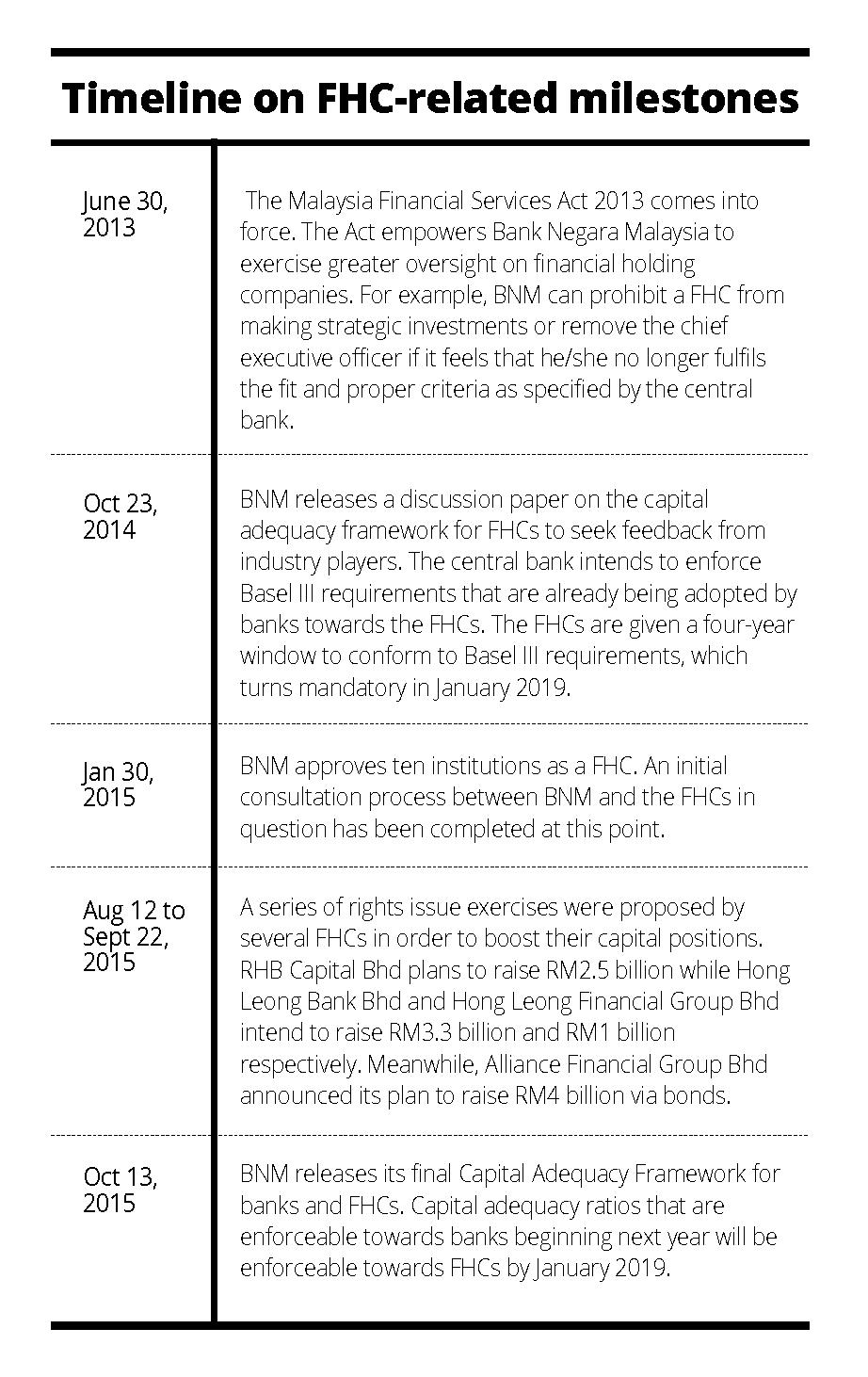

Bnm Capital Adequacy Framework 2019

1 national bank of moldova decision regarding approval of regulation on banking activity management framework no.

Bnm capital adequacy framework 2019. Basel ii consists of 3 pillars as follows. 6 375 and 8 500 2018. The capital adequacy ratios of the bank are computed in accordance with bnm s capital adequacy framework capital components and basel ii risk weighted assets reissued on 02 february 2018. 1 5 article 56 of january 4 2019.

3 may 2019 part a overview a 1 executive summary 1 1 this document is part of the capital adequacy framework that specify the. The minimum regulatory capital adequacy. The bank s capital ratios comply with the prescribed capital adequacy ratios under bnm s capital adequacy framework for islamic banks. In line with the transitional arrangements under the bnm capital adequacy framework capital components the minimum capital adequacy requirement for common equity tier 1 capital ratio cet 1 and tier 1 capital ratio are 7 000 2018.

Licensed investment banks. Capital adequacy framework capital components 2 of 44 issued on. 5 february 2020 5 interpretation 5 1 the terms and expression used in this policy document shall have the same meanings assigned to them in the fsa unless otherwise defined in this policy document. As at 31 december 2019 overview a b c the pillar 3 disclosure is required under the bank negara malaysia bnm s capital adequacy framework for islamic banks cafib which is the equivalent to basel ii issued by the islamic financial services board.

Capital adequacy framework basel ii risk weighted assets issued on 3 may 2019. 7 875 respectively for year 2019. 5 2 for the purpose of this policy document. 322 of december 20 2018 in effect as of april 4 2019 official monitor of the republic of moldova no.

Bnm rh pd 032 5 prudential financial policy department capital adequacy framework basel ii risk weighted assets page 1 506 issued on. The bank have adopted the standardised approach for credit risk and market risk and the basic indicator approach for operational risk. 12 november 2019 repurchase agreement transactions table of. Ng said the minimum regulatory requirement for common equity tier 1 capital ratio is 4 5 under basel iii and that banks are also required to maintain a capital conservation buffer of up to 2 5.