Major Determinants Of Capital Structure

Determinants of capital structure an empirical evidence us by ra the university of lahore pakistan.

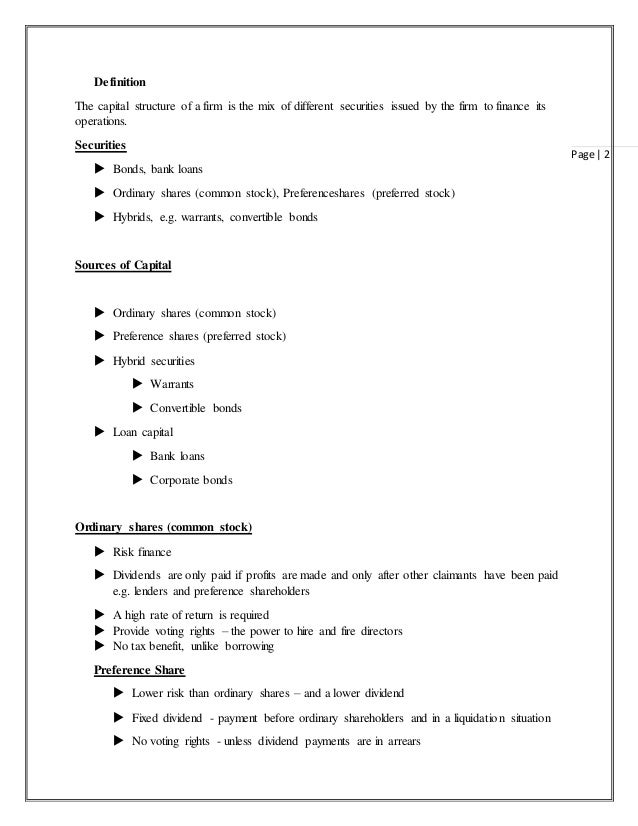

Major determinants of capital structure. There are numerous factors both qualitative and quantitative including the subjec tive judgment of financial managers which conjointly determine a firm s capital structure. The major contending theories of capital structure as well as. Scott 33 suggests that by selling secured debt firms increase the value of their equity by expropriating wealth from their existing unsecured creditors. Capital structure is how a company funds its overall operations and growth.

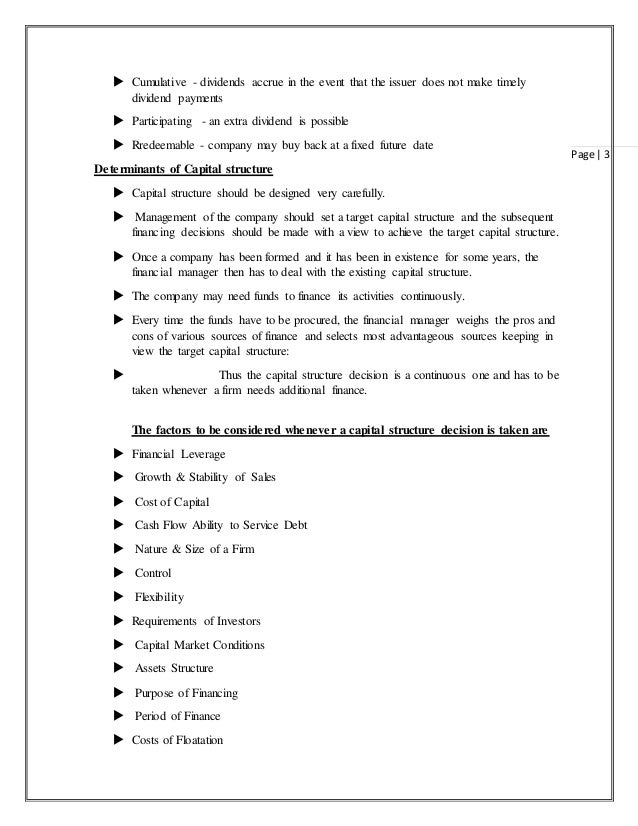

In addition to this the two variables profitability and growth established. Determinants of capital structure of a firm. Design methodology approach different conditional theories of capital structure are reviewed the trade off theory pecking order theory agency theory and theory of free cash flow in order to formulate testable propositions concerning the determinants of capital structure of the manufacturing firms. The purpose of this paper is to study the status of studies on capital structure determinants in the past 40 years.

Abstract this paper develops a study on identifying the most significant determinants of capital structure of 15 firms listed on the s p 500 index new york stock exchange using panel data over 5 years period from 2010 to 2014. Since inflation is a major driving force behind interest rates the financing decision should be cognizant of inflationary trends. We may now briefly discuss the key factors governing a firm s capital structure decisions. Debt consists of borrowed money that is due back to the lender commonly with interest expense.

Consequently we know little about the applicability of various capital structure theories to firms that are private small and or outside the manufacturing industry in these economies. This paper highlights the major gaps in the literature on determinants of capital structure and also aims to raise specific questions for future research the prominence of research is assessed by studying the year of publication and region level of economic development firm. The evolution of capital structure theory from both theoretical and empirical perspectives. 3 3 seesmith and warner 35 for a comment on scott s model.

The major findings of the study indicated that profitability size age and tax shield variables are the significant firm level determinants of capital structure in ethiopian commercial banks case. Determinants of capital structure.