First Time Home Buyer Malaysia Stamp Duty

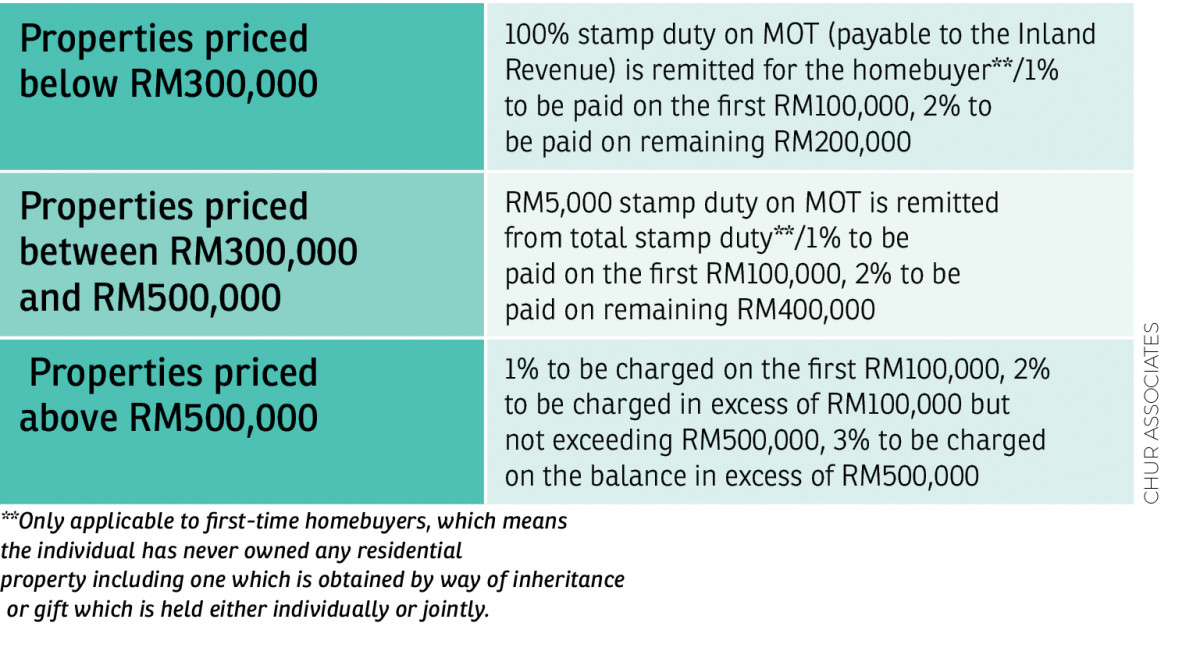

For purchases of between rm300 001 and rm500 000 a similar stamp duty waiver is applicable limited to only the first rm300 000 of the house price.

