Qualitative Characteristics Of Useful Information And How They Are Applied To Financial Reporting

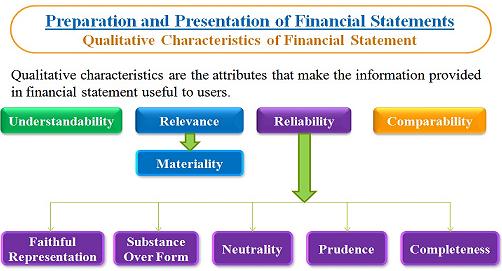

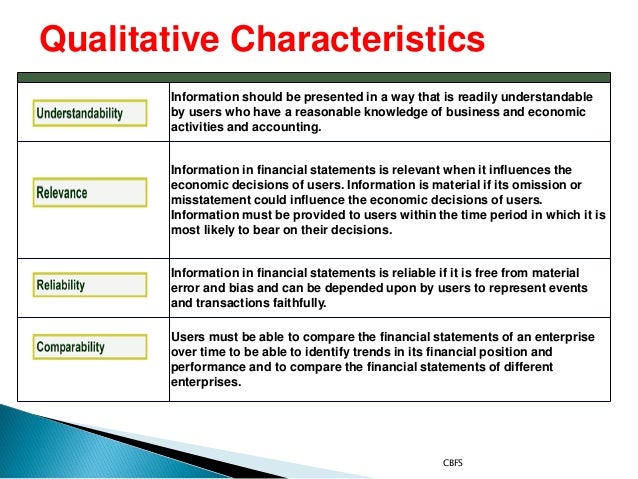

Qualitative characteristics are the tributes that make the information provided in financial statements useful to users.

