What Is Deferred Tax Assets And Liabilities

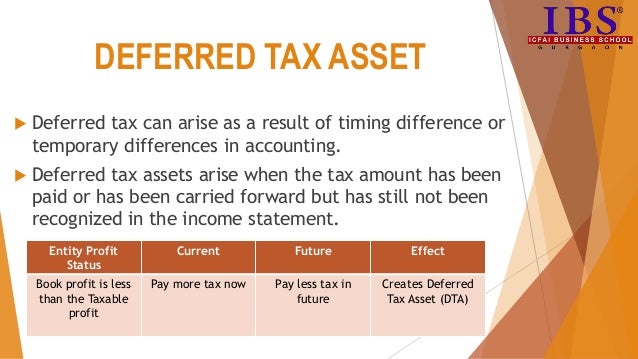

A deferred tax asset is an item on the balance sheet that results from overpayment or advance payment of taxes.

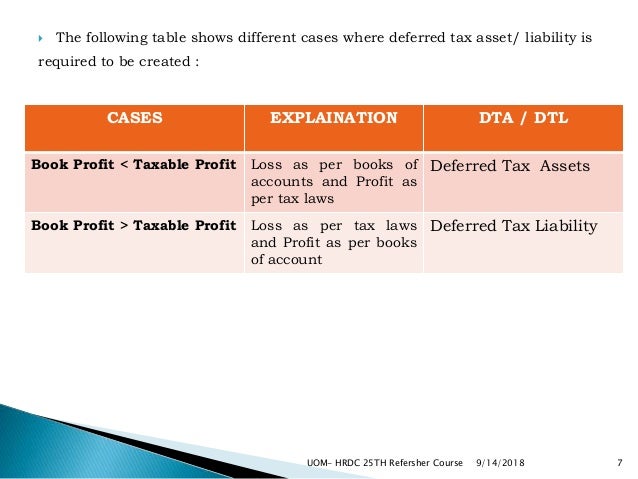

What is deferred tax assets and liabilities. A simple way to define the deferred tax liability is the amount of taxes a company has underpaid which will eventually be made up in the future. Therefore an enterprise recognizes deferred tax assets only when it is probable that taxable profits will be available against which the deductible temporary differences can be utilized ias 12 paragraph 27. The balance of rs. It results in the difference in income tax expense recognized in the income statement and the actual amount of tax owed to the tax authorities.

Simplifying deferred tax liability. The deferred tax asset in this case is rs 3 00 000 rs 2 94 000 rs 6 000. Many people find deferred tax as a very difficult topic to understand but the reality is just the opposite deferred tax is a simple concept and one can master it by just understanding the concept properly. 3 09 000 will be shown as deferred tax asset under non current assets.

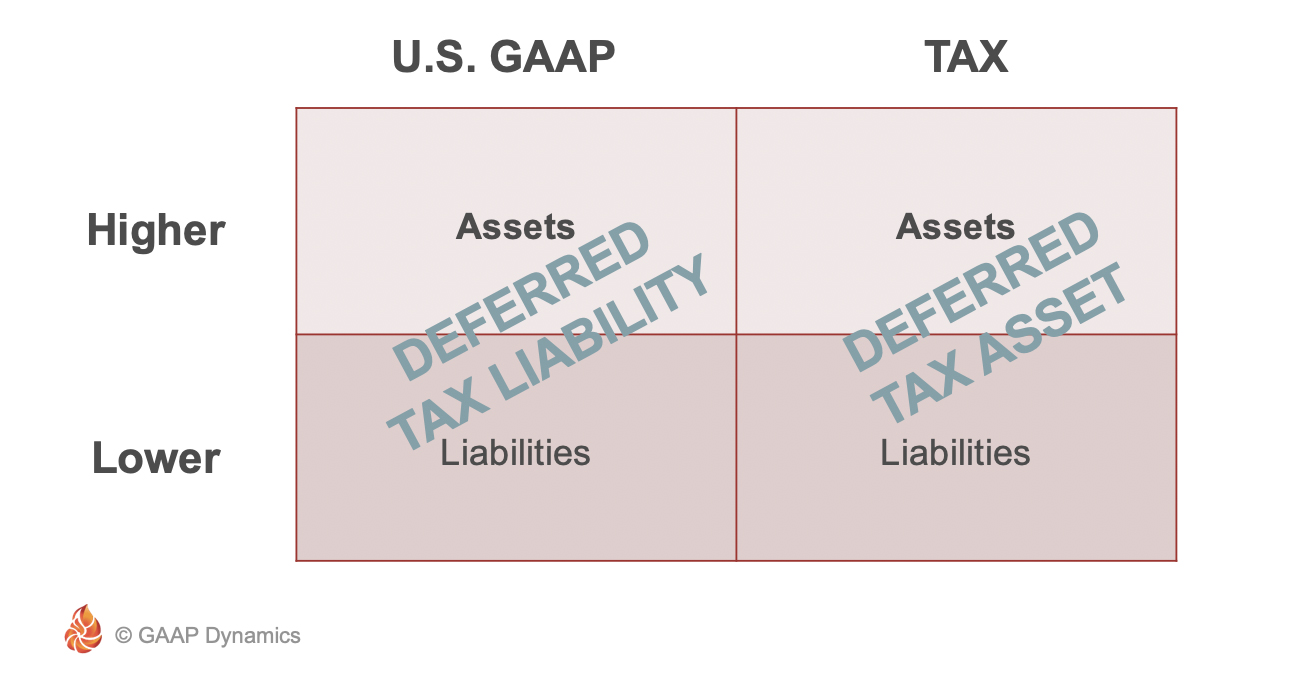

Analyzing the change in deferred tax balances should also help to understand the future trend these balances are moving towards. Deferred tax liability arises when there is a difference between what a company can deduct as tax and the tax that is there for accounting purposes. It is the opposite of a deferred tax liability which represents income taxes owed. In general accounting standards gaap and ifrs differ from the tax laws of a country.

All about deferred tax asset and liability. Recognition of deferred tax asset and deferred tax liability under ias 12 provides guidelines to assess net tax liability. So deferred tax asset is created which is adjusted with the deferred tax liability of last year. By computing differences in wdv as per it and companies act.

291 000 will be charged back in profit and loss account under tax expenses and rs. Deferred tax liabilities formula. What is deferred tax asset and deferred tax liability dta dtl in some cases there is a difference between the amount of expenses or incomes that are considered in books of accounts and the expenses or incomes that are allowed disallowed as per income tax. A deferred tax asset is an income tax created by a carrying amount of net loss or tax credit which is eventually returned to the company and reported on the company s balance sheet as an asset.

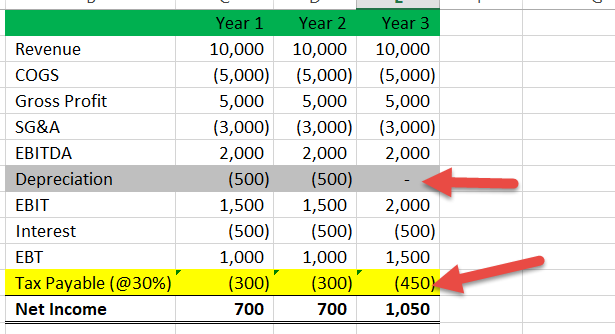

A very common example of this is depreciation. Likewise a decrease in liability or an increase in deferred asset is a use of cash.

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)