What Is Deferred Tax Asset In India

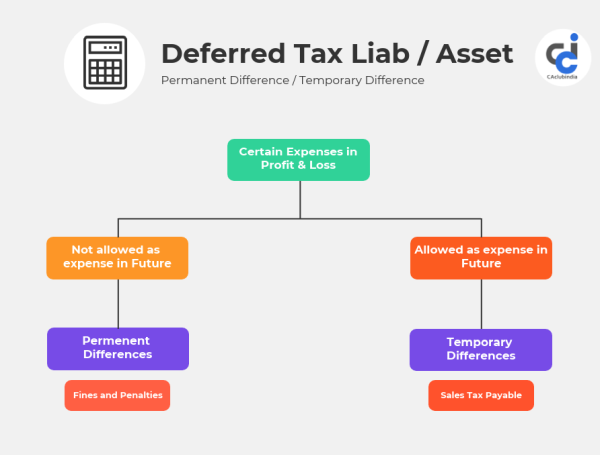

Companies use tax deferrals to lower the income tax expenses of the coming accounting period provided that next tax period will generate positive earnings.

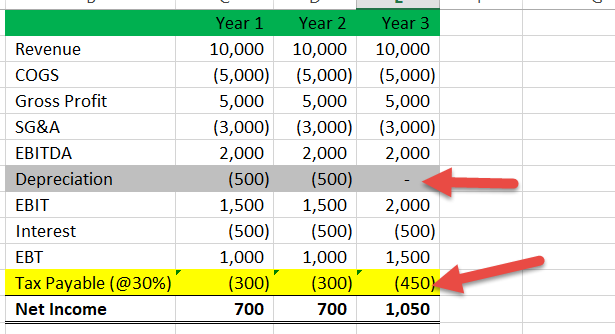

What is deferred tax asset in india. There is no separate deferred tax rate followed in taxation practices in india. Hence in these years the company will have to create a deferred tax asset for clarity the following table is provided. Therefore in accordance with as 22 it is not appropriate to consider mat credit as a deferred tax asset. A deferred tax asset is an income tax created by a carrying amount of net loss or tax credit which is eventually returned to the company and reported on the company s balance sheet as an asset.

This is because in the years to come the depreciation as per income tax act will be lesser that the depreciation as per books of accounts. Therefore the general corporate tax rate is applicable in the calculation of deferred tax. Many people find deferred tax as a very difficult topic to understand but the reality is just the opposite deferred tax is a simple concept and one can master it by just understanding the concept properly. Minimum alternate tax mat does not give rise to any difference between bp tp.

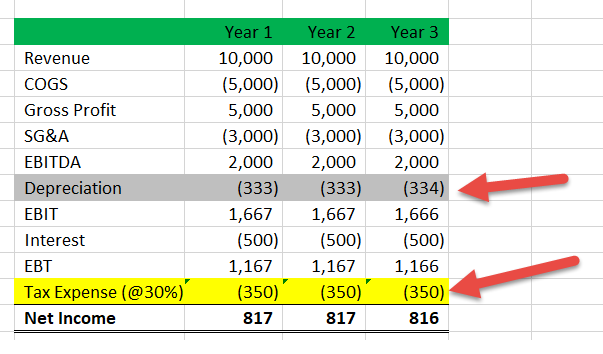

According to as22 deferred tax asset and deferred tax liability arises due to the difference between bp tp and do not rise on account of tax expense itself. The value of deferred tax asset is created by taking the difference between the book income and the taxable income. To simplify if we have fixed assets in the books as gross block rs 250 lacs and accumulated depreciation rs 150 lacs the net value in the books is rs 100 lacs. Deferred tax assets arise when the tax amount has been paid or has been carried forward but has still not been recognized in the income statement.

A deferred tax asset is an item on the balance sheet that results from overpayment or advance payment of taxes. All about deferred tax asset and liability. A very common example of this is depreciation. Calculation of deferred tax.

Deferred tax dt the tax effect due to the timing differences is termed as deferred tax which literally refers to the taxes postponed. To introduce deferred tax first time in the books we have to find difference between the value of assets as per books of accounts and the value of assets as per income tax act. It simply means that the company will definitely have a tax liability of that much in the future years. Deferred tax is recognised on all timing differences temporary and permanent.

25 x 10 000 or rs. Therefore it is creating a deferred tax asset of rs.

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/GettyImages-1188027141-ab15a71307e84faa8a922f5789608905.jpg)