Pioneer Status And Investment Tax Allowance Malaysia

Pioneer status and investment tax allowance are two of the main tax incentives available in malaysia.

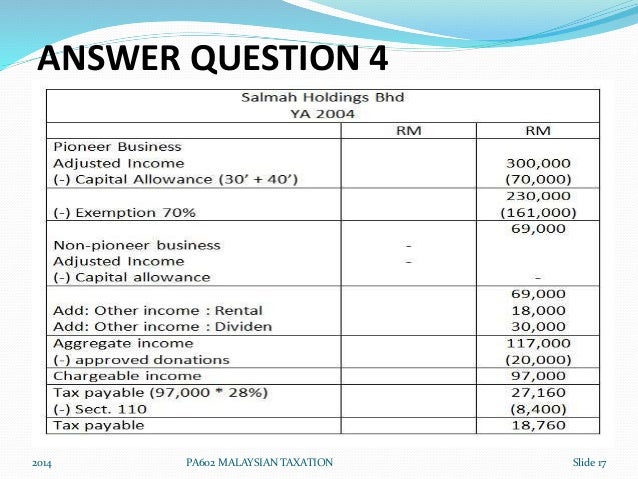

Pioneer status and investment tax allowance malaysia. Approval of pioneer status by a company producing a product or participating in an activity of national and strategic importance to malaysia. While pioneer status is an income based tax incentive investment tax allowance is a capital expenditure based one that generally provides for a. Unabsorbed losses not to be carried forward to post pioneer period. Tax exemption of statutory income for 10 years.

Pioneer status ps and investment tax allowance ita companies in the manufacturing agricultural hotel and tourism sectors or any other industrial or commercial sector that participate in a promoted activity or produce a promoted product may be eligible for either ps. Similar lists of promoted products or activities as applied for pioneer status would also be applied for ita. Understanding malaysia pioneer status and investment tax allowance for your business june 17 2009 by sabrie for those who are aware of the malaysian government s effort in promoting a selected industry ict for msc companies for example. Utama investment tax allowance.

In the 2006 malaysian budget it was proposed to further enhance the effectiveness of the pioneer status incentives by allowing accumulated losses and unabsorbed capital allowances incurred by companies during the pioneer period to be carried forward and deducted from post pioneer income of a business relating to the same promoted activity or promoted product. Iii pioneer status iv investment tax allowance and v reinvestment allowance. Pioneer status often provides a 70 exemption of statutory income for a period of 5 years. Unabsorbed capital allowances not to be carried forward to post pioneer period.

Pioneer status ps and investment tax allowance ita companies that have generally started production less than a year and fall under the promoted activity or promoted product criteria in the manufacturing food processing agricultural hotel tourism or other industrial or commercial sectors will be eligible to avail benefits under ita or ps. A company approved with a pioneer status certificate can enjoy income tax exemption between 70 100 of statutory income for 5 to 10 years whereas for investment tax allowance a company can get allowances between 60 100 on qualifying capital expenditure incurred within a period of 5 to 10 years. Akta penggalakan pelaburan 1986. We hear that these companies are given financial or fiscal incentives.

Pioneer status ps is an incentive in the form of tax exemption which is granted to companies participating in promoted activities or producing promoted products for a period of 5 or 10 years. Ibu pejabat lembaga hasil dalam negeri malaysia menara hasil persiaran rimba permai cyber 8 63000 cyberjaya selangor. Malaysia offers a wide range of tax incentives ranging from tax exemptions allowances to enhanced tax deductions.