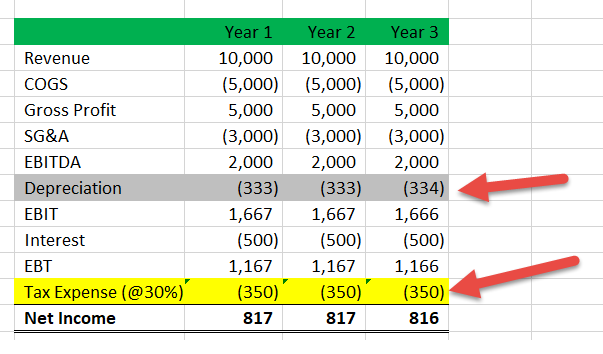

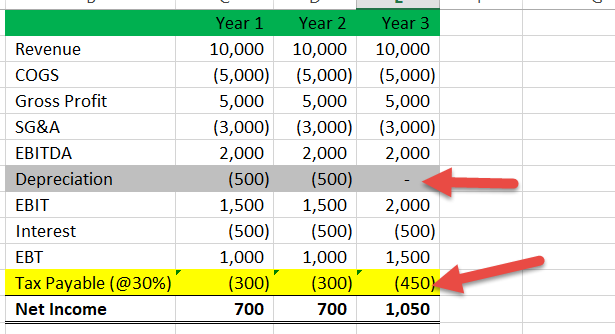

What is deferred tax asset how a deferred tax asset is most commonly created. The value of deferred tax asset is created by taking the difference between the book income and the taxable income. A deferred tax liability arises. Hence there will be a dta of 1000 750 250 due to the difference in depreciation rates. With deferred tax assets the firm will have either paid taxes early or have paid too much tax and is therefore entitled to some money back from the tax authorities deferred tax assets can be used when the company carries over a.

For example a case of deferred tax may arise if the tax authority recognizes revenue or expenses at different points of time than that set by an accounting standard. Likewise a decrease in liability or an increase in deferred asset is a use of cash. When a company overpays for a particular tax period this can be marked as a deferred tax asset on the balance sheet. If the carrying value of an asset is greater than its tax base or.

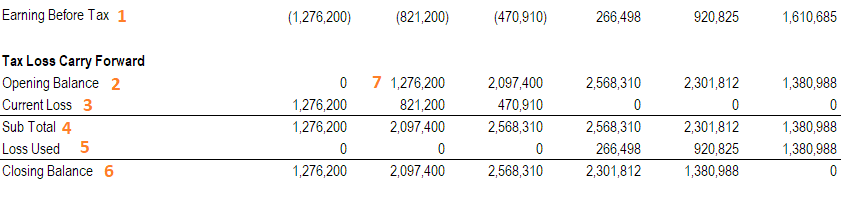

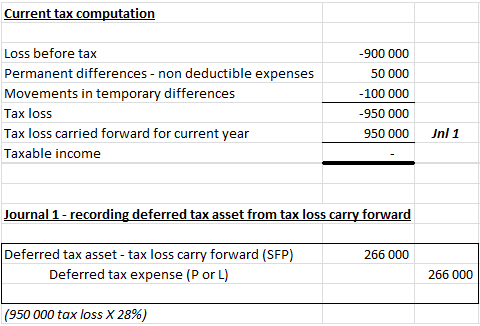

An increase in deferred tax liability or a decrease in deferred tax assets is a source of cash. In the above two examples i e deferred tax assets are arising due to depreciation and carry forward losses this asset is recorded only if it can materialize. The most generic forms of deferred tax are deferred tax asset and deferred tax liability. Deductible temporary differences result in amounts being deductible when determining the taxable profit or loss in the future period when assets or liabilities are recovered or.

A deferred tax asset can arise when there are differences in tax rules and accounting rules or when there is a carryover of tax losses. Deferred tax assets originate when the amount of tax has either been paid or has been carried forward but it has still not been acknowledged in the statement of income. If the carrying value of a liability is less than its tax base. A deferred tax asset is an accounting term on a firm s balance sheet that is used to illustrate when a firm has overpaid on taxes and is due some form of tax relief.

Thus as per this the tax will be 750 on the income statement and 1000 paid to the tax authorities. A deferred tax asset is a tax reduction whose recognition is delayed due to deductible temporary differences and carryforwards this can result in a change in taxes payable or refundable in future periods. Analyzing the change in deferred tax balances should also help to understand the future trend these balances are moving towards.

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

/GettyImages-1188027141-ab15a71307e84faa8a922f5789608905.jpg)