What Is Deferred Tax Asset

A deferred tax asset is an asset on a company s balance sheet that may be used to reduce its taxable income.

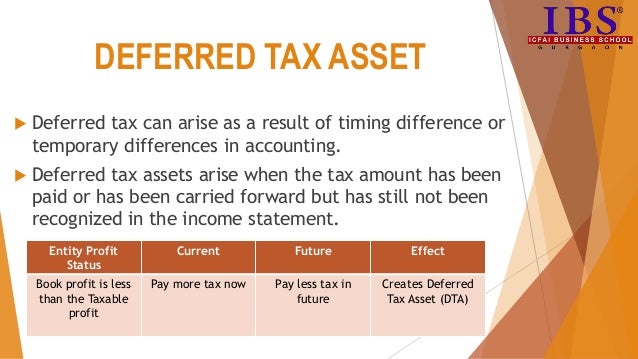

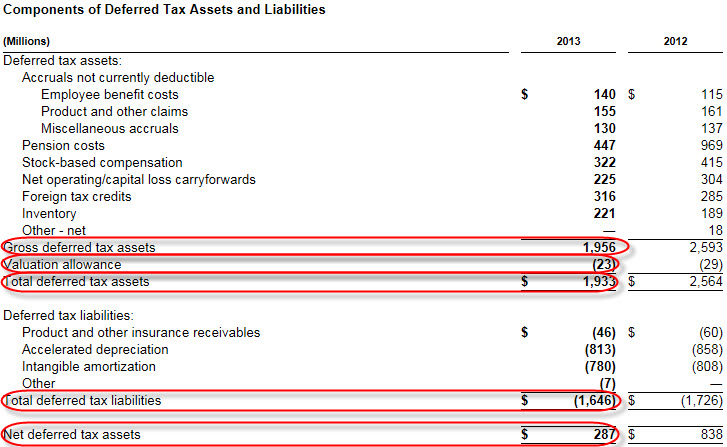

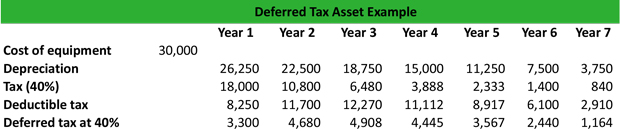

What is deferred tax asset. It is the opposite of a deferred tax liability which represents income taxes owed. Companies use tax deferrals to lower the income tax expenses of the coming accounting period provided that next tax period will generate positive earnings. A deferred tax asset is an item on the balance sheet that results from overpayment or advance payment of taxes. Deferred tax is a notional asset or liability to reflect corporate income taxation on a basis that is the same or more similar to recognition of profits than the taxation treatment.

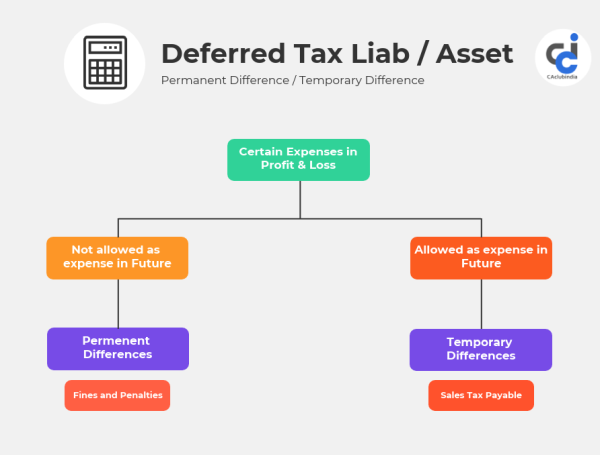

While computing income for the purpose of calculating tax liability the provisions of income tax act 1961 are applicable whereas while computing income for disclosure in financial statements principles of financial accounting are. The basic difference between deferred tax asset and deferred tax liability is the difference in income that is computed as per the provisions of different laws. A deferred tax asset is an asset to the company that usually arises when either the company has overpaid taxes or paid advance tax. Such taxes are recorded as an asset on the balance sheet and are eventually paid back to the company or deducted from future taxes.

A deferred tax asset is an income tax created by a carrying amount of net loss or tax credit which is eventually returned to the company and reported on the company s balance sheet as an asset. Deferred tax liability arises when there is a difference between what a company can deduct as tax and the tax that is there for accounting purposes. What is deferred tax asset and deferred tax liability dta dtl in some cases there is a difference between the amount of expenses or incomes that are considered in books of accounts and the expenses or incomes that are allowed disallowed as per income tax. All about deferred tax asset and liability.

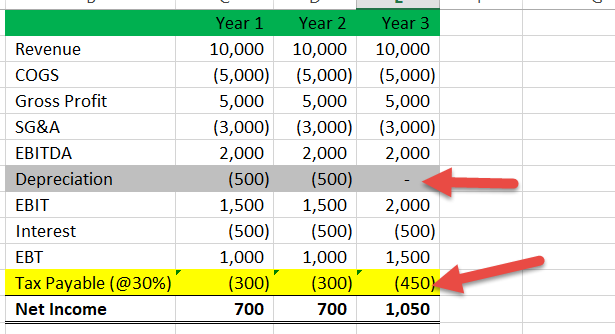

The deferred tax asset in this case is rs 3 00 000 rs 2 94 000 rs 6 000. A very common example of this is depreciation. When a company overpays for a particular tax period this can be marked as a deferred tax asset on the balance sheet. Tax loss carryforward definition.

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)