What Is Deferred Tax Asset Journal Entry

The book entries of deferred tax is very simple.

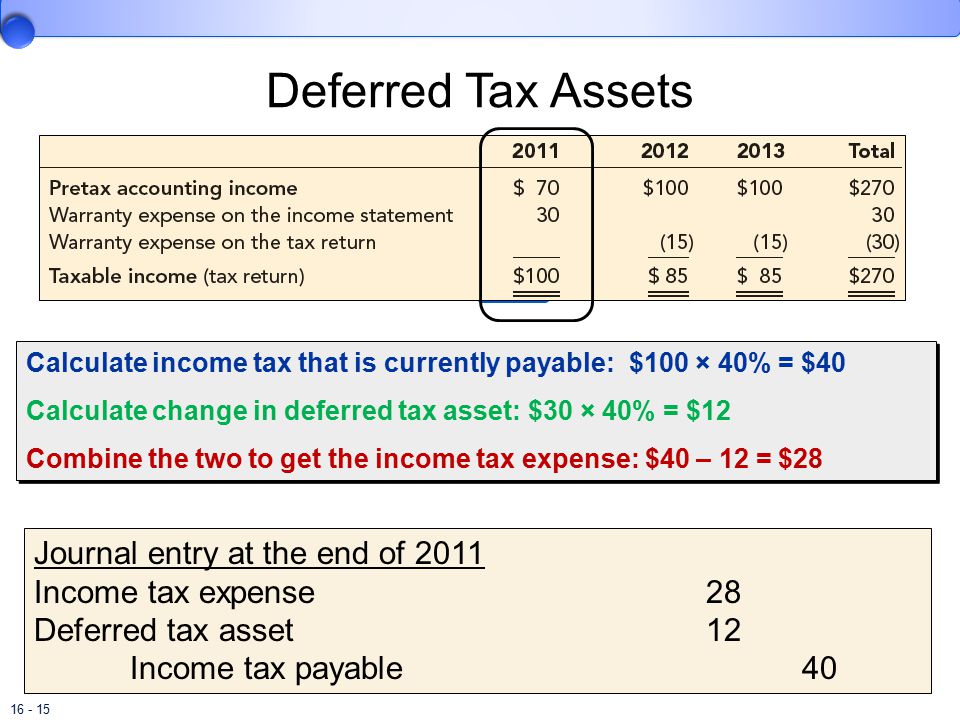

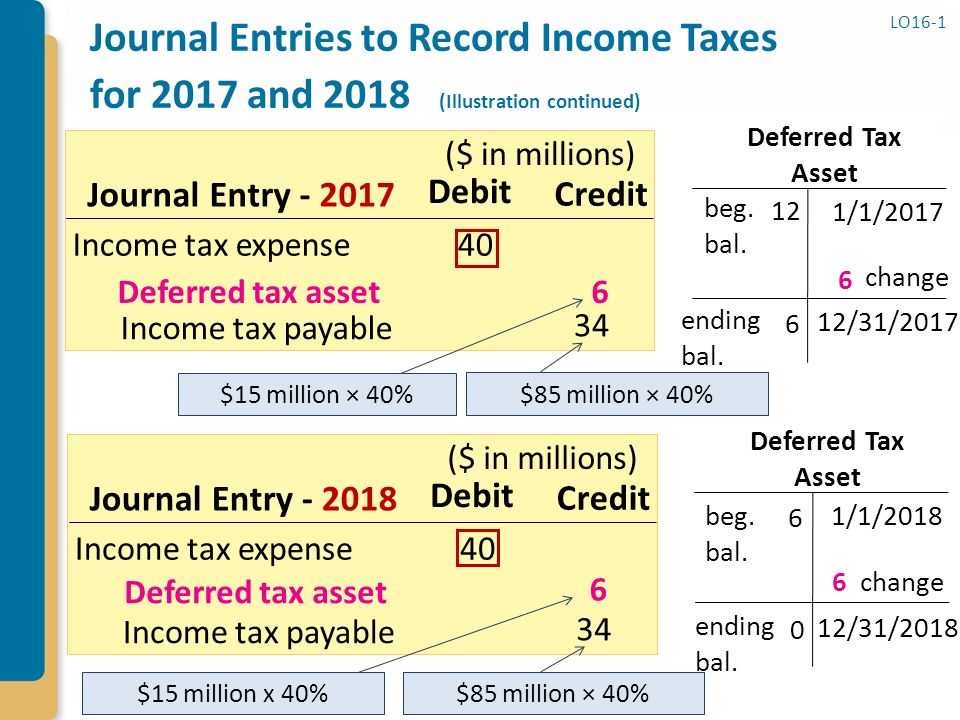

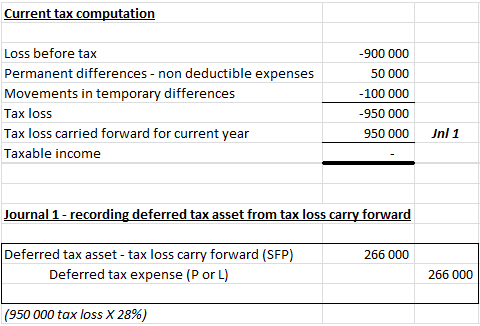

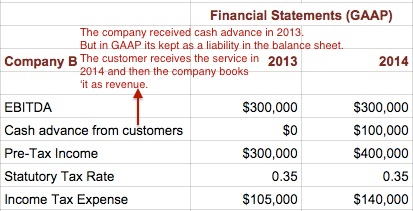

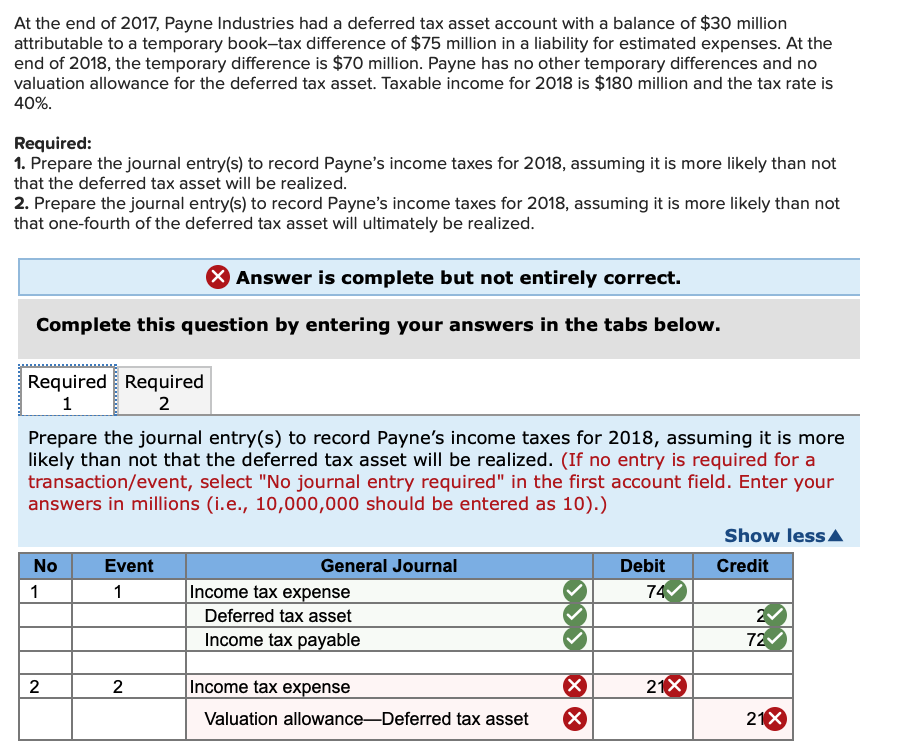

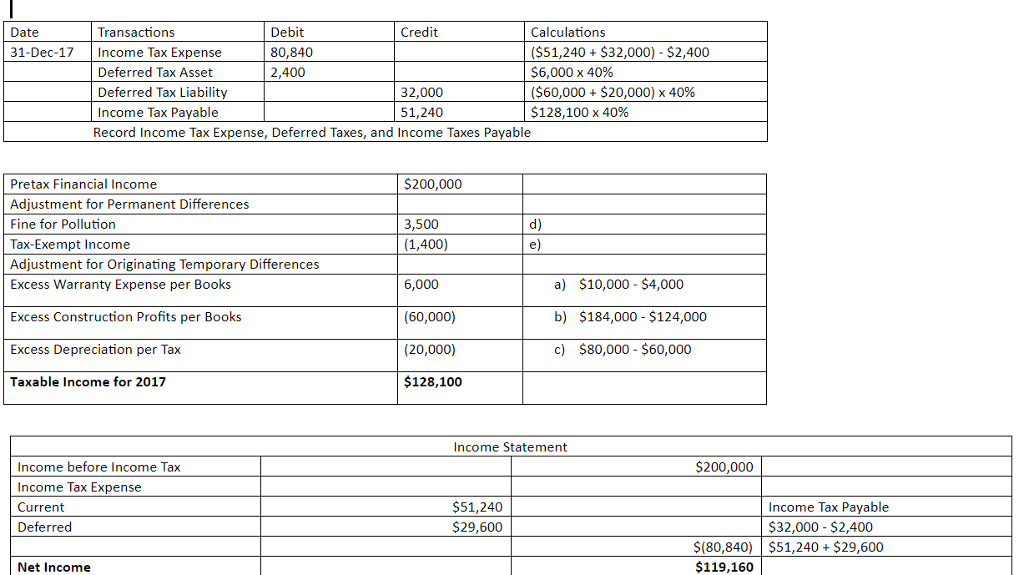

What is deferred tax asset journal entry. The temporary timing differences which created the deferred tax liabilities in years 1 and 2 are partially reversed in year 3 as the book depreciation is now higher than the tax depreciation. We have to create deferred tax liability a c or deferred tax asset a c by debiting or crediting profit loss a c respectively. If a company has overpaid its tax or paid advance tax for a given financial period then the excess tax paid is known as deferred tax asset and its journal entry is created when there is a difference between taxable income and accounting income. It is the opposite of a deferred tax liability which represents income taxes owed.

It arises from one of two situations. A deferred asset is an expenditure that is made in advance and has not yet been consumed. 1 profit loss a c dr. The deferred tax is created at normal tax rate.