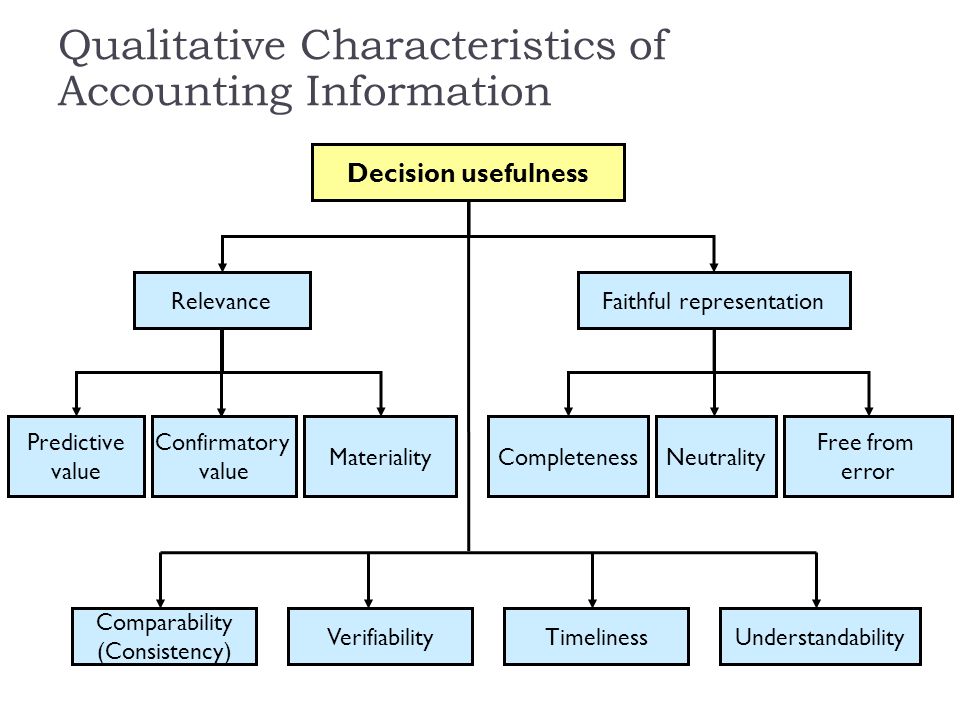

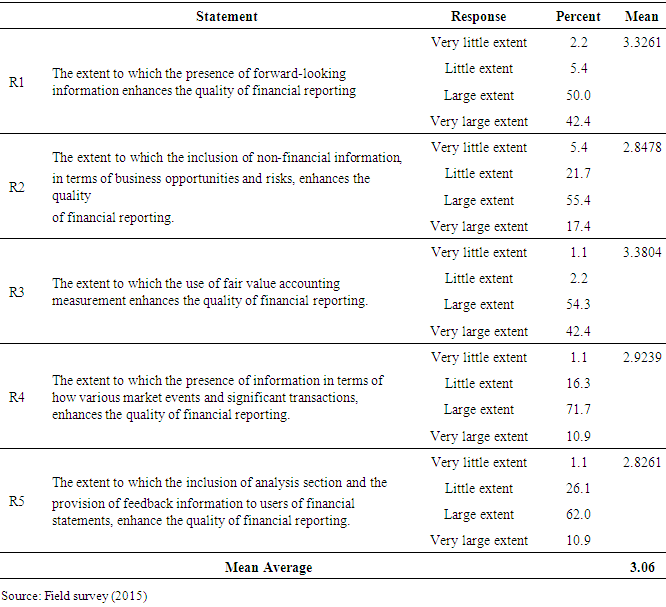

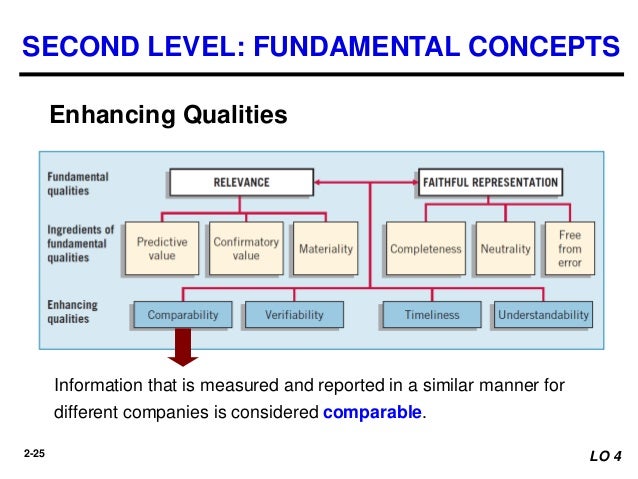

Qualitative characteristics of useful information and how they are applied to financial reporting. The usefulness of financial information is enhanced if it is comparable verifiable timely and understandable. There are seven main groups of users which are public investors lenders. Qualitative characteristics or qualities necessary for information serve a major supporting role in the decision usefulness decision model approach to accounting theory. These normative qualities of information are based largely upon the common needs of.

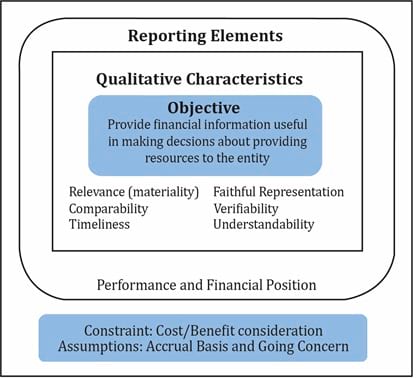

Ifrs qualitative characteristics of financial reporting. Qualitative characteristics are the attributes that make financial information useful to users. The purpose of financial statements is to give financial statements information about the change in financial position financial performance and financial position of the organization these can provide data use in decision making such as investment credit and economic decision making which are useful for various users. The boards propose that the objective of general purpose financial reporting is to provide financial information about the reporting entity that is useful to present and potential equity investors lenders and other creditors in making decisions in their capacity as capital providers.

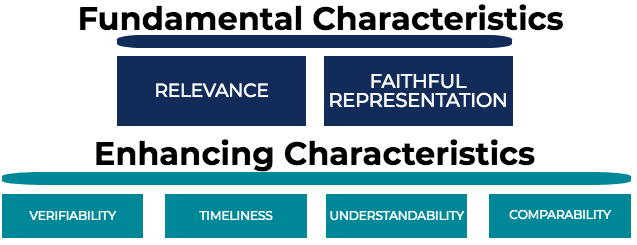

For analytical purposes qualitative characteristics can be differentiated into fundamental and. The above mentioned characteristics relevance materiality understandability comparability consistency reliability neutrality timeliness economic realism make financial reporting information useful to users. Accounting information that is reported to facilitate economic decisions should possess.