Determinants Of Capital Structure In Emerging Markets Evidence From Vietnam

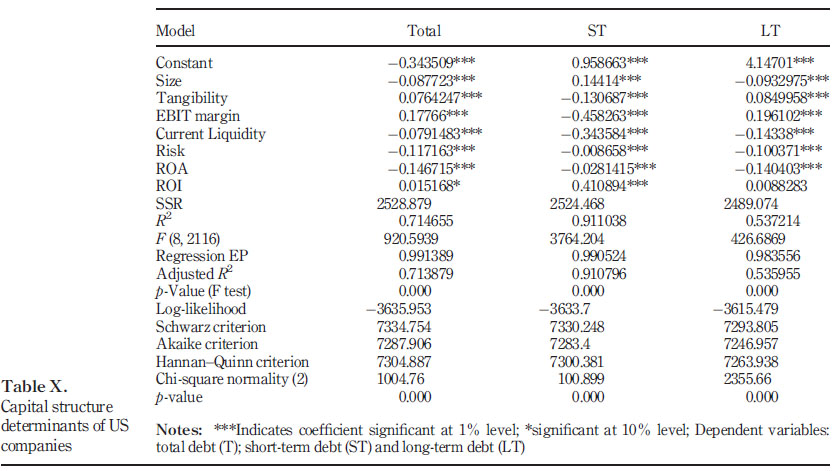

The study used table data methods including pooled regression pooled.

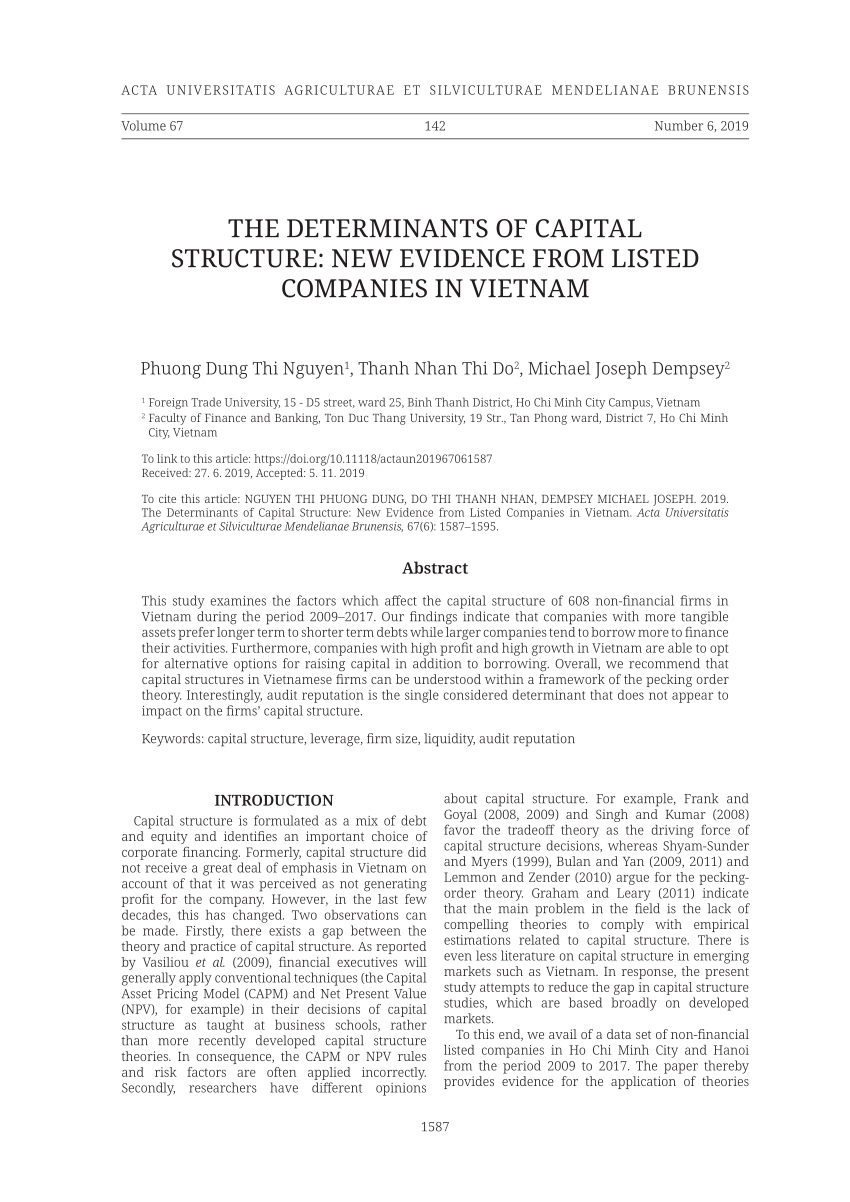

Determinants of capital structure in emerging markets evidence from vietnam. Determinants of capital structure. It is more important in emerging markets due to their unique legal cultural and institutional characteristics. New evidence from listed companies in vietnam 1593 result is consistent with the empirical studies of bevan and danbolt 2002 daskalakis and psillaki. The main purpose of this study is to shed further light on forces driving capital structure decision in vietnam an emerging market economy.

The paper investigates determinants of capital structure in vietnam. Capital structure decision is an important corporate behavior which draws strong interest from different stakeholders. Evidence from vietnam industrial firms. 2020 international transaction journal of engineering.

Evidence from vietnam capital structure decision is an important corporate behavior which draws strong interest from. Industrial firms listed on the vietnam stock market for 2008 2018. Nguyen et al 2012 they limit testing the contribution of certain firm leverage s indicators non debt tax shields tax or volatility which have been found significant at. It is more important in emerging markets due to their unique legal cultural and.

This paper sheds further light on the question of whether capital structure determinants are different in emerging markets. Determinants of capital structure in emerging markets. We utilize a comprehensive dataset of firms listed on the ho chi minh city stock exchange from 2006 to 2015. This paper sheds further light on the question of whether capital structure determinants are different in emerging markets.

We utilize a new and unique data set containing firm specific attributes over the period from 2006 to 2015. 40 issue c 105 113. Determinants of capital structure. Capital structure decision is an important corporate behavior which draws strong interest from different stakeholders.

Capital structure decision is an important corporate behavior which draws strong interest from different stakeholders. It is more important in emerging markets due to their unique legal cultural and institutional characteristics. This study examines role of various financial variables in determining the capital structure of vietnamese firms. Although some prior research were conducted within the same context nguyen 2010.

Request pdf determinants of capital structure in emerging markets.