Determinants Of Capital Structure Slideshare

Abstract this paper develops a study on identifying the most significant determinants of capital structure of 15 firms listed on the s p 500 index new york stock exchange using panel data over 5 years period from 2010 to 2014.

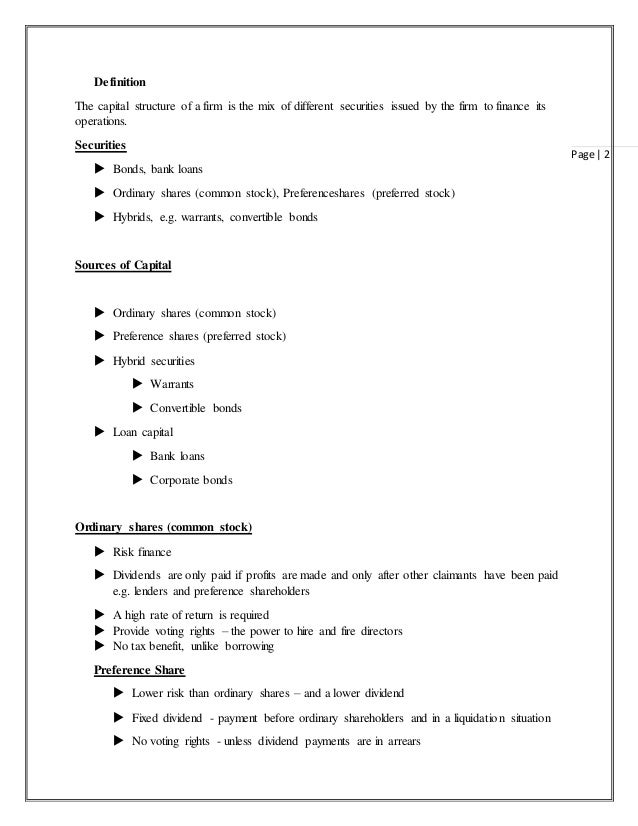

Determinants of capital structure slideshare. Capital structure theories 1 net income approach ni suggested by durand it says a change in the capital structure will lead to a corresponding change in the overall cost of capital as well as the total value of the firm if the ratio of debt to equity is increased the weighted average cost of capital will decline while the value of the firm will increase and vice versa assumptions. Ul li a way a corporation finances itself through some combination of equity and debt. Determinants of capital structure slideshare uses cookies to improve functionality and performance and to provide you with relevant advertising. Li ul ul li the capital structure should be.

3 3 seesmith and warner 35 for a comment on scott s model. Scott 33 suggests that by selling secured debt firms increase the value of their equity by expropriating wealth from their existing unsecured creditors. The goal of this chapter is to discuss the various theories that help to explain the determination of capital structure. Determinants of capital structure.

The capital structure puzzle is unravelled and a clear. Determinants of capital structure in ethiopian commercial banks case. 2 1 1 goal of this chapter. The present article seeks to unravel the evolution of capital structure theory from both theoretical and empirical perspectives.

