2008 Global Financial Crisis

Below is a brief summary of the causes and events that redefined the industry and the world in 2007 and 2008.

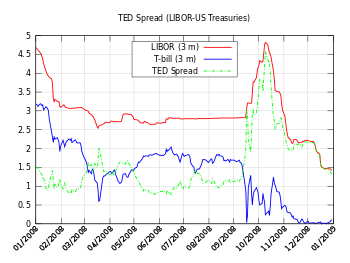

2008 global financial crisis. The global financial crisis gfc or global economic crisis is commonly believed to have begun sometime in early to mid 2007 with a credit crunch when a loss of confidence by us investors in the value of sub prime mortgages caused a liquidity crisis. Both involved reckless speculation loose credit and too much debt in asset markets namely the housing market in 2008 and the stock market in 1929. Around the world stock markets have fallen large financial institutions have collapsed or been bought out and governments in even the wealthiest nations have had to come up with rescue packages to bail out their financial systems. Financial institutions started to sink many were absorbed by larger entities and the us government was forced to offer bailouts.

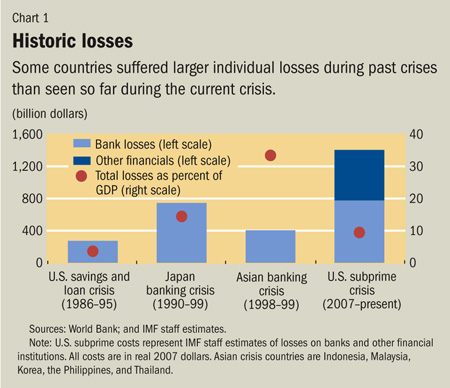

The demise of bear stearns. The financial crisis took its toll on individuals and institutions around the globe with millions of american being deeply impacted. The 2008 financial crisis was the largest and most severe financial event since the great depression and reshaped the world of finance and investment banking. The crisis led to the great recession where housing prices dropped more than the price plunge during the great depression.

The 2008 financial crisis has similarities to the 1929 stock market crash. The global financial crisis of 2008 2009 refers to the massive financial crisis the world faced from 2008 to 2009. Unlike the past few crises. The effects are still being felt today yet many people do not actually understand the causes or what took place.

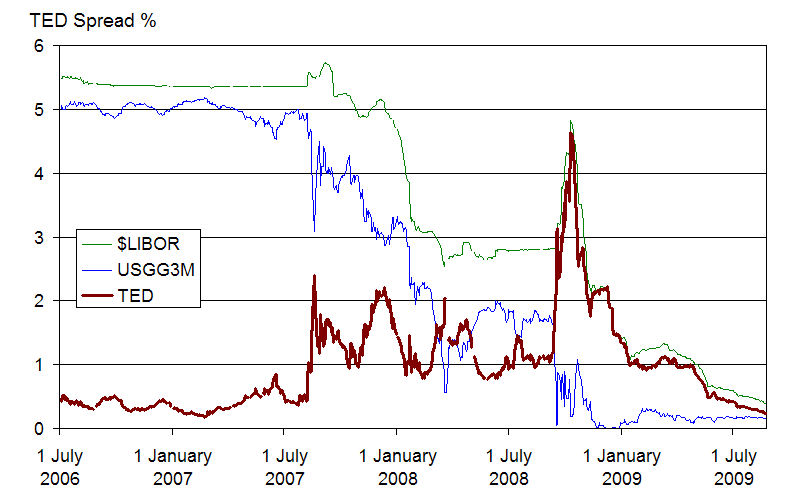

Real estate to plummet damaging financial institutions globally culminating with the bankruptcy of lehman brothers on september. It occurred despite the efforts of the federal reserve and the u s. The financial crisis of 2007 2008 also known as the global financial crisis gfc was a severe worldwide financial crisis excessive risk taking by banks combined with the bursting of the united states housing bubble caused the values of securities tied to u s. The 2008 financial crisis and great recession induced a bear market in oil and gas sending the price of a barrel of crude oil from nearly 150 to 35 in just a few months.

Economy was in a full blown recession and as financial institutions liquidity struggles continued global stock markets. The global financial crisis brewing for a while really started to show its effects in the middle of 2007 and into 2008. Department of the treasury.

/what-caused-2008-global-financial-crisis-3306176_FINAL-5c61ad8ac9e77c000159c893.png)

/2008-financial-crisis-3305679-final-JS-03a006d464d7465aaf331145a1252beb.png)

:max_bytes(150000):strip_icc()/is-the-real-estate-market-going-to-crash-4153139-final-5c93986946e0fb00010ae8ab.png)