Bnm Capital Adequacy Framework For Islamic Banks

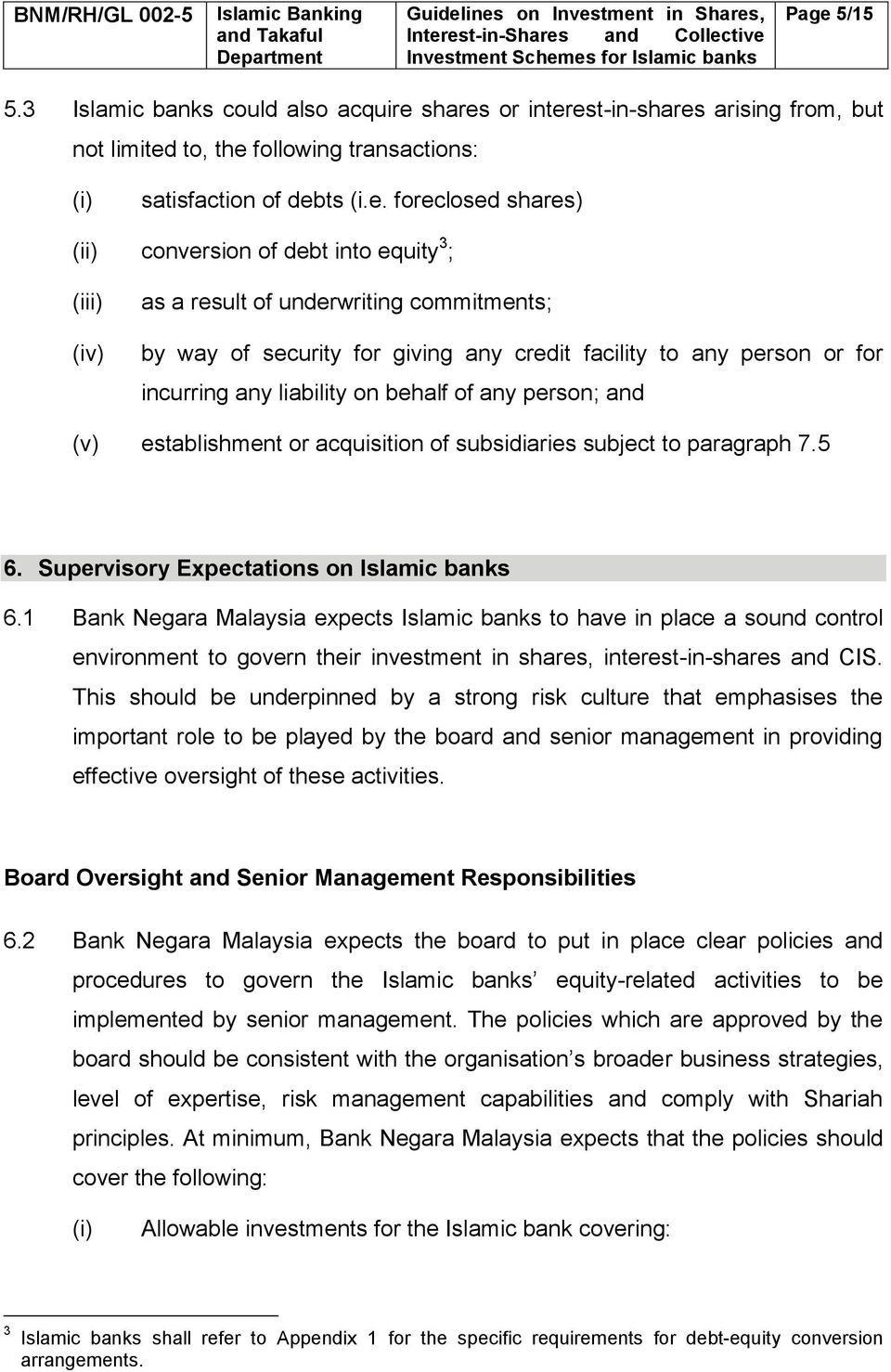

Capital adequacy for islamic banks in the advent of the global financial crisis of 2007 9 islamic banking practitioners are under significant pressure to comply with capital adequacy standards.

Bnm capital adequacy framework for islamic banks. 1 2 the computation of the risk weighted assets is consistent with pillar 1 requirements set out by the basel committee on banking supervision bcbs and the islamic financial services board ifsb in their respective. Bnm rh pd 029 3 islamic banking and takaful department capital adequacy framework for islamic banks risk weighted assets issued on. In a statement today bank islam said the sukuk shall qualify as tier 2 regulatory capital in compliance with bank negara malaysia s capital adequacy framework for islamic banks capital components hence will enhance the capital adequacy of bank islam in line with the basel iii requirements. Licensed islamic banks 2.

Basel ii consists of 3 pillars as follows. It should be read together with capital adequacy framework capital components. Bnm issued policy documents on the framework for domestic systemically important banks d sibs and on the capital adequacy frameworks for both conventional and islamic banks. The hope of regulators is that compliance will reduce the chance of individual bank failure and also contagion within the financial system.

Licensed banks carrying on islamic banking business 3. 2 february 2018 bnm rh pd 029 2 capital adequacy framework for islamic banks capital components applicable to. 2 february 2018 part a overview a 1 executive summary 1 1 the capital adequacy framework for islamic banking institutions risk. Bnm rh pd 029 3 islamic banking and takaful department capital adequacy framework for islamic banks risk weighted assets page 1 517 issued on.

1 1 this document is part of the capital adequacy framework for islamic banking institutions risk weighted assets the framework specifies the measurement methodologies for the purpose of calculating risk weighted assets rwa for credit risk market risk and operational risk. The policy on d sibs sets out the assessment methodology to identify d sibs in malaysia and contains the inaugural list of d sibs.