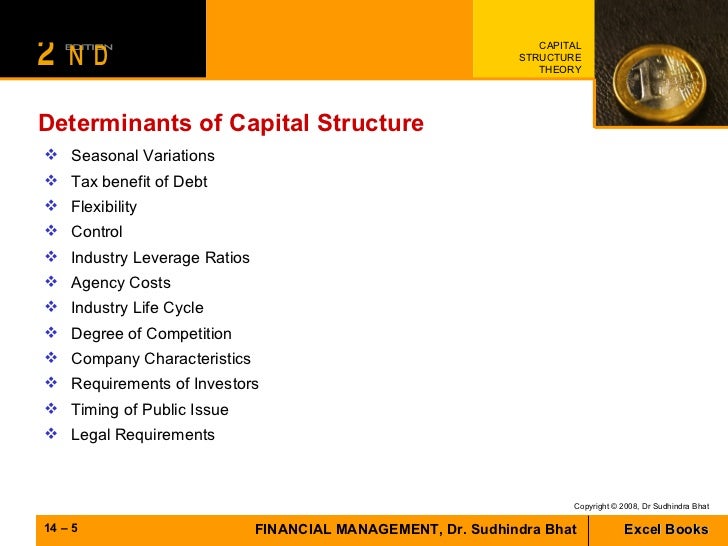

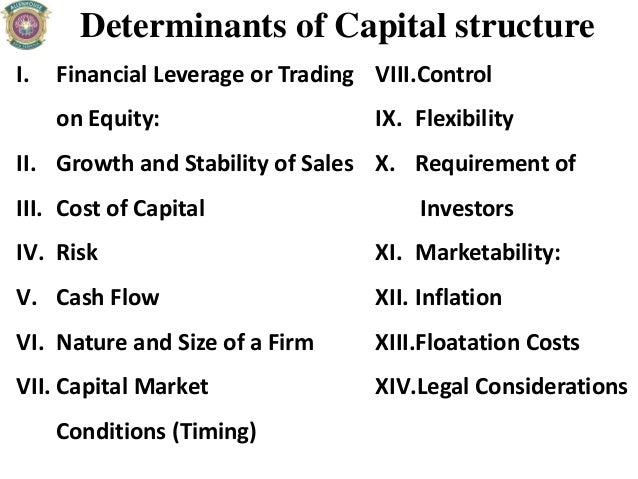

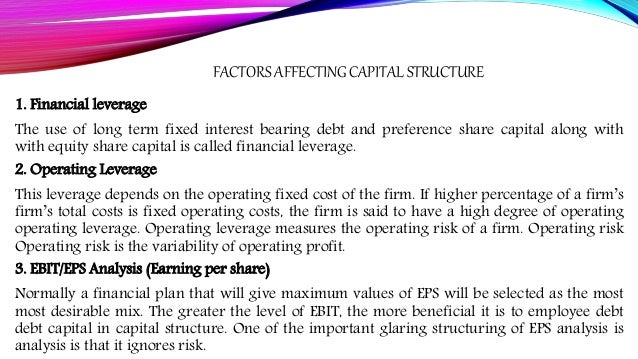

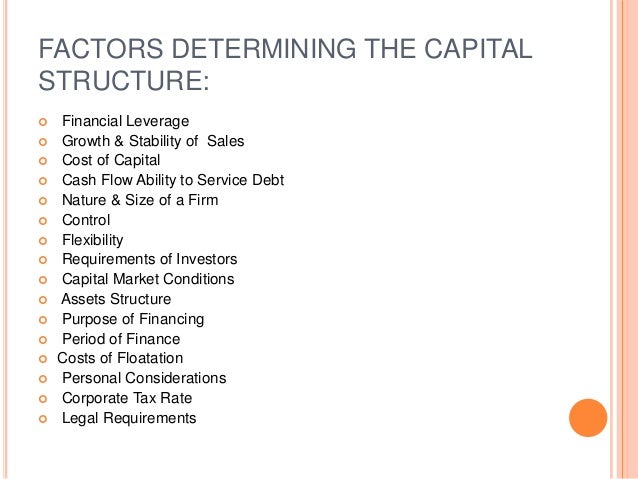

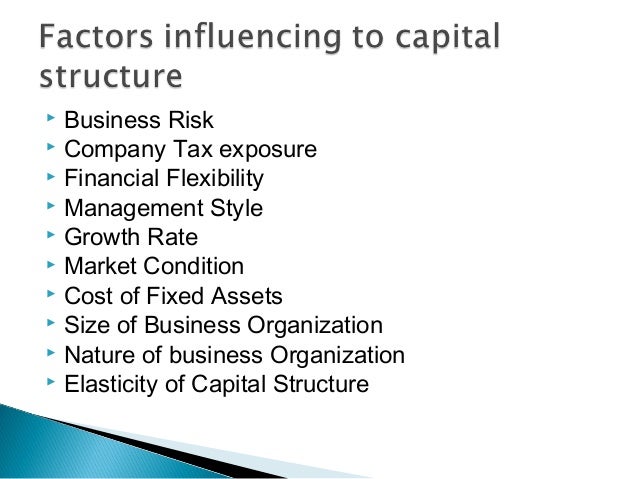

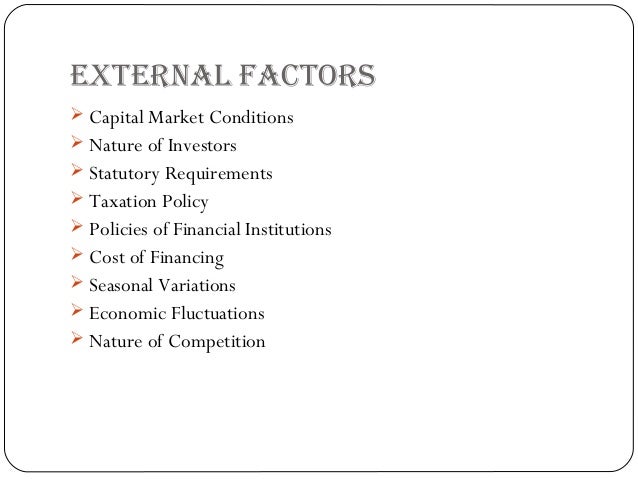

In addition to this the two variables profitability and growth established negative relationship and the remaining four variables tangibility size age and tax shield showed positive. If you continue browsing the site you agree to the use of cookies on this website. The capital structure of a concern depends upon a large number of factors such as leverage or trading on equity growth of the company nature and size of business the idea of retaining control flexibility of capital structure requirements of investors cost of floatation of new securities timing of issue corporate tax rate and the legal requirements.