Qualitative Characteristics Of Useful Financial Information

They are defined as follows.

Qualitative characteristics of useful financial information. Fund providing institutions banks insurance companies assets funding firms etc potential. That is why the fasb created the qualitative characteristics of financial information. Although the main statutory recipients of these statements are shareholders but there are many other stakeholders that rely on these statements during their decision making process e g. In relation to these enhancing qualities note.

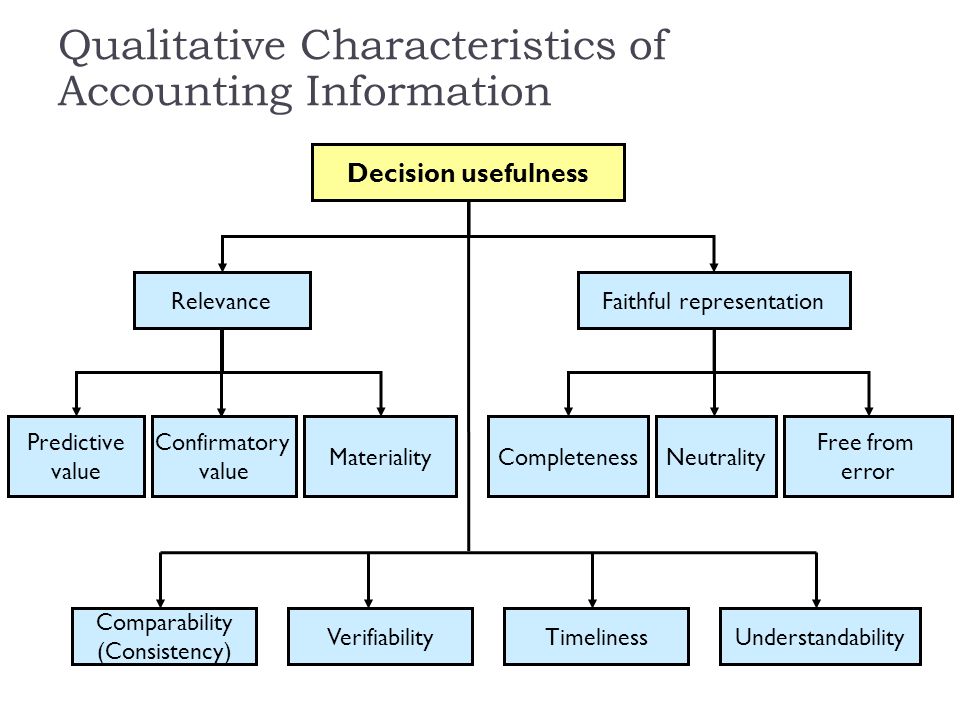

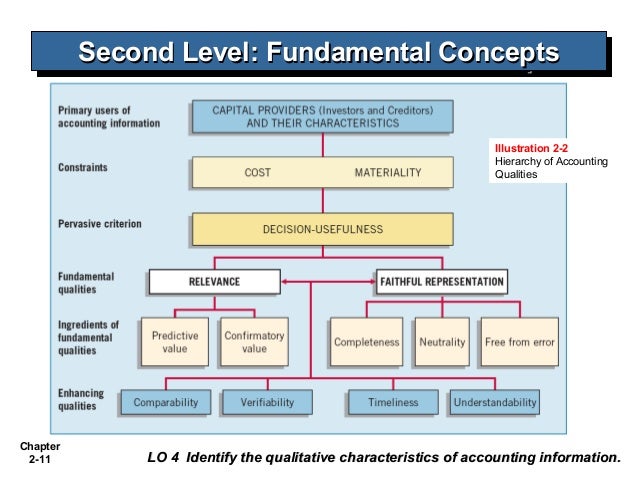

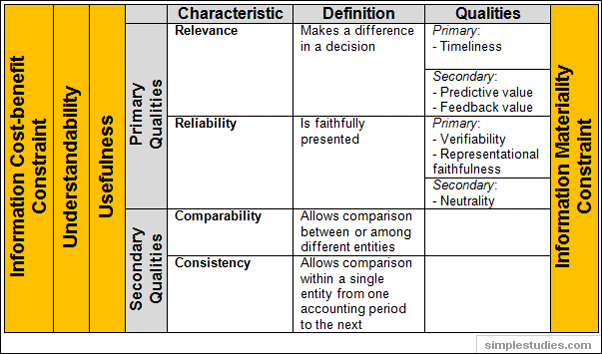

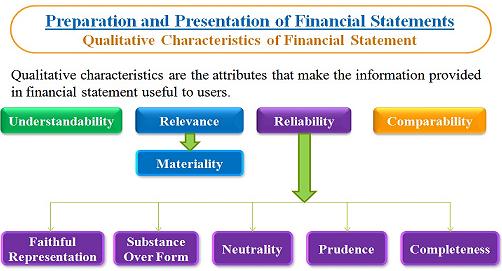

For financial information to be of any use to investors creditors and other stakeholders it must exhibit certain required and desired attributes. What are the qualitative characteristics of accounting information. The following are all qualitative characteristics of financial statements. Relevance financial information is regarded as relevant if it is.

In order for the financial statements to be useful to the stakeholders of a business they must embody certain qualitative characteristics. The information provided in the financial statements must be relevant to the needs of its users. The qualitative characteristics of financial information. These characteristics describe what useful information is and how it relates to financial decision making.

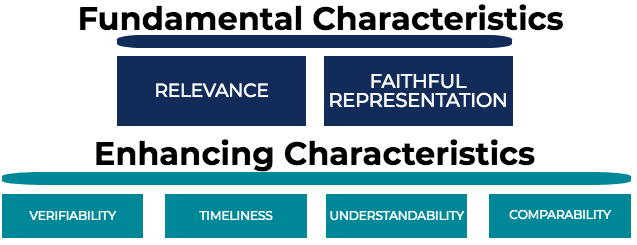

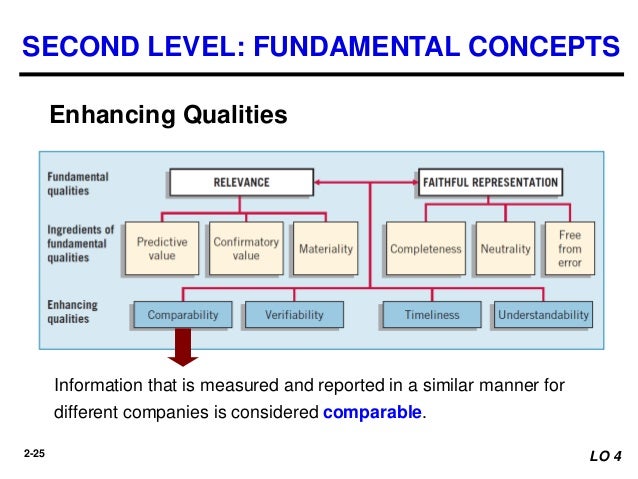

These attributes are called qualitative characteristics of useful financial information. The usefulness of financial information is enhanced if it is comparable verifiable timely and understandable. The above mentioned characteristics relevance materiality understandability comparability consistency reliability neutrality timeliness economic realism make financial reporting information useful to users. Comparability is the quality of information that enables users to identify similarities in and differences between two sets of economic phenomena.

These normative qualities of information are based largely upon the common needs of. Comparability refers to the ability of the users to distinguish similarities and differences between two economic phenomena. The demand for accounting information by investors lenders top banks in the usa according to the us federal deposit insurance corporation there were 6 799 fdic insured commercial banks in the usa as of february 2014. Accoding to the conceptual framework financial information is useful when it is relevant and represents faithfully what it purports to represent.

Evaluating the qualitative characteristics. Businessmen and women along with investors and credits should however clearly understand the information presented in the financial statements. The information must be readily understandable to users of the financial statements. The fundamental qualitative characteristics.

Enhancing qualitative characteristics are additional benefit added to the fundamental to enhance the decision usefulness of financial information. The enhancing qualitative characteristics of financial information distinguish more useful information from less useful information.