What Is Deferred Tax Asset In Hindi

What is deferred tax assets and liabilities deferred tax assets and liabilities in hindi easy understanding this video provides an example to illustrate why how a deferred tax is calculated.

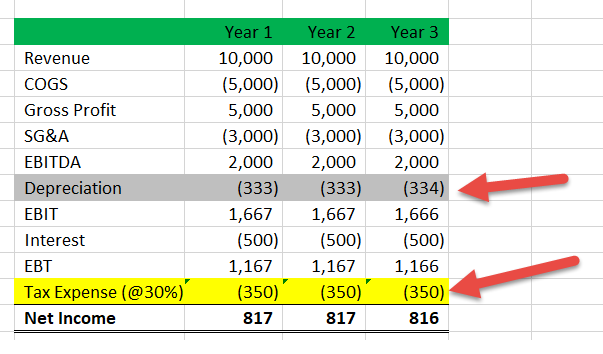

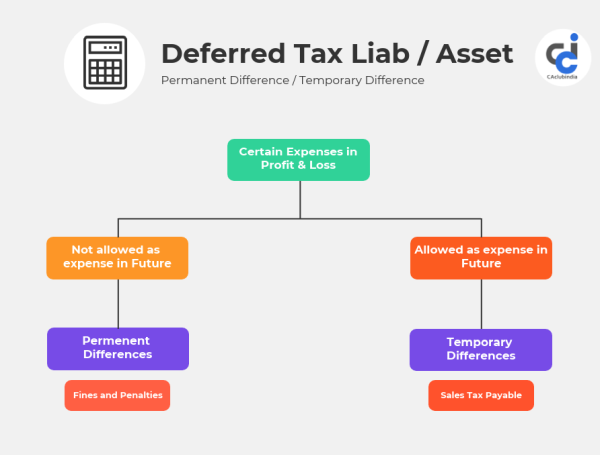

What is deferred tax asset in hindi. Jonathan collects all relevant information from the company s balance sheet and income statement and creates the following excel spreadsheet. According to as22 deferred tax asset and deferred tax liability arises due to the difference between bp tp and do not rise on account of tax expense itself. Meaning of deferred in hindi hindi meaning of word deferred what is meaning of deferred in hindi. Annuities charges taxes income either as an asset or liability.

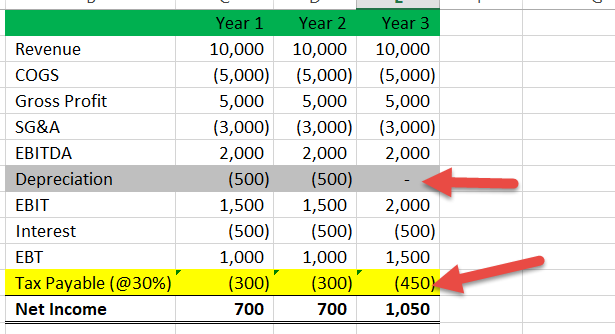

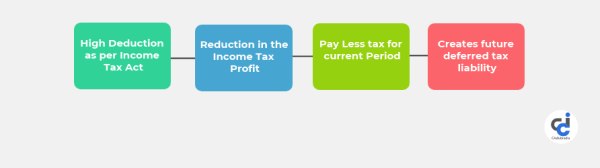

When a company overpays for a particular tax period this can be marked as a deferred tax asset on the balance sheet. Deferred tax liability arises when there is a difference between what a company can deduct as tax and the tax that is there for accounting purposes. Of or pertaining to a value that is not realized until a future date e g. Deferred tax liability meaning in hindi.

Toggle navigation english to hindi. Minimum alternate tax mat does not give rise to any difference between bp tp. The deferred tax asset in this case is rs 3 00 000 rs 2 94 000 rs 6 000. Example of deferred tax asset and liability.

What is assets and liabilities business म business क व द ध और business क अस त त व म assets और liabilities बह त महत वप र ण role play करत ह न क वल business म बल क हम र द न क ज वन म भ assets और liabilities. Deferred tax liability क एक फर म क ब ल स श ट पर स च त क य ज त ह और वर तम न ल ख कन अवध म भ गत न क ए गए कर और अगल. Therefore in accordance with as 22 it is not appropriate to consider mat credit as a deferred tax asset. For the purpose of tax profit bad debts will be allowed in future when it s actually written off.

Dta suppose book profit of an entity before taxes is rs 1 000 and this includes provision for bad debts of rs 200.

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)