Difference Between Pioneer Status And Investment Tax Allowance

Iii pioneer status iv investment tax allowance and v reinvestment allowance.

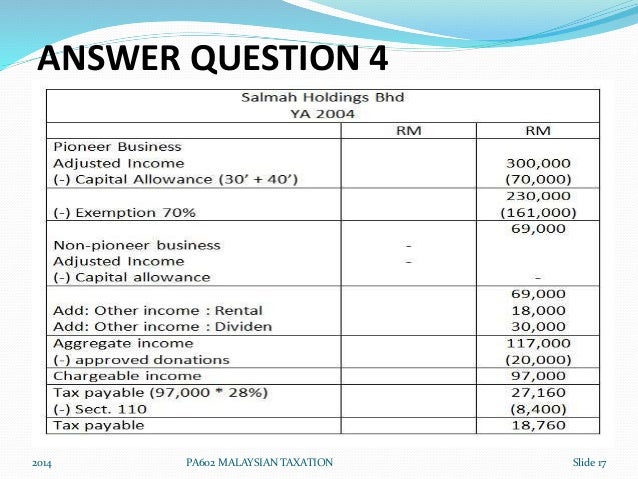

Difference between pioneer status and investment tax allowance. Akta penggalakan pelaburan 1986 investment tax allowance. A company approved with a pioneer status certificate can enjoy income tax exemption between 70 100 of statutory income for 5 to 10 years whereas for investment tax allowance a company can get allowances between 60 100 on qualifying capital expenditure incurred within a period of 5 to 10 years. The same activity. Application for pioneer status received on or after 1 1 1991 but before 1 11 1991.

Candidates must first study closely the source authority for these incentives ie the relevant laws and the respective irb public rulings or guidelines where available to obtain a good general understanding. Table below is the comparison between pioneer status and investment tax allowance. Capital expenditure incurred on assets acquired during tax relief period deemed incurred on the day following the end of tax relief period. Ii differences between pioneer status and investment tax allowance.

A company approved with a pioneer status certificate can enjoy income tax exemption between 70 100 of statutory income for 5 to 10 years whereas for investment tax allowance a company can get allowances between 60 100 on qualifying capital expenditure incurred within a period of 5 to 10 years. Investment tax allowance ita an allowance of 60 100 on qualifying capital expenditure factory plant machinery or other equipment used for the approved project incurred within 5 to 10 years from the date the first qualifying capital expenditure is incurred. Pioneer status often provides a 70 exemption of statutory income for a period of 5 years. Tax exemption of statutory income for five years.

While pioneer status is an income based tax incentive investment tax allowance is a capital expenditure based one that generally provides for a. We hear that these companies are given financial or fiscal incentives. Similar lists of promoted products or activities as applied for pioneer status would also be applied for ita. Tax relief period may be extended for a further 5 years for certain.

View b docx from accounting mbc3413 at university college of technology sarawak. Understanding malaysia pioneer status and investment tax allowance for your business june 17 2009 by sabrie for those who are aware of the malaysian government s effort in promoting a selected industry ict for msc companies for example. What is the difference between pioneer status and investment tax allowance a company approved with a pioneer. Pioneer status investment tax allowance rm 000 rm 000 exempt account 10 859 7 800 tax payable 1 537 68 2 271 84 based on the table above the aggregate exempt income credited to exempt account for.