Leave Passage Tax Treatment In Malaysia 2017

Section 13 1 a leave pay leave pay is a cash item taxable under section 13 1 a.

Leave passage tax treatment in malaysia 2017. Objective the objective of this public ruling pr is to explain the tax treatment accorded to a person in respect of goods and services tax gst paid or to be paid as. In malaysia for at least 182 days in a calendar year. 1 2017 date of publication. And one overseas leave passage in a calendar year limited to a maximum of rm3 000 benefits used by the employee solely in connection with the performace of his duties.

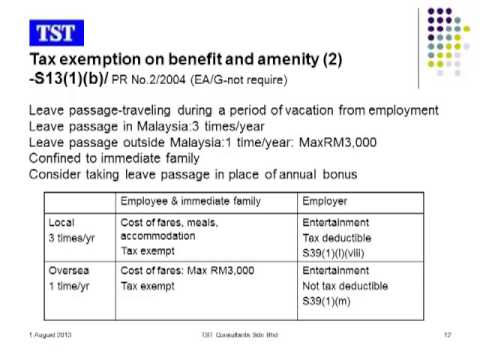

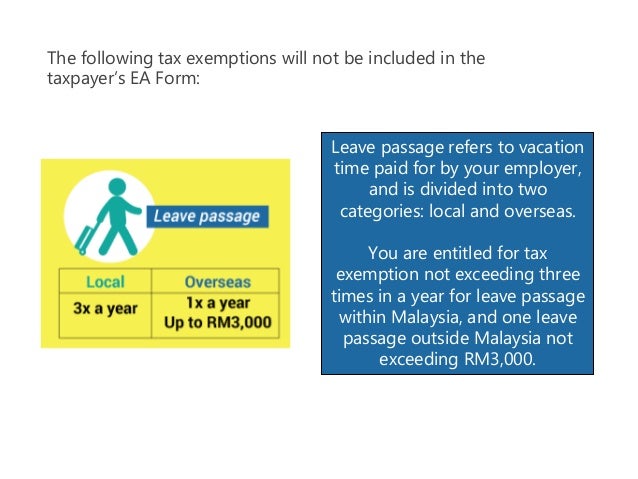

Medical or dental treatment including a benefit for childcare. Leave passage is about an employee traveling during a period of vacation from employment. Leave passage can be categorized into the local leave passage and the overseas leave passage. You are entitled to tax exemption not exceeding three times in a year for leave passage within malaysia and one leave passage outside malaysia not exceeding rm3 000.

1 leave passage leave passage refers to vacation time paid for by your employer and is divided into two categories. Tax treatment of leave passage inland revenue board malaysia addendum to public ruling no. When a person receives leave pay the amount will be assessable to tax either in year of departure or late depending on conditions provided under section 25 6. I gross income from an employment includes an amount equal to the value.

Local leave passage not exceeding 3 times in a calendar year. Income tax treatment of goods and services tax part ii qualifying expenditure for purposes of claiming allowances example 8 amended on 12 07 2017 08 06 2017. C paragraph 13 1 c of the ita value of living accommodation in malaysia provided for the employee. For local leave passage in malaysia an employee is entitled to a tax exemption of three times the amount spent on the cost of.

23 august 2007 director general s public ruling a public ruling as provided for under section 138a of the income tax act 1967. Inland revenue board of malaysia income tax treatment of goods and services tax part i expenses public ruling no. 1 2003 date of issue.