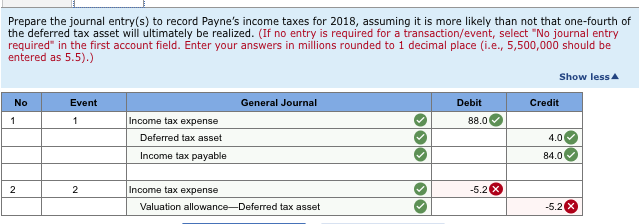

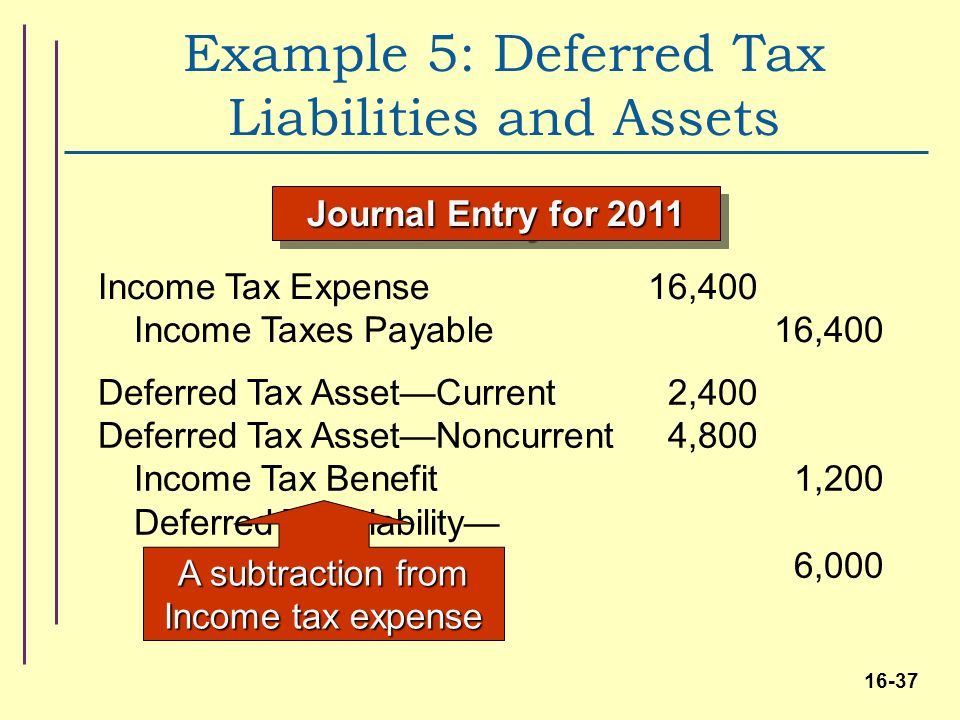

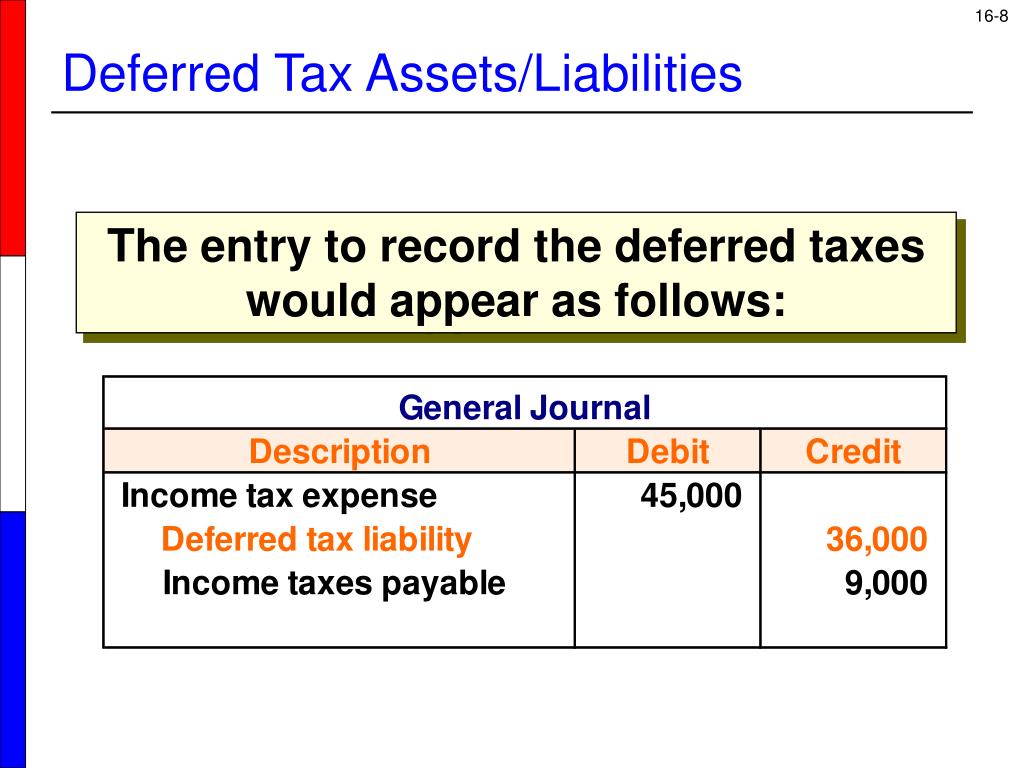

Deferred tax liability journal entry. To deferred tax liability a c 2 deferred tax asset a c. A deferred tax liability is a liability recognized when tax paid in current period is lower that tax that would be payable if calculated under accrual basis. Journal entries for deferred tax assets.

The double entry bookkeeping journal to post the deferred tax liability would be as follows. There can be the following scenario of deferred tax asset. The main purpose of dta dtl is to streamline the profit amount that is mismatched due to income tax deductions restrictions on deduction. To profit loss a c.

The expenditure is made in advance and the item purchased is expected to be consumed within a few months. A very common example of this is depreciation. This deferred asset is recorded. Deferred tax asset is an asset recognized when taxable income and hence tax paid in current period is higher than the tax amount worked out based on accrual basis or where loss carryforward is available.

A deferred tax asset moves a portion of the tax expense to future periods to better match tax expense with accounting income. What is deferred tax asset and deferred tax liability dta dtl in some cases there is a difference between the amount of expenses or incomes that are considered in books of accounts and the expenses or incomes that are allowed disallowed as per income tax. Short consumption period. It arises when tax accounting rules defer recognition of income or advance recognition of an expense resulting in a decrease in taxable income in current period that would reverse in future.

So for creating dta you credit p l and then subsequently debit pnl in future fys to which the difference.