How To Calculate Tax Estimate For Cp204a

The most commonly asked question by our clients in filling up the form cp204 is.

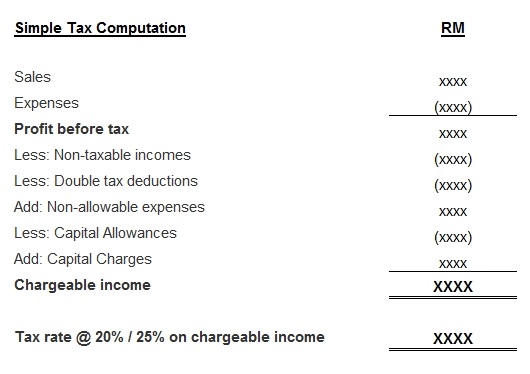

How to calculate tax estimate for cp204a. The calculator will help you estimate your property tax payable based on the annual value of your property. Balance of tax payment when a company has determined its actual tax payable balance of tax which is the actual tax payable after deducting total instalments on the tax estimate has to be paid within 7 months from the close of the accounting period. The estimated tax payable for the first year will be the basis for the tax estimate for the next year of assessment. A company is required to pay the instalment of the estimated tax by the 15th day of each month.

You can calculate your property tax from five preceding years up to the following year. How to calculate tax estimate for cp204. Is from 01 01 2012 to 31 12 2012 for the year of assessment 2012. With effect from y a 2008 where a sme first commences operations in a year of assessment the sme is not required to furnish an estimate of tax payable or make instalment payments for a period of two years beginning from the year of assessment in which the sme.

Melayu malay 简体中文 chinese simplified estimate of tax payable in malaysia. You can view the annual value of your property at mytax iras gov sg. In the 6th 9th month the company revises the tax estimate to rm100 000. Abc sdn bhd has furnished estimate for the year of assessment 2007 amounting to rm50 000.

The revision is agreed by irbm. In order to calculate the possible tax payable for the coming year the company must made several assumptions and projections based on the current year s management results. This page is also available in.