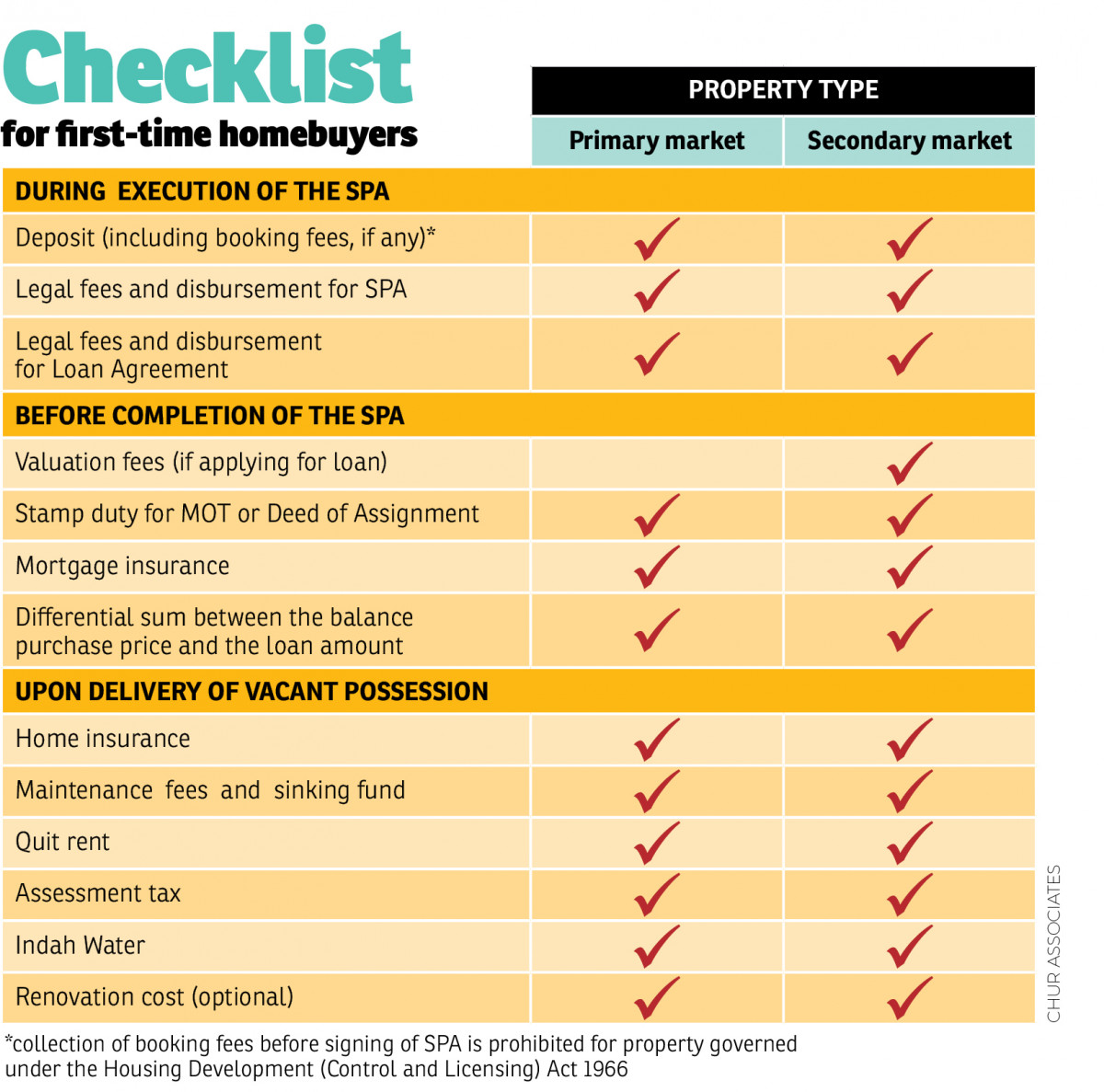

First time home buyer malaysia stamp duty. As for the first time home buyers purchasing a rm300 000 property there will be savings of circa rm5 000 on the stamp duty on the instrument of transfer. This applies for buyers of properties priced between rm300 000 to rm2 5 million with the fee exemption applicable to the first rm1 million. How much is the stamp duty 2020. This exemption is available until may.

Pay lower or no stamp duty fees to buy a new property. Based on budget 2019 criteria for first time house buyer stamp duty waiver. First time home buyers in malaysia will be fully exempted from paying stamp duty for properties that cost between rm300 001 and rm1 million us 240 800 the finance ministry. However the property developer must offer a 10 discount on selling prices to qualify under the hoc campaign.

With the generosity of the malaysian government and to increase the purchasing house for first time house buyer the government had implemented a stamp duty exemption started 1st january 2019 until 31st december 2020. Full stamp duty exemption on loan agreement and transfer instrument 14a doa rm300 000 ppp rm500 000. Disbursement fees to be ranging of rm1000 rm1500 00 based on estimation for first time house buyer you can check for the latest. Meanwhile under budget 2019 the stamp duty on the transfer of property valued at more than rm1 million will increase from 3 to 4.

How to calculate stamp duty in 2020. Stamp duty on the transfer of property valued at rm2 000 0000 will be rm54 000 prior to the revised rate and rm64 000 after the revised rate. First time homebuyers get stamp duty exemption on the memorandum of transfer and loan agreement for property purchases priced no more than rm300 000. Rm100 001 to rm500 000 stamp duty fee 3.

The stamp duty waiver for those purchasing a rm300 000 home for instance will give first time homebuyers a savings of around rm5 000. 1 jan 19 31 dec 20 2 purchase 1 residential property a house condo unit an apartment a flat 3 malaysian citizen first time home buyer. Stamp duty fee 1. 1 jul 19 31.

How to calculate stamp duty malaysia in 2020. Property and housing summary stamp duty malaysia 2020 new updates. Stamp duty waiver for first time house buyer updates on stamp duty malaysia for year 2020 budget 2019. Is first time house buyer stamp duty exemption applicable to soho sovo sofo and service apartment property.

Must be first time house buyer. Property stamp duty 2020 question. Rm500 001 and rm1 000 000 stamp duty fee